How to successfully build channel ecosystems to drive subscription and consumption models

We are now firmly in the subscription era. Driven by changing customer behavior and software (powered by the cloud) eating the world, and accelerated by the pandemic, most technology vendors have either committed to or made significant strides to transform their business models.

We are now firmly in the subscription era. Driven by changing customer behavior and software (powered by the cloud) eating the world, and accelerated by the pandemic, most technology vendors have either committed to or made significant strides to transform their business models.

Subscription and consumption business models are an effective hedge against the current macroeconomic uncertainty. The models look to build a stable base of recurring customers and create predictable revenue that vendors can plan for (and enrich) in the future. Benefits include exponential growth potential, when gaining new subscribers, and attaining greater than 100% retention of current revenue. Successful subscription businesses achieve more efficient and manageable growth.

Without the need to hit the reset button each quarter, vendors and partners can benefit from increased business agility. The new and never-ending customer journey can logically be divided into three steps: getting the customer to the dance (vendor selection), getting them up on the dance floor (initial purchase) and keeping them dancing all night long (retention and enrichment).

Large vendors are committing to subscription and consumption models

In addition to cloud IaaS, PaaS and SaaS companies that built their models as subscription, consumption, product-led growth (PLG) or value-based, we have seen a full commitment by the largest hardware companies in the world. Cisco announced Plus in March 2021, followed shortly after by Dell announcing Apex. Lenovo announced TruScale in September 2021 and the company it acquired its PC and infrastructure businesses from, IBM, spun out its infrastructure services business into Kyndryl and committed to a full multi-cloud, hybrid cloud and AI-focused recurring model.

HPE started a pay-as-you-go model in 2006 and continued to develop what became the GreenLake announcement in late 2017, largely direct focused. Having a multi-year head start over its rivals, HPE was able to create a successful channel program (with some notable early bumps in the road) and recruit subscription-friendly partners as a first mover. GreenLake has now delivered three straight quarters of triple-digit growth, even outpacing the growth of supercharged IaaS leaders AWS, Microsoft Azure and Google Cloud.

Suffice it to say, many customers and partners are ready for the subscription era. For those vendors looking to embrace that model, here is how to successfully build channel ecosystems to drive subscription and consumption models:

1. Channel programs must change from recognizing/paying at the point of sale to recognizing/paying at the point of (partner) value

For over 40 years, channel programs and the underlying technology have been designed to drive the sales motion. Enabling resellers, MSPs, distributors, retailers, dealers and agents to more frictionlessly market and sell products at scale was the goal of every channel leader. This led to a bell-curve scenario where you could be underpaying partners who fully invested in the marketing, selling and engineering assistance to land a deal to overpaying partners who showed up late and collected the order.

Recognizing the partner point of value takes a new set of skills, organizational structure, processes, programs and underlying technology to accomplish.

For example, the average customer prospect will move through many moments before making a vendor selection for a considered purchase. In a post-cookie world, vendors will need to identify and attribute (and hopefully share real-time data with) a partner that has driven that moment. Whether it be a well-placed ebook, an event, a social media engagement, some expert consulting, design or architecture work, it doesn’t matter. Partnerships will be needed to replace elements of martech and adtech that were used for this purpose in the past.

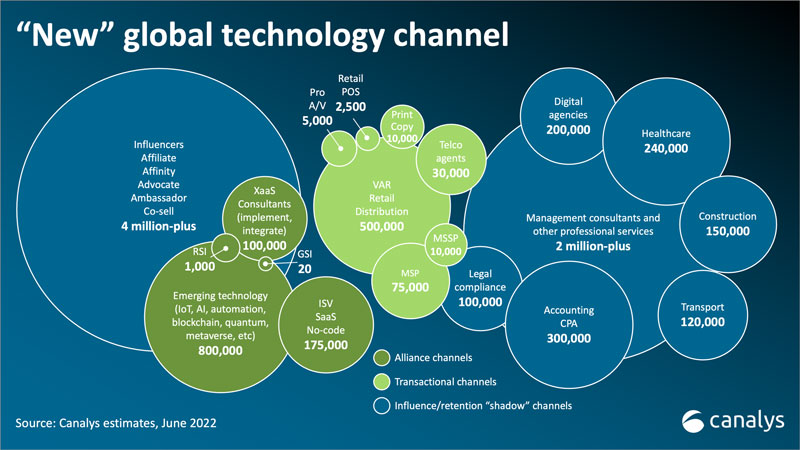

The key for channel leaders is that most partners that own these moments are not transactional – they have no need or desire to actually sell the products they are recommending. This is more than just an affiliate, affinity, advocate, ambassador or influencer program of the past – it is now a vital element to get customer prospects to the dance.

These non-transactional partners also show up at the point of sale. Canalys estimates that by 2025, hyperscalers will rely on partners for nearly a third of their marketplace transactions, which will include walking customers in and pressing the buy button on their behalf. Programs will need to measure (and quantify) the value of partner-assist regardless of the deal being completed indirectly, directly or via a marketplace.

After getting the customer on the dance floor (in a subscription model) the fun starts. Driving adoption, deeper integrations, stickiness, upsell and cross-sell, and enrichment every 30 days forever is paramount to making the business model work. Partners play a central role in driving a retention strategy, recognizing these efforts come from reporting inside the vendor products themselves, as well as forms of post-sale attribution and data-sharing.

Adding a layer of complexity, this trifurcated model of partner-assist is then supplemented with the technology, strategic and business alliances that are measured on co-innovation, customer value creation and network effects. These three alliance relationships may show up in the customer journey or be completely hidden in an increasingly embedded and white-labeled world.

As a case in point, over the past few years, Microsoft has evolved its partner-friendly language from “partner-sourced” to “partner-assisted”. While recruiting upwards of 400 partners a day across these six new types of partner motions, it measures (and reports) 96% of its business as partner-assisted – a key to its platform driving a multi-trillion-dollar valuation and outgrowing its competition during the pandemic.

2. Channel organizational structures, skills and leaders of these new partnership motions need to evolve quickly

When looking at the people and organizational elements of these subscription models, we have seen the largest technology companies make significant changes. Last year, Microsoft replaced its top channel executive with an ecosystem leader. AWS, Google, IBM and others have followed in the last few quarters. Even smaller vendors, such as Sage, have made the change. In fact, over 11,000 people on LinkedIn now have “ecosystem” in their title (growing by 2,000 each quarter) and over 500,000 people use the term in the description of what they do.

Channel organizations (across all industries) have been somewhat siloed over the past 40 years, including having their own channel marketing, sales, operations and finance groups built in. In fact, the Harvard Business Review concluded that successful channel chiefs have skills more in common with a CEO or general manager than a line-of-business leader, such as a head of sales or marketing.

These new ecosystem chiefs are looking to run technology alliances, strategic alliances, business alliances, influence channels, transaction and transaction-assist channels and retention channels in parallel. Instead of building an empire of people siloed from the rest of the company under these six partner models/motions, they are embedding partner professionals in marketing, sales, customer success, product and strategy groups. This “dotted-line” approach to channel leadership looks more akin to data science (embedded in every department and indirectly reporting to a central CTO) than it does to previous incarnations of indirect sales departments.

3. Channel leaders need to speak a new language

These six partner lanes require new individual measurements, management and KPIs. It is also a recognition that one specific partner may play all six roles in a given day! For example, Accenture is one of Salesforce’s premiere implementation and integration partners, while it is also building thousands of Lightning Bolts and Flows, engaging heavily in marketing, and even providing managed procurement services to clients that don’t want to hassle themselves with negotiating and provisioning the products. Salesforce recognizes that its average customer will have six other partners engaged along the way and is actively recruiting 250,000 new partners to assist.

Salesforce was also the first vendor to quantify this ecosystem (or economic) value of partnerships and publish a detailed multiplier showing where the partner ecosystem can make upwards of US$6 for every dollar of Salesforce products sold. Partners could look at their own skills, business practices and M&A strategies inside this ecosystem and it resulted in a new language where partners are moving from the resell model of making 30% of the deal to making 200% to 300% (at 75% margin). Other vendors have capitalized on this new language, such as HubSpot, Google, Microsoft and AWS.

Canalys believes this new language of multiplier versus margin is vital to communicating the value to partners in an increasingly noisy environment. It is also imperative to reach the right kind of partners (in the five non-transactional lanes) that can drive a subscription and consumption model. In terms of sizing, the average vendor will need to be visible and appeal to upwards of 10 times the partners it is engaging with today.

4. Channel leaders must find new partner community watering holes

The pressing question is not only how to speak the new channel language, but where to find partners receptive to it. Recognizing the scale of partnerships to support a subscription and consumption model means that vendors need to rethink their partner engagement approach.

Canalys believes that channel leaders will need to significantly scale both their top-down enterprise approach to partners as well as their bottom-up (grassroots) community approach.

Beyond Adobe and Microsoft, it isn’t a secret that some of the larger vendors that succeeded in earlier license/maintenance models for software have not made the leap to cloud as successfully as born in IaaS, PaaS and SaaS-type companies. One of the reasons is the rapid decline of larger procurement-led, RFP-driven “million-dollar” software deals. The subscription economy grew up in a land and expand environment and recognizes a US$30,000 pilot (or free if you are PLG) as the winning sales/marketing approach.

Companies such as Salesforce, which recently overtook SAP in revenue and is approaching Oracle in valuation, or HubSpot, which was the marketing automation company that didn’t get acquired by a Fortune 100 company last decade but achieved a US$47 billion valuation, realize that winning a department- or director-level-led pilot and then expanding that into new divisions and geographies is the route to big ticket clients. Leveraging the rogue- or shadow-IT buyer, which is now a mainstream buyer supported by IT, required a multi-partner, ecosystem approach to each client.

Finding, engaging and recruiting these different partner types requires a move from traditional models of partner communication, to-partner marketing and the focus on internal communities (build it and they will come). The pandemic finally moved channel marketers from the legacy “fishbowl” event-driven approach to more modern and expansive digital engagements.

Subscription and consumption models require multiple new partner types to address a wider range of buyers, subindustries, geographies, segments, product areas and delivery methods.

There is no linear method to partner recruitment and collaboration anymore

Leveraging customer and partner communities – basically, what they read, where they go and, especially, who they follow – is now the most effective way to find, engage, recruit, nurture and activate partners. Influencers and superconnectors in a vendor’s target market are the (physical and digital) gateway to earning trust and endorsements in front of new types of partners.

Every vendor should have a repeatable process to identify the many spheres of influence around its partner ecosystem and to create top 100-type lists of the most influential people traveling inside these spheres. This isn’t consumer theory or a dusty marketing list anymore, it is something that needs serious research, planning and execution. The most successful channel leaders are converting legacy CAM-type roles into community-based roles that drive visibility and engagement into key market segments aligned with the overall business direction.

5. Processes, programs and the underlying technology need to modernize

Recognizing (and rewarding) partner-assist across the different points of value requires new thinking around legacy channel programs and gross-to-net investments. Additionally, finessing changes in partner behavior, psychology and experience (PX) requires fundamentally different approaches to channel strategy, communication, community, recruitment, onboarding, education, training, certifications, competencies, incentives, motivation, loyalty, co-marketing, co-selling, tech enablement, collaboration and overall engagement.

Channel automation is quickly moving from a nice-to-have in a linear sales model to a need-to-have. Channel leaders are talking about new subscription and consumption models and the new levels of scale and execution required, but many of their basic program and partner management processes are still painfully manual and error prone.

The recently published Channels Ecosystem Landscape lists 223 software companies in 11 categories that are aggressively spending in R&D and have product roadmaps that will provide the advanced automation technologies to get vendor’s front- and back-end systems to a future-ready state. Channel organizations have historically been very human-centric and relationship-driven, but laggards when it comes to technology. We have watched as sales and marketing leaders reimagined their processes and drove success on the back of the technological automation of job roles.

Channel leaders need to be next on the automation train

In this new ecosystem model, vendors will suffer (competitively) from constrained access to data, manual human-centric processes, ad hoc channel account manager interactions with labor-intensive quarterly business reviews and programs that still run on spreadsheets. These workflows need to be automated (end to end) and human-based partner interactions should only be focused on joint business planning, customer value creation and co-innovation – not on chasing data and putting up artificial gates.

One thing is clear. Vendors have heightening growth expectations in a subscription model as many direct sales and marketing strategies aren’t providing sufficient returns. Senior leadership is demanding new levels of go-to-market execution, efficiency and innovation as they realize they can’t implement a recurring business model alone. They are not throwing money at solving the problem, however. They are asking channel leaders to take the current gross-to-nets inside the resell model and redeploy the funds into the many points of value.

Recognizing and paying toward different points of value across the customer journey and in the alliances necessary to drive the business forward will involve a rethinking of how money is allocated. The front- and back-end margin payouts in most programs rely on the partner transacting with the customer (supported in most cases by distribution). If that point of sale is executed either direct or via a marketplace, those funds don’t get triggered and paying at the point of value is impossible without funds.

Adding to this financial complexity is the (very different) economics of subscription and consumption models. When that HPE server that used to transact for US$1 million through the channel is now shifting to a subscription for US$9,000 per month (forever), partner economics are affected. It was the same when that Microsoft Office license went from US$300 to a US$6 per month or when that product-led growth company (think Zoom, Slack or Dropbox) doesn’t charge anything until there is adoption and product fit.

Many vendors will consider a points-based channel partner program in the next few years

Earlier this year, Microsoft announced a major rebranding of its partner program and replaced the gold/silver/bronze tiering with a points system. This was shortly after announcing the New Commerce Experience, which creates a subscription “object” for Microsoft regardless of how the license is procured. In fact, this one-two punch of a singular system for subscriptions combined with a points system is a bellwether for the industry and shows the future state for most companies (and channel leaders) across the industry.

These point-based programs allow vendors to create value-based algorithms that shift focus (that is, program money) to match the needs of the overall business. It’s interesting to note that Microsoft, on the initial deployment of points, values the retention channel higher than influence and transactional. For a partner to reach that highest level (70 points in Microsoft’s program) it needs to build the right skills and competencies across the cloud and drive CLV “customers for life” for Microsoft. It has not included tech alliances (ISVs and emerging tech) into the algorithm yet – but expect that next year.

The algorithms behind points-based programs are agile and expected to be updated as business needs shift. Think about how Google adjusts its algorithm for SEO over time. For example, if Microsoft drops below AWS and Google Cloud in growth over a few quarters, you could expect it to increase influence channel points and decrease retention points to compensate. This new “levers and dials” approach to channel programs, supported by emerging channel technology, will change the skill requirements and approach to channel leadership overall.

Channel leaders must embrace the subscriptions era. As CEOs and boards come to the realization that they can no longer do it alone, it is the channel leader that will help drive company culture around partnerships. Building and delivering on the ecosystem strategy to support partner-assist in subscription and consumption models will require immediate change in organizational structure and the skills that are aligned to it. It will require change in channel-facing language, lexicon, taxonomy and the places it needs to be spoken. It will require changes in the processes, programs and underlying technology to support the partner motions and scale needed.

One important thing to note, for the companies (so far) that have hired the top ecosystem chief position, none have promoted the current channel chief into that role. In fact, none of the new ecosystem chiefs have ever been on a magazine list of top channel chiefs before. Whether by accident or design, driving partnerships in a subscription and consumption model requires a new general management (non-empire building) approach.

Getting customer prospects to the dance, getting them up on the dance floor and then keeping them dancing all night long are the new rules of business. Investors and stakeholders know these terms as subscribers, new subscribers and churn rate. While revenue, profit and customer satisfaction are still meaningful metrics – especially given our current macroeconomic conditions – you can quickly do a check on valuations on Wall Street to understand where the train is headed.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band