European telcos get close and personal

How do telcos remain relevant to customers and deliver customer-centricity?

Telcos expand ways to reach customers

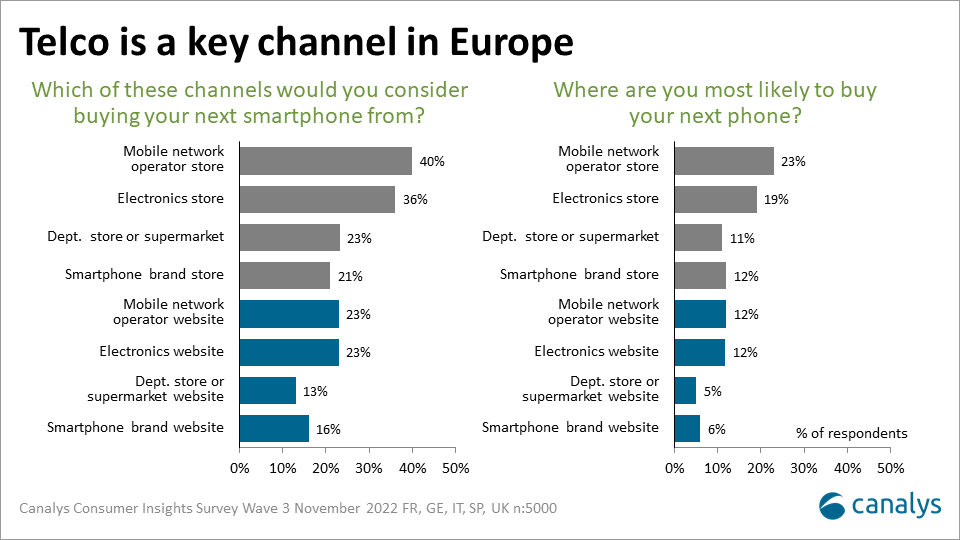

The share of the telco channel overall declined during the pandemic as offline channels were severely impacted by the fall in smartphone sales. However, the pandemic's effect of accelerating the uptake of e-commerce has increased direct contact with customers. Faced with increased competitive pressure from all channel types, most telcos have expanded their channel reach and invested in online channels to better serve their customers. In addition, most have also expanded into services, and new devices and tools to win, service and retain customers. Yet despite the necessary efforts to provide customer choice, physical operator stores remain a preferred route to market for the end user. According to the Canalys Customer Insights Survey, which helps vendors better understand what aspects of telco’s offerings consumers in each major European market favor – it is evident from the results that physical stores remain the main preferred channel.

Category expansion is key to profitability

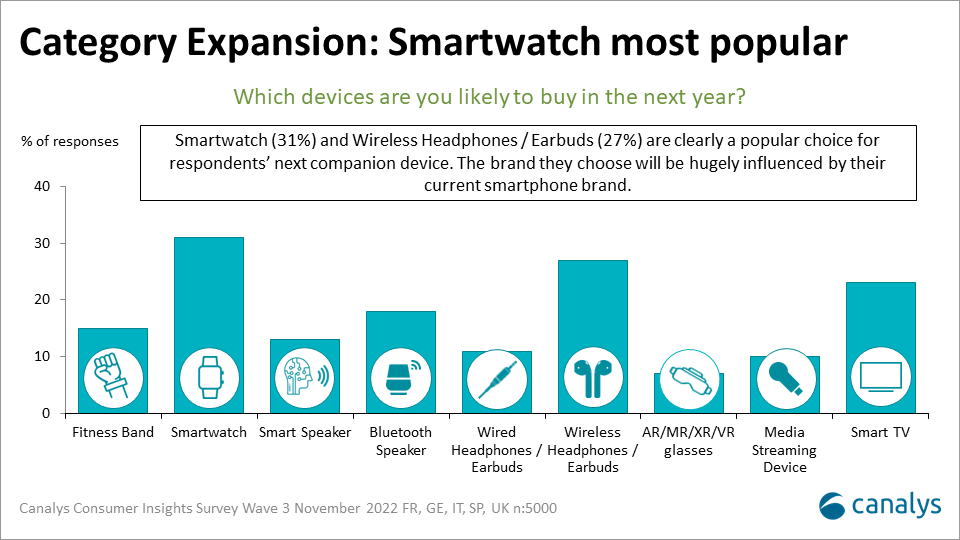

The market is very price-competitive, and telcos are facing significant financial pressure, driven by stiff price competition on data tariffs, where ARPU is not increasing fast enough to cover the increasing CAPEX costs they are incurring. In addition, there is a general shift in some markets from contract to a prepay model and/or a SIM-only payment model, which as a result, is driving the sales volumes to vendors’ stores or to large scale retailers. This is particularly challenging for telcos, as they rely on new devices to acquire and retain subscribers as data is their main revenue stream. But as smartphone device margin has become less of a revenue generator for telcos, many have moved into higher margin product areas and have stepped out of their comfort zone into devices like smartwatches, wearables, PCs, TVs and even e-scooters – all to improve and expand customer interaction and retain customer loyalty.

But transitioning to a diversified product portfolio has not been easy. Supply shortages posed a challenge for telcos seeking to offer a seamless connected experience across multiple devices such as smartphones, PCs and smart home devices, all locked into an ecosystem bundle with tariffs and services. Guaranteeing availability of multiple products at the same time is a challenge, especially if the products are from multiple vendors.

In addition, telco’s pricing strategy is less competitive than retailers' online offerings. So telcos must adapt and become more agile in their pricing to compete in the online world. As the cost of living limits consumers’ disposable income in the short to mid-term, there may be additional options for margin such as services around consumer financing and bundles of services with devices. This could further differentiate its price to that of retailers, but the market will remain price sensitive. As 5G roll out plans pick up, the challenge remains for most telcos to increase their service coverage. Telcos must also earn relevance in front of consumers with a solid value proposition around 5G with upgraded services and better 5G user experience, all priced competitively.

Customer-centricity is a source of competitive advantage

Telco’s future challenges will be to remain close to the customer to increase interactions and retain customer loyalty. Many continue to have a focus on customer retention, but some telco's are now going for growth by focusing on segments such as B2B, SMB and IOT and providing solutions in these segments. Sustainability packages based on trade-ins, and refurbished devices may also be a valuable proposition for customers attracted to environmental initiatives and bundles. To remain relevant going forward customer-centricity is key.

According to the Canalys Consumer Insights survey, other than price, customer service was a key reason to buy connected devices from a Telco, as 29% valued this as the second most important factor that would convince them to buy smart devices from a Telco.

The market post-pandemic has become more competitive and, as a result, telcos have had to re-evaluate their sources of competitive advantage and focus more on their routes to market and customers, and less on products. To prevent a further decline in share, telcos must also evolve their value proposition and product portfolio, seeking higher margin devices and services while offering good customer service and customer-centricity. Strengthening their partnerships with vendors that offer an ecosystem of connected devices should also be a key strategic priority to ensure future growth.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band