The next 5G opportunity for smartphone vendors in Europe

5G may not be a big talking point in the European smartphone industry anymore. But it continues to create opportunities for smartphone vendors to take slots in the operator channel.

The 5G hype has faded in Europe. For mid-to-high-end smartphones, 5G has become standard, and the industry has already started to move onto 6G as the next emerging technology. In practice, 5G remains a key priority for network operators across Europe. Currently, network operators are looking to bring more users onto 5G subscriptions to capitalize on the recently rolled out infrastructure, while also preparing for more devices to be added in the coming years. In addition to leveraging the new infrastructure, network operators in some markets, such as the UK and the Nordics, have committed to turning off their 3G infrastructure within the next few years. Here, operators will aim to upgrade current 3G customers directly onto 5G subscriptions, presenting an opportunity for vendors to offer 5G-enabled devices across the price spectrum.

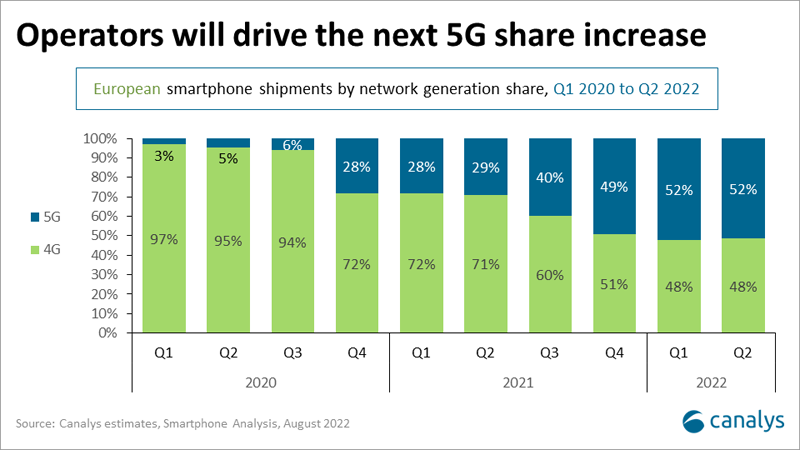

In the first half of 2022, over half of smartphones shipped in Europe were 5G-enabled. But most of these devices were mid-range to high-end models. According to Canalys estimates, only 10% of smartphones costing US$300 or less were 5G-enabled. This 5G share reflects the challenge operators face to drive more users to subscribe to 5G data packages, particularly in the short term. The current challenge with upgrading customers lies in expanding portfolios sufficiently to cover lower price bands and create competitive offerings. Here, smartphone vendors have an opportunity to capitalize by gaining share and securing slots in the lower-end 5G price segments if they are early to market with compelling options that fit with operators’ standards and requirements.

Currently, Xiaomi and Samsung dominate the low-end 5G smartphone vendor space in Europe. In the first half of 2022, the low end of Samsung’s Galaxy A series and Xiaomi’s Redmi Note series drove shipments in the sub-US$300 segment. But most of these devices are priced between US$200 and US$300, with nothing in the sub-US$200 segment that will be necessary to bring the most price-sensitive customers onto 5G devices. The first sub-US$200 devices started to show up in operator channels in the second half of 2022, with Samsung’s Galaxy A13 5G, Xiaomi’s Redmi 10 5G and Motorola’s Moto G62 5G. Deutsche Telekom has even taken the step of launching its own device with the T Phone, designed to help 5G penetration with an affordable model that easily meets its network requirements.

Can operators stay relevant as a channel for smartphone sales in Europe?

From 2023, most smartphones shipped into the operator channel will be 5G-enabled. Still, 4G-enabled devices will remain relevant despite being predominantly shipped into open market channels. This creates a challenge for operators as 5G versions of smartphones continue to have a significantly higher ASP than 4G versions. The price difference can easily become a challenge for operators in convincing budget-conscious consumers to choose them as a channel unless the 5G version is subsidized by the operators. Furthermore, the price difference between 4G and 5G versions will continue in the short-to-medium term as production costs of 4G and 5G enable components to stay at different levels. For example, chipsets make a big difference: most budget-friendly 5G smartphones are currently powered by MediaTek or Qualcomm, and the lack of competitive 5G chipsets from UniSoc and Samsung Exynos will make it difficult to drive down the costs of 5G-enabled smartphones.

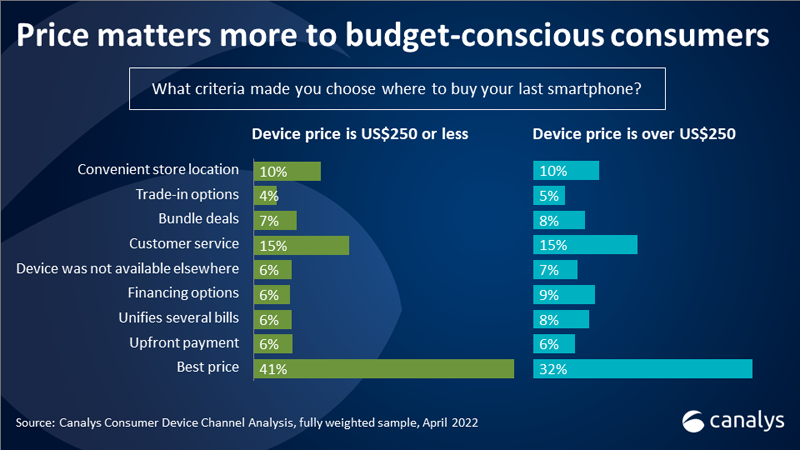

The price difference between devices makes it vital for operators to find unique selling points or subsidize devices to help them drive consumer demand. Otherwise, they face the risk of losing budget-conscious consumers and, consequently, not being able to drive users onto 5G data subscriptions. According to Canalys’ Consumer Device Channel Analysis, which surveyed over 7,000 consumers in Europe about their phone purchasing preferences, customers owning a device costing US$250 or less were 28% more likely to highlight price as the most important factor when choosing where to buy their next smartphone, compared with those with a device costing more than US$250. The operator channel has faced tough competition from big retail chains over the last three years as the shift toward omnichannel strategies dominated during the pandemic. With a looming downturn in the economy and a cost-of-living crisis across the region, budget-oriented consumers will be even more price-sensitive. Operators must find the right value proposition for price-sensitive consumers and navigate carefully to ensure a successful 5G subscription strategy and to remain relevant as a smartphone channel.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band