What are the major barriers to the channel’s adoption of sustainability practices?

Channel partners are trying to help their customers with sustainability strategies, but several issues are hindering the rapid uptake of solutions.

As we near the end of the first half of 2022, sustainability is clearly at the top of many channel partners’ customer board agendas. In EMEA, over a quarter of channel partners are now seeing environmental sustainability criteria form a significant part of their customer RfPs.

2022 has seen more vendors, distributors and partners develop their internal strategies by setting environmental sustainability-related goals. Though there is growing awareness of sustainability, and a lot of marketing hype, there are still many challenges to developing best practices and quantifiable outcomes.

Inconsistency in vendor growth strategies

In recent years, vendor sustainability strategies have started to include new partner programs, or elements within programs, as well as incentives that drive partners to improve their own sustainability practices. Notable examples include Cisco’s Environmental Sustainability specialization, launched in April 2022, and HP’s Amplify Impact program, which provides training to help partners understand how they can use sustainability in their marketing to differentiate themselves.

But many of these vendor initiatives remain low on detail and measurement of real change. For example, vendors are still offering incentives to partners to sell new products rather than weaving refurbished equipment into partner sales targets. Much of this is financial, as vendors make more money on new equipment sales and have less control over the refurbished equipment market. Vendors also argue older products, such as servers and PCs, are less energy efficient than newer ones. Partners have highlighted that some of this confusion has slowed the adoption of the circular economy in the IT channel. Companies such as Microsoft are also falling short. It requires new licenses to be bought for refurbished Surface laptops, causing frustration among partners that see this as charging twice for the same thing.

Financial benefits are still not appealing for most

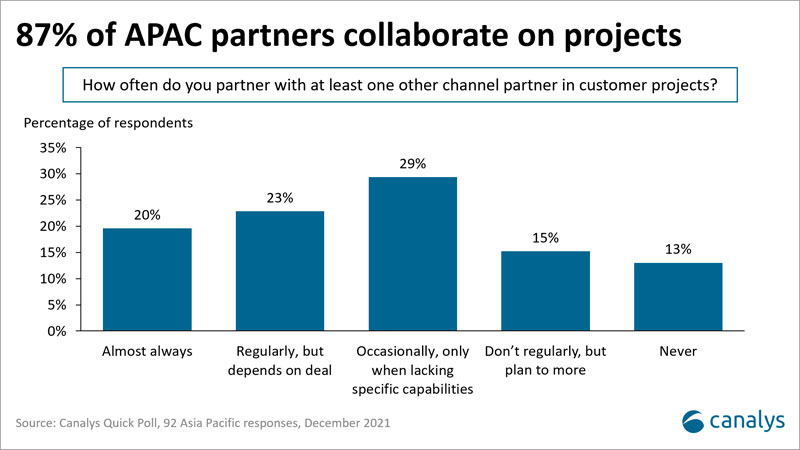

Though sustainability has moved up the agenda, it is hindered by many external factors. Fears of a global recession could damage investments in sustainability in 2022 and beyond. But among the ongoing supply chain challenges and component shortages, interest is growing in refurbished equipment. At the same time, a Canalys Quick Poll found that one in three partners have still not thought about their environmental, social and governance (ESG) goals. The lack of guidelines and standardization has slowed adoption of circular practices, notably among small and mid-market partners as they don’t have the resources to deploy refurbishment operations at scale.

In this, and many other ways, it is down to vendors and distributors to build and market their asset takeback services and logistics capabilities. It is only by providing clear, quantifiable goals and frameworks that the IT channel will see sustainable practices become standardized. Leadership is required and many partners are waiting for vendors to step up.

The skills gap affects sustainability too

Investing in skills is seen as vital to successfully unlock the potential of the sustainable economy. Inevitably, as in other areas of IT, there is a lack of expertise in sustainable business practices. Specialists might shake their heads at this suggestion, but the reality is that the circular economy still accounts for a small minority of the IT equipment sold through the channel. Channel partners must provide education and training to their employees to increase awareness of the impact of the products they sell, but also to build efficient long-term strategies. The lack of investment in new skills also creates barriers for partners in sales discussions when engaging with their customers, who are increasingly asking for sustainable solutions.

The barriers hindering the adoption of sustainable practices are still (unsurprisingly) high, but the last couple of years have seen vendors and channel partners increasingly map out their ESG strategies. A recent Canalys survey found that 40% of channel partners expect to generate revenue from sustainability solutions in 2022 and this will continue to increase as 60% of polled partners expect to have their strategies set by the end of 2022. Multivendor cooperation needs to bring clearly identified and agreed standards to enable clear reporting and measurement of sustainability progress across the industry.

Canalys will be discussing sustainability in Expert Hub sessions at the Canalys Channels Forums in Barcelona and Singapore in 2022. Canalys also has a Sustainable Channels Initiative to help vendors tailor their channel strategies to enable a more sustainable future.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band