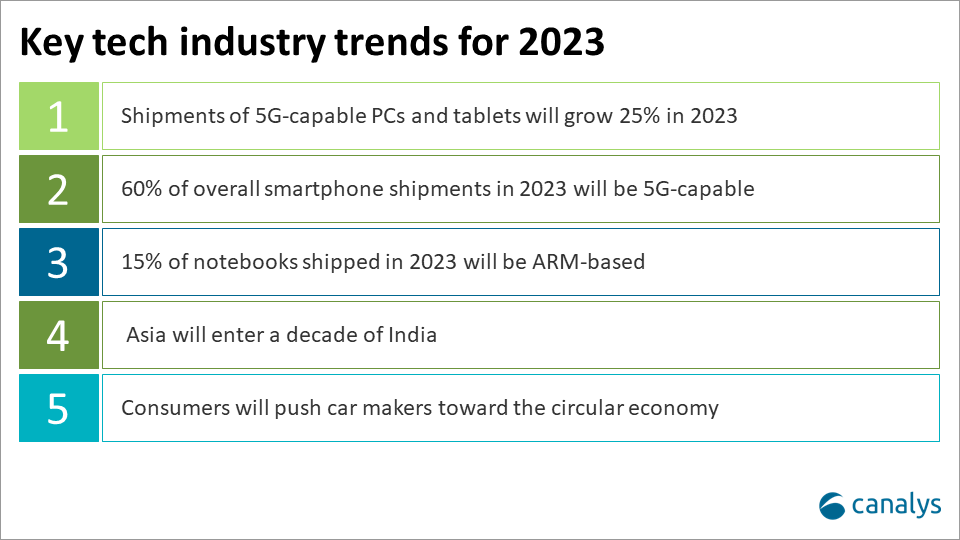

Canalys outlines five key tech industry trends for 2023

Canalys reveals major trends on the horizon for the PC, smartphone and technology industry as we begin 2023.

1. Shipments of 5G-capable PCs and tablets will grow 25% in 2023

5G-capable devices accounted for 24% of overall connected PC and tablet shipments in Q3 2022 after making up just 2% a year ago. Overall connected PCs grew a modest 4% in Q3 2022, but 5G adoption for PCs has ramped up. In 2023 this trend will accelerate as 5G infrastructure improves, vendors expand device offerings, and carrier support increases.

Leading PC vendors have now forayed into the space. Meanwhile, increasing focus from Intel Corporation, MediaTek and Qualcomm has helped frame a roadmap for designing and marketing 5G-capable devices. In 2022, carriers significantly expanded their 5G offerings. AT&T and Verizon now sell 5G connected notebooks and tablets in the US. Continued carrier adoption in 2023 will be a crucial element for the growth of connected PCs.

The advent of remote and hybrid work will create ample commercial opportunities for 5G PCs in 2023 and beyond. Employees will seek mobile connectivity options when it comes time to refresh their devices. Employers will look for solutions to the security threats posed by public and unsecured Wi-Fi networks.

2. 60% of overall smartphone shipments in 2023 will be 5G-capable

2022 was a rough year for 5G. Macroeconomic headwinds and inflationary conditions resulted in consumer demand shifting away from 5G for more practical aspects of smartphones such as battery life, storage, processor speed, and camera quality. Furthermore, 5G deployment has stalled, with many operators undergoing structural changes with efforts directed at growing their subscriber base and maintaining financial stability rather than the deployment of 5G.

2023 will be different. The overall macroeconomic situation is expected to improve and global economies are expected to recover. Network operators will be more aggressive than ever, both in pushing for 5G deployment and growing the 5G subscriber base. Smartphone vendors like Samsung Mobile and Apple are expected to spearhead 5G-capable devices.

The average selling price of 5G-capable devices is expected to drop, bringing 5G to the masses, a core driving factor for price-sensitive developing regions.

3. 15% of notebooks shipped in 2023 will be ARM-based

This will be up from about 10% in 2022 and a stellar increase from the 2% share in 2020. Apple’s transition to its own silicon has fueled most of this rise, and it is expected to continue accounting for the bulk of ARM-based shipments in 2023.

Nevertheless, Canalys expects the architecture to accelerate its success with Windows devices from next year onward. Recent device launches by Lenovo and HP have helped highlight ARM-based PCs' benefits, including better battery life, 5G/LTE optionality and thin-and-light designs. These features align with consumers' usage behavior post-pandemic as they use notebooks more frequently, for longer durations and in a greater variety of locations.

With Microsoft and Qualcomm also significantly improving the user experience and application compatibility on ARM-for-Windows, the stage is now set for more PC vendors to jump in and expand their offerings. CES 2023 represents an opportunity to drive home the messaging around ARM-based PCs and generate enthusiasm among consumers ahead of what is set to be a tough year for the market amid growing economic uncertainty.

4. Asia will enter a decade of India

Despite the increasingly worsening global economy, Asia Pacific still expects to see growth in 2023. The two fastest-growing major economies in Asia Pacific are currently ASEAN and India. Historically, China was the fastest growing, but growth has been tapering and there are now some challenges in that economy which have surfaced since the COVID-19 pandemic. This brings about opportunities for other economies to overtake and become the economy that drives Asia Pacific forward.

In the 80s and 90s, Japan drove the Asia Pacific economy. From the 2000s onward, it’s been China. Moving forward, India will increasingly take center stage. India is one of the fastest growing economies, and it is strategically positioned to connect APAC to the rest of the world. Its population at 1.41 billion is set to overtake China’s at 1.45 billion. Investors are now forced to not invest too much into China because of uncertainties, and we see some global tech companies moving towards India – which paves the way for India to become an economic powerhouse.

There will still be challenges in terms of bureaucracy, infrastructure and climate change. And It will take time, effort, and resources to build India up. But there are many positive trends in India: The government is placing strong emphasis on manufacturing, the highly skilled and young workforce is growing, digitalization is at an all-time high, many foreign entities are placing funding into India and investments into India will not be stopping anytime soon.

India is in an advantageous position to learn from what other successful economies have done in the past, to set itself up as a powerhouse as Asia enters a decade of India.

5. Consumers will push car makers toward the circular economy

Sustainability and promoting the circular economy will be key topics presented by automotive OEMs at CES 2023. Increasingly, consumers will look for recycled materials AND zero emissions in their next vehicle.

The automotive industry must keep as much of a vehicle’s raw materials in circulation beyond the 12- to 15-year average lifespan of the vehicle. It is a challenge the industry has already been tackling for several years and OEMs and the supply chain have set goals to achieve 100% sustainable materials in their vehicles and comply with international recycling standards.

However, according to Canalys estimates, at the start of 2023, there will be over 1.3 billion cars and light commercial vehicles in use around the world. So, while the increase in recyclable materials, lightweight vehicle construction, new production methods, electrification, software definition and common platforms in new vehicles are all super important, replacing today's vehicles in use, that lack all of the above, will take many years. Not helped by tough market conditions.

Global light vehicle sales peaked in 2017 and will not even return to pre-pandemic levels in the next three years according to Canalys estimates.

Want to learn more about Canalys’ predictions and forecasts for 2023? Subscribe to our complimentary insights or contact us directly for more depth.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band