EMEA PC market experiences headwinds from Russia

All notebook leaders, including Lenovo, HP, Apple and Dell stopped shipments to Russia in February

As the Q1 2022 reporting season approaches, the impact of the war becomes obvious

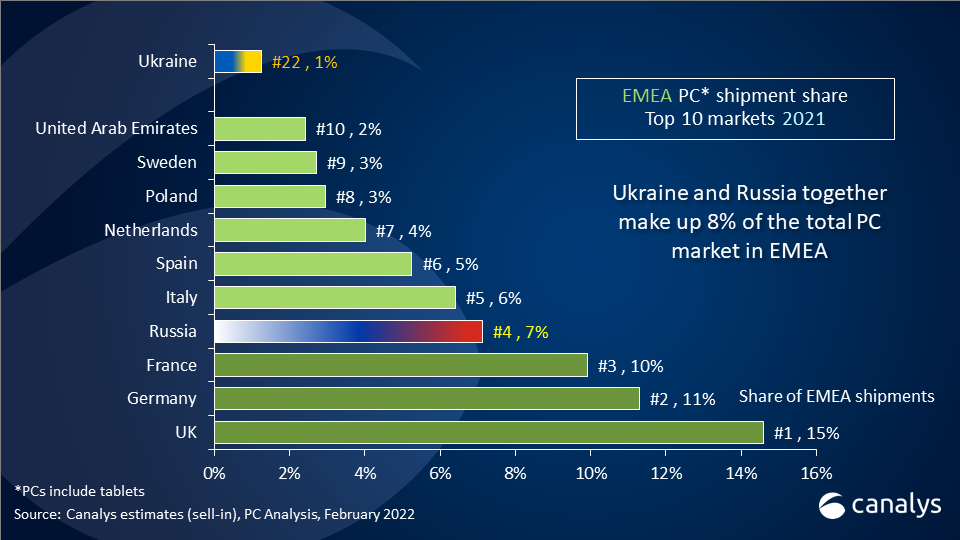

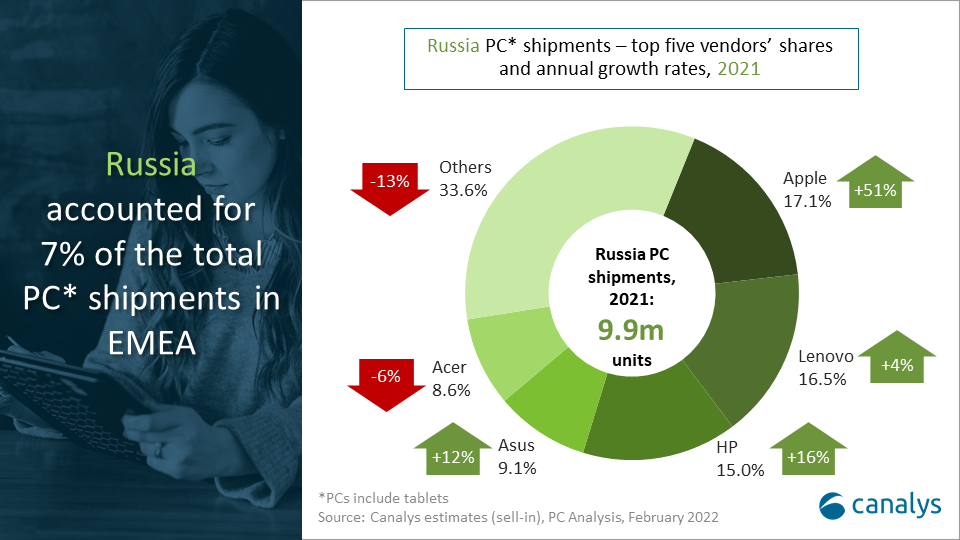

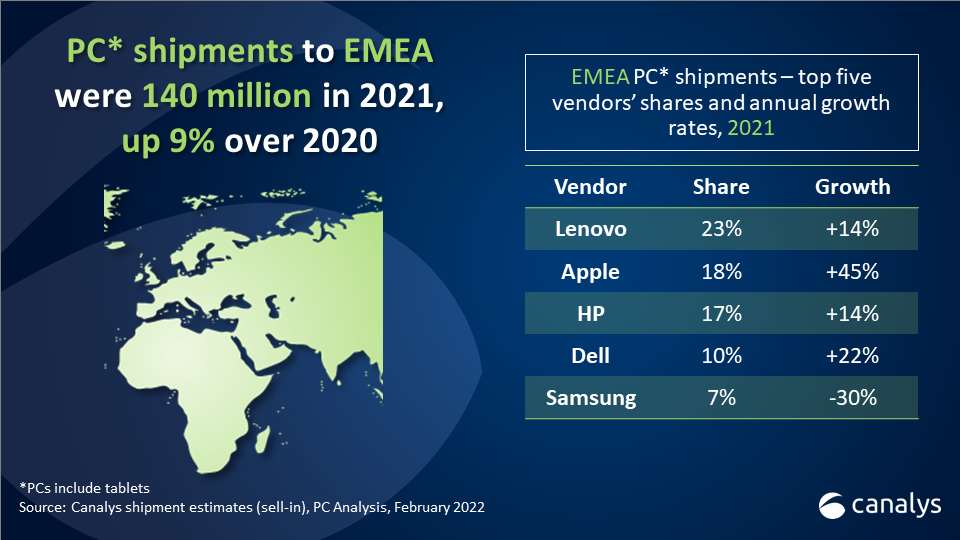

Russia’s war against Ukraine has brought an end to the seven quarters of boom for EMEA’s PC market, as sanctions restrict supply to the fourth largest market in the region that contributes a little over 7% to the total.

As reported previously, Canalys research shows the major PC vendors, including HP, Lenovo, Dell, Apple and Samsung have prevented PC shipments from entering Russia since mid-February. These vendors even managed to stop some containers that had been mid-way through the journey to Russia at the end of February and divert those deliveries elsewhere. Swift changes to distribution contracts have stopped third parties from selling into Russia too, with the result that there have also been minimal grey market activities. The consequences have been stark, with widespread shortages and prices in Russian retail outlets doubling and then rising each week. There, sadly, appears to be no prospect of an end to the war in the short-term. The five leading vendors will likely record zero shipments to Russia throughout the second quarter, and possibly for much longer.

PC shipments have ground to a halt in Ukraine too, as the war devastates that country, canceling another 1.25% from the EMEA total. The disruption in Russia and Ukraine, plus remembering that Q1 2021 was an incredibly strong Covid-boosted quarter, will inevitably lead to year-on-year PC shipment declines for Q1 2022 when Canalys reports these results next week.

However, market watchers would be wrong only to notice the negatives, as the countertrend of Western Europe returning to the office has kept demand for commercial PCs strong. Many employees, who have been frustrated by working at home for two years on an old machine, are demanding not just a new PC, but also products with high-resolution cameras, speakers and microphones. Many enterprises have increased their PC budgets because staff retention is their biggest challenge, and the cost of a PC is still far lower than the price of searching for a new member of staff.

The consumer PC market in Europe, on the other hand, faces familiar challenges. The massive rise in energy prices, combined with interest rate increases in many countries (but not yet in the Eurozone) and rampant inflation, will reduce the amount of free cash available to be spent on consumer goods. Consumer PC supply moved into equilibrium with demand during the first quarter, and there could be pockets of oversupply by the end of June.

COVID-19 has moved into the rear-view mirror across most of Europe, but that is not the case in Mainland China. The recent shutdowns in Shanghai, Shenzhen and Taiwan have further complicated the supply chain challenges, and commercial PCs will remain in short supply for at least the next three months. The ongoing lockdowns across China and Hong Kong are also impacting consumer sentiment there, adding another drag to global performance.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band