Canalys Forums 2023: cybersecurity channel opportunities outlook

The demand for cybersecurity-managed services is expected to grow by 16% to US$70.2 billion in 2023, providing partners with significant growth opportunities. This blog suggests ways for partners to adapt to the changing landscape and meet the changing needs of their customers.

Channel partners play a vital role in the cybersecurity ecosystem by improving the cyber-resilience of their customers. Over 90% of the US$223.8 billion cybersecurity spend (on technology and services) in 2023 will go through the partner community. Advising customers on technology selection remains an essential function fulfilled by partners, given the highly fragmented vendor landscape and the need for organizations to consolidate supplier relationships. But providing 24/7 monitoring, threat hunting and incident response, as well as other cybersecurity managed services, is now more important as threat levels rise and the skills shortage widens.

The demand for cybersecurity-managed services

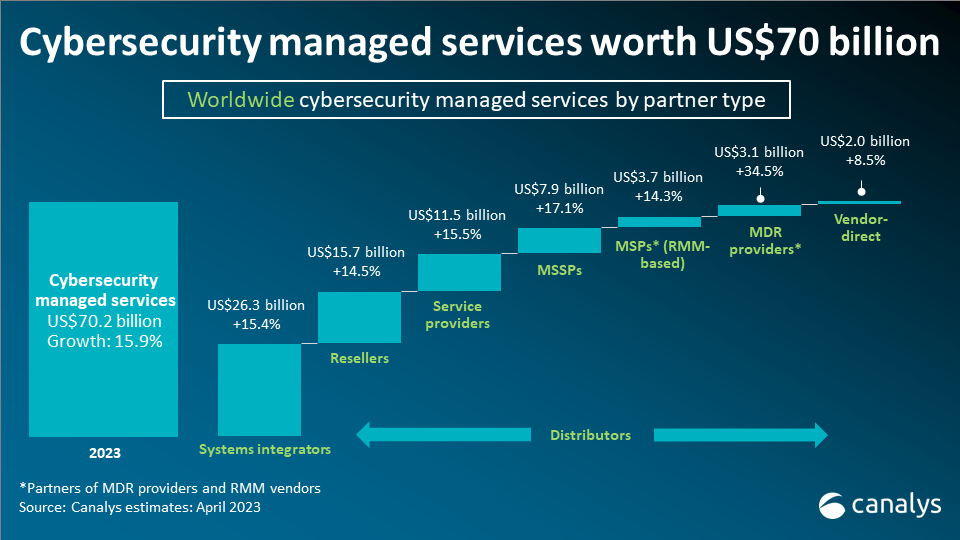

The demand for cybersecurity managed services will grow 16% to US$70.2 billion in 2023, according to Canalys estimates. Managed services represent the most significant growth opportunity for the cybersecurity channel, but capitalizing on it is not guaranteed for all partners. Customer requirements have diversified beyond just managing the administration of cybersecurity technology used for protection in terms of setting up, modifying rules and configurations, patching, updating, operating and monitoring, as well as backup and disaster recovery. More operational-focused managed services delivered via SOCs are in high demand as organizations struggle with the complexity of integrating multiple technologies, dealing with too many alerts and trying to manage the workforce gap. Identifying, classifying, prioritizing and remediating vulnerabilities, external attack surface reduction, penetration testing, security information and event management (SIEM) as a service, and awareness training are all key areas of growth. But customers need more holistic XDR-managed services that provide detection and response to deal with the entire lifecycle of incidents, which are increasing in frequency, complexity and severity.

The cybersecurity partner landscape

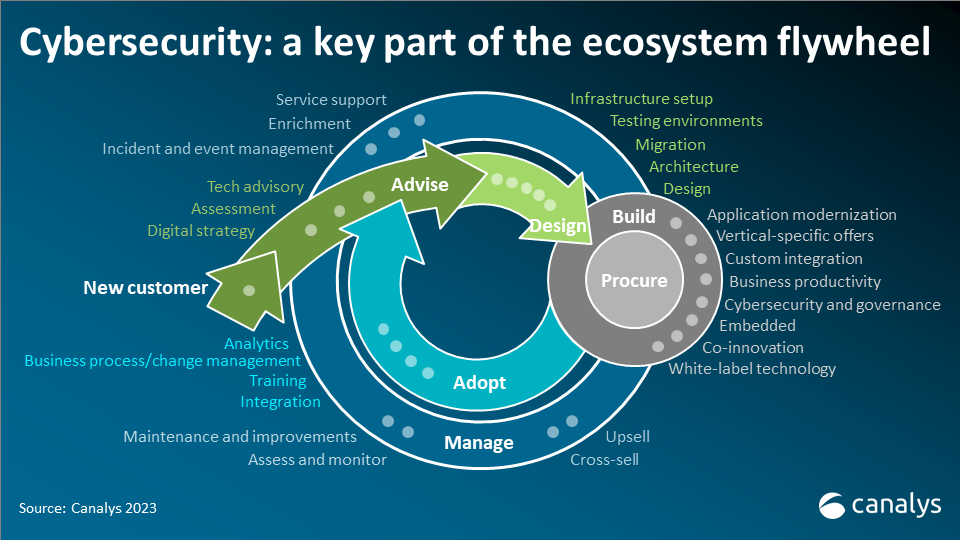

The cybersecurity-managed service provider landscape is highly diverse, consisting of a range of partner types with different capabilities, business models and customer focus. They also play different but essential roles in the Partner Ecosystem Multiplier economy, with cybersecurity acting as a catalyst for revenue opportunities within each segment of the Canalys Partner Ecosystem Flywheel.

- Systems integrators are the largest category by revenue. They are at the forefront of technology advisory, assessment services and implementing secure digital transformation strategies for customers. These consulting-led partners have a significant global reach and extensive delivery capabilities.

- Service providers are pivoting more to cybersecurity-managed services, as traditional voice and data revenue comes under pressure. They benefit from their established brands and typically offer more network-centric services. Acquisitions have helped boost their capabilities and geographic reach.

- MSSPs are more specialized, providing advisory services and full cybersecurity suites based on combining point products with their own proprietary tools, and underpinned by SIEM as a service. MSSPs typically send validated alerts to customers for remediation but have also established their own tailored incident response offerings.

- MDR specialists are offering more standardized detection and response services, using their own platforms and analysts, that is resold through partners. MDR vendors have received significant venture capital funding to expand geographically. Some endpoint security vendors have also launched their own offerings to compete.

- Resellers are evolving their cybersecurity-managed services and are increasingly competing with systems integrators, service providers and MSSPs. The shift from point products to platforms has enabled these partners to deliver more profitable services at scale, but many lack detection and response capabilities.

- RMM-based MSPs are increasingly upselling cybersecurity, on top of their IT-managed services, to smaller customers. RMM vendors have acquired cybersecurity technology and integrated it into their platforms, but they also collaborate with other cybersecurity vendors to integrate their offerings.

The future of the cybersecurity channel

The cybersecurity channel is facing several challenges, including keeping up-to-date on the constantly shifting threat landscape, recruiting and retaining skilled SOC analysts and engineers, managing complexity within their vendor portfolio, scaling their capabilities, as well as increasing competition. However, there are also huge growth opportunities, especially managed services, despite the uncertain economic environment and increased customer scrutiny on spending.

Partners that can adapt to the changing landscape and provide customers with the technology and services to increase their cyber-resilience will be best placed to succeed. This will require a focus on innovation, collaboration and customer service.

If you are a cybersecurity partner, we encourage you to register for Canalys Forums 2023 at: https://www.canalys.com/events. The events will provide channel partners with the opportunity to learn more about these latest trends in cybersecurity and address how they can swiftly adapt to meet the changing needs of their customers alongside top distributors and channel-committed vendors.

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5-7 December

This research is taken from the much more in-depth client report 'Now and Next for the cybersecurity ecosystem in 2023'. Do get in touch if you're interested in accessing this.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band