Success of US’s Emergency Connectivity Fund will serve as a strong template for PCs in education in other markets

The US’s Emergency Connectivity Fund will boost spending and inflate the US PC market by an additional 15 million tablets and notebooks.

On 10 May 2021, the US’s Federal Communications Commission (FCC) adopted a “Report and Order” establishing an Emergency Connectivity Fund (ECF) to close the “Homework Gap” and connect the 17 million-plus students, staff and library users across the country who have suffered due to lack of access to a computer with inbuilt connectivity. The US$7.17 billion fund can be used by schools and libraries to buy tablets, laptops and Wi-Fi hotspots to help connect those left behind due to socioeconomic conditions.

As per the directive, schools can apply for funding for PCs and Wi-Fi hotspots, restricted by upper limits of US$400 and US$250 respectively. As of the Phase 1 cutoff, which was 13 August 2021, the government had already received applications for 9.1 million devices and 5.4 million broadband connections. Phase 2 for applications starts 28 September.

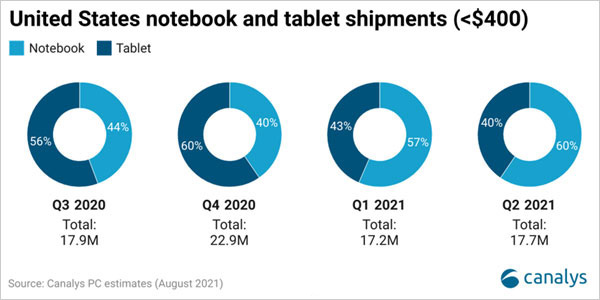

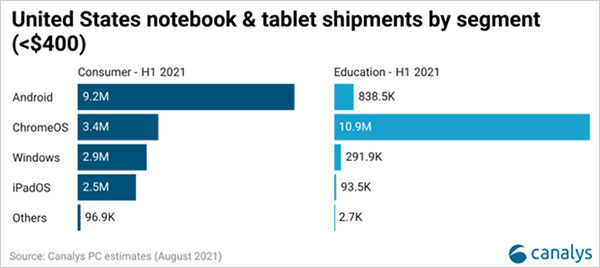

While the FCC has not set down other guidelines, the price limits per device are indirectly biased in favor of Chromebooks and Android tablets, which typically ship at lower price points than Windows notebooks or iPads. Canalys’ PC shipment data suggests that for the past four quarters, more than 17 million sub-US$400 notebooks and tablets shipped into the channel. These cheaper devices made up 50% of all notebooks and about 70% of all tablets shipped to the US in the first half of 2021. ChromeOS accounted for 78% of all such notebooks, with Windows taking the rest. Similarly, 77% of all sub-US$400 tablets were Android-based, with Apple’s iPads taking the remainder.

Canalys expects the ECF to account for an additional 15 million notebook and tablet shipments to the US from July 2021 to June 2022, and this benefits the PC market in two ways. One, the demand in the education market that had flared up over the last six quarters but was starting to slump is likely to remain strong due to the ECF funding. And two, the success of the ECF funding will establish a template for future device funding in other markets, especially where both connectivity and device availability are an issue. Unlike in the US, however, funding in these markets will not be central or from one resource, and it is unlikely to be of this size.

For PC OEM vendors chasing success in education, it is now increasingly clear that a baseline strategy must entail the following:

- Solid notebook and tablet offerings in the sub-US$400 and sub-US$300 price categories respectively, with varying screen sizes and platforms.

- At least one cellular-connected SKU both in notebooks and tablets.

- Additional operational support to customers (schools, institutions, etc) to help with legal procedures during funding and post-funding compliance activities.

- Ability to fulfill large device orders in minimal phases (magnitude of 10,000 at least).

- Partnerships with local content providers for digital education enablement.

- Partnerships with and support for local connectivity solution providers, such as telcos and ISPs.

While this is not an exhaustive list, it is a starting point for PC OEM vendors and channel partners looking to make a dent in the education space. Clearly, the focus for multiple governments and educational institutions around the world is ensuring continuity in education, via multiple forms of discourse, such as on-demand, online or even device-aided physical sessions. PC penetration among students, however, is dismal in most markets outside the US. Mapping the success of the ECF in the US will give many PC OEM vendors strong cases to pitch device use in classrooms to other markets, and thereby build a very strong long-tail pipeline for PCs in the education market.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band