Chile leads 5G push in Latin America

As Latin American operators have declined in recent years, it has become clear they have to reinvent themselves to survive in a new era of service-led convergence. 5G arrived as a savior, and has earned relevance with consumers, however, offering 5G requires considerable investment that most operators are not willing to make in a short timeframe. Instead 5G, in most cases, has derived into a number of B2B services where operators own both the service and the infrastructure, making them more competitive in terms of services compared to most tech companies. That is helping operators with immediate ROI, and is seen as an oxygen balloon for their investors, to the detriment of consumer experience.

As Latin American operators have declined in recent years, it has become clear they have to reinvent themselves to survive in a new era of service-led convergence. 5G arrived as a savior, and has earned relevance with consumers, however, offering 5G requires considerable investment that most operators are not willing to make in a short timeframe. Instead 5G, in most cases, has derived into a number of B2B services where operators own both the service and the infrastructure, making them more competitive in terms of services compared to most tech companies. That is helping operators with immediate ROI, and is seen as an oxygen balloon for their investors, to the detriment of consumer experience.

The rollout of 5G commercial networks in Latin America has been uneven, mostly as a consequence of the economic emergency caused by the pandemic. Despite this, two groups of countries have emerged:

- Those already making 5G networks commercially available or coming before the end of the year, including: Chile, Brazil and Mexico.

- Those without a clear timeline to do so, and where a 5G spectrum auction hasn't even taken place.

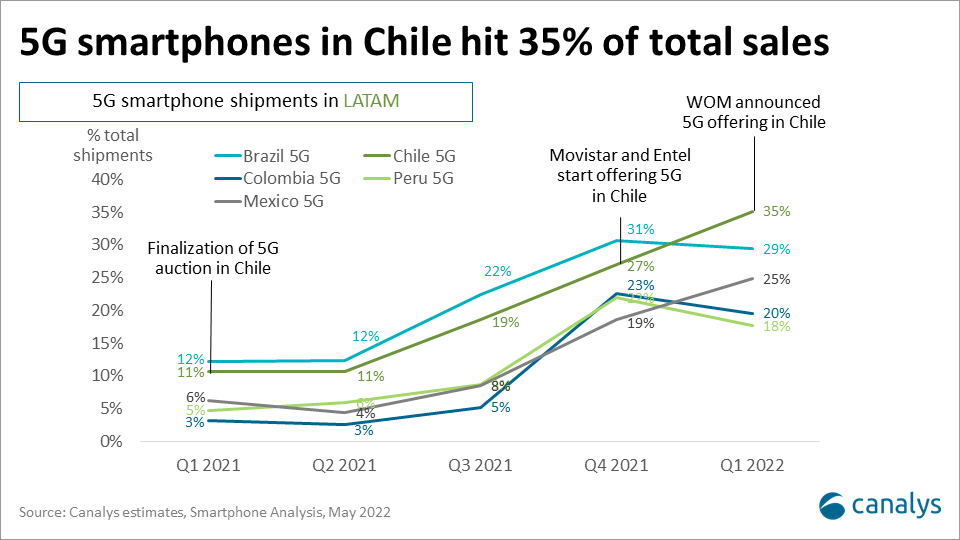

Group 1 has seen shipments of 5G enabled smartphones above 25%, with Mexico in the lower end.

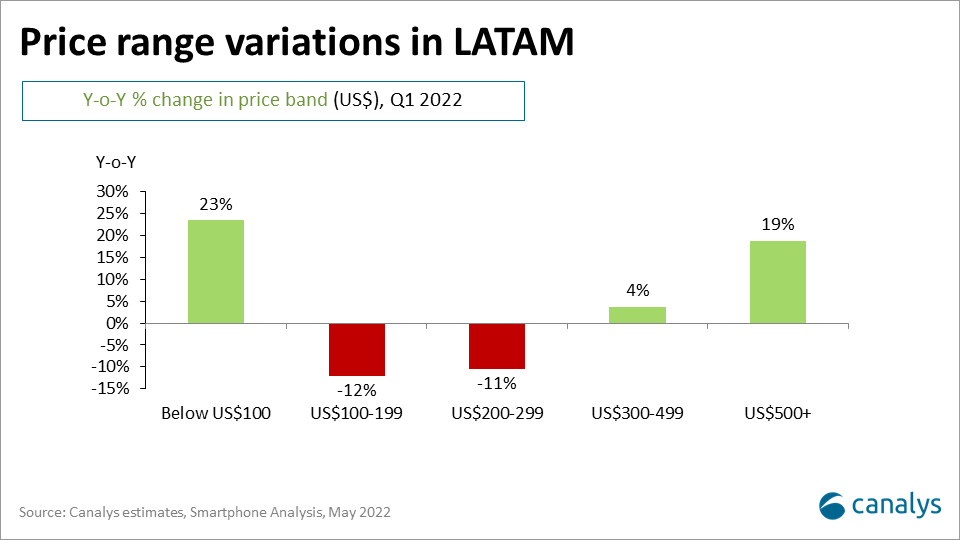

There is clear correlation between the commercial offering of 5G and a higher commercialization of 5G-enabled smartphones. In the specific case of Chile, after operators brought 5G to the market, Chile overtook all other countries in the region in terms of percentage of 5G shipments (see above graph). This comes with a 5% ASP increase Y-o-Y and 15% growth of the US$300-499 price band Y-o-Y. Chile, therefore, is setting a different trend compared to others in the region. There, in most cases, shipments are growing in entry-level – below US$100 – and over US$500, as can be seen in the graph below.

This though is not only helping smartphone vendors. Operators such as Entel, Movistar and WOM are using 5G as a commercial incentive to increase subscribers over other operators, and to differentiate against virtual operators, while they increase their 5G coverage across the country. This type of strategy would be unthinkable in other markets, however, in Chile it is possible given that more than 40% of the country’s population is concentrated in the Metropolitan area of Santiago. In fact, operators can already see positive results in terms of subscriptions and income increases. Entel Chile increased its customer base by 11% in the post-paid segment, while Movistar Chile increased its revenue about 5% Y-o-Y in the same period.

Therefore, the strategy of Chilean telcos to make 5G accessible as an improved user experience rather than an exclusive, higher-priced service is boosting the market for both smartphone vendors and telcos, with the latest increased number of subscribers and revenue coming from subscriptions.

The idiosyncrasy of the Chilean market makes it difficult to replicate this model in other markets, though it can serve as an example of how to accelerate 5G adoption and increase telco revenues without directly impacting prices for consumers.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band