Cellular-connected notebooks for workers are not an easy sell

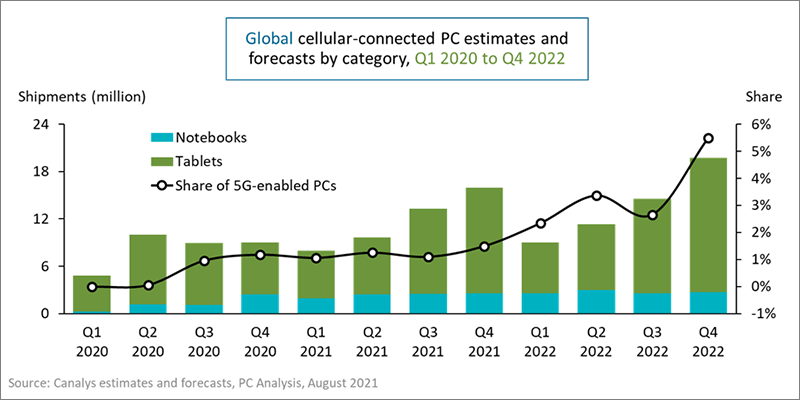

According to the latest Canalys data, in the first half of 2021, worldwide cellular-enabled notebook shipments increased a massive 204% year on year, from 1.4 million units to 4.4 million units, of which the latest 5G-enabled models accounted for 89,000 units.

More than a year and a half after the advent of COVID-19, people are gradually returning to workplaces, schools and colleges around the world. But the pandemic has weakened the appeal of high-rise office buildings and vast university campuses. At the same time, digital-transformation initiatives are empowering people to work and study seamlessly and securely from anywhere, especially as wired and wireless broadband can handle large amounts of data and vast numbers of users. It seems a near certainty that hybrid business models will become increasingly popular across business functions, industries and economies. The hybrid economy will introduce the luxury of flexibility that millions of people never had before the pandemic. Globally, businesses have adapted relatively well during the extended lockdowns, but an obstacle has arisen around the limitations of Wi-Fi. While “wireless”, retail Wi-Fi solutions are still limited in the range they offer to users, mostly restricted to a home or a part of it. And, of course, broadband penetration in most regions around the world is dismal, with no signs of sudden improvement.

This situation puts the spotlight on an existing technology – cellular-enabled notebooks. Cellular connectivity is an attractive candidate to replace or complement Wi-Fi and supplement remote bandwidth bottlenecks. Until recently, the growth opportunity was limited to the healthcare and construction industries, where people worked either in transit or using unstable Wi-Fi networks. But now, many employers are proactively looking to upgrade their remote and hybrid workforces with cellular-enabled PCs. According to the latest Canalys data, in the first half of 2021, worldwide cellular-enabled notebook shipments increased a massive 204% year on year, from 1.4 million units to 4.4 million units, of which the latest 5G-enabled models accounted for 89,000 units. Additionally, Canalys forecasts cellular-enabled notebook shipments will reach 5.2 million units in the second half of 2022, of which 5G-enabled notebooks will represent 8.1% or 216,000 units.

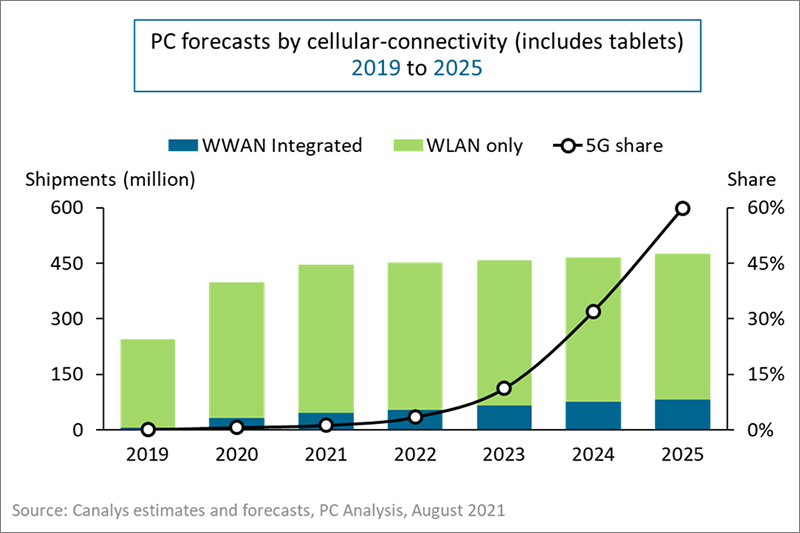

This tech-spending frenzy will further increase with 5G technology rolling out on a large scale around the world. 5G is still not fully implemented but has consumers clamoring and telcos encouraging the development of a range of 5G-enabled devices. According to the GSA’s September 2021 Member Report on 5G Devices, 72 markets globally have already launched one or more 3GPP-compliant 5G networks, up from 44 a year ago. The pandemic has introduced new avenues of growth and unprecedented demand for mobile computing devices. Given the growing demand for 5G devices, PC vendors together have created a portfolio of 18 5G-enabled notebooks in just six months, furthering the innovation and disruptive momentum caused by COVID-19. By 2025, Canalys projects that of total notebook shipments of 306 million, cellular-enabled notebooks will account for 9% or 27 million. Furthermore, 5G-enabled notebook shipments will reach 16 million, representing 60% of all cellular-enabled notebooks.

As the battle against the pandemic hopefully draws to an end, organizations looking to rebound in a profoundly digitalized and hybrid business environment should keep a close eye on how the 5G ecosystem, especially relating to devices and connectivity, develops. While smartphones have enabled connectivity everywhere, standalone cellular connections for PCs have a massive inherent advantage – 4G/LTE or 5G will offer better security than Wi-Fi.

But connected PCs are not an easy sell. Sketchy coverage, bandwidth choking in dense areas, and a lack of reliability are significant hurdles, especially in markets that are yet to achieve the full potential of LTE. Employers will need to define relevant use cases, prioritize roles that will require always-connected devices, and analyze the true ROI of this investment. Also, business and domestic users of connected PCs are unlikely to switch to cellular completely but use it as a failsafe or backup. To triumph here, connected PC vendors will need strong go-to-market partnerships with telcos, resellers and PC OEM vendors. Finally, promoting a connected PC as a standalone device without packaged connectivity is a mistake, one that OEMs and channel partners must avoid.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band