Vendors are trying to navigate evolving routes to market

As the industry moves to the cloud, managed services or ecosystems, and cybersecurity risks increase, it is important to see how vendors are managing these changes, and what effect their responses have on the community of channel partners.

Moving with the times

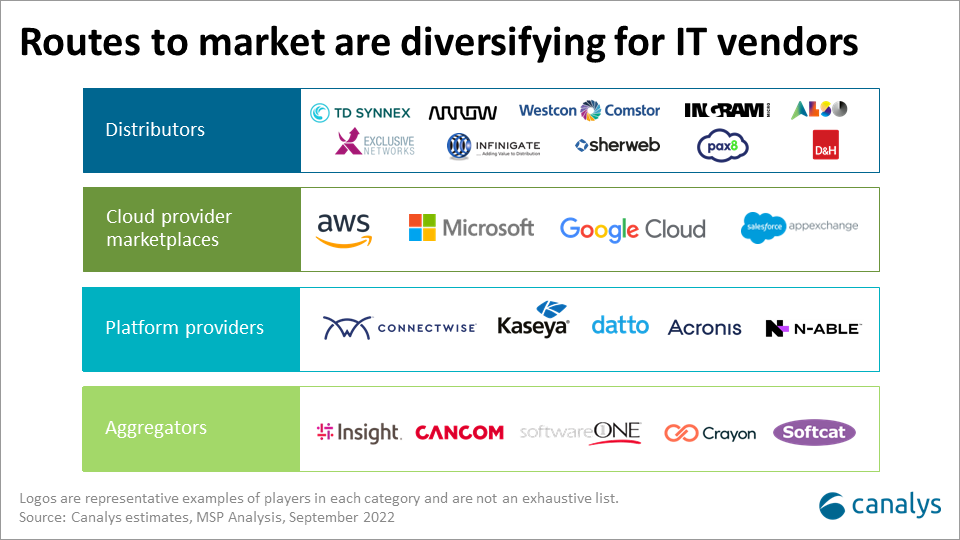

The options for IT vendors selling products and services through the channel are expanding. In software particularly, the different types of companies playing modern distribution-style roles is both an opportunity and a challenge for vendors as they decide where to place investments.

Distributors

IT distribution is always evolving, trying to maintain relevancy with existing vendors, making bets on new technologies, and attracting new partner types. Most, if not all, leading distributors continue to invest in marketplaces, ISV incubator programs, and changing their revenue and incentive models to adapt to a shifting landscape.

The next 12 to 24 months will see accelerated change in distribution. Established distributors must find ways to adapt to remain relevant, while also defining and building on their differentiation. That includes channel recruitment and management, training, and professional services offerings, which will continue to set them apart from hyper-scale cloud marketplaces.

Cloud service provider marketplaces

Cloud service provider marketplaces are a rapidly growing route to market for IT vendors. AWS and Microsoft’s Azure marketplaces dominate, followed by Google Cloud Marketplace. They are taking an increasingly large share of software vendors’ distributed revenue. The biggest challenge for vendors embracing hyperscale marketplaces as a route to market is how to manage the growing competition this creates with existing distributors (and partners where customers source directly).

An over-reliance on one hyperscale marketplace is also a risk for vendors, particularly when it is a dominant player like Amazon. As this volume of business through this channel increases, the need for vendors to maintain balance in their channels – between marketplaces and existing routes to market – will become more critical.

Platform providers

Companies such N-able, ConnectWise and Kaseya (now also owner of Datto) are fast becoming interesting routes to market for selected vendors looking to tap into their MSP communities. For these companies the most important drivers are those products which are directly within the MSP tech stack. Anything related to cybersecurity, cloud infrastructure and data center, networking, backup and disaster recovery, common SaaS applications, or other IT service management tools will be seen as a core part of the MSP ecosystem.

However, platform providers also have limited resources to build and manage multiple vendor relationships, so they must pick and choose. For any vendor looking to partner with these platform providers the question should not be ‘can they provide me with access to the MSP community’ but ‘how can a properly integrated partnership between our two companies bring value to the MSP community?’

Aggregators

Large channel partners and licensing specialists such as SoftwareOne, Crayon, Insight and Softcat have built revenue streams as software and cloud ‘aggregators’ serving smaller partners and MSPs, alongside their core businesses selling to end-customers. Some telco service providers are playing this role as well. This has seen them grow in importance to vendors looking to access and manage smaller partners, often in competition with distribution.

These companies can represent significant volumes for vendors, given their scale, however, they tend to have far less focus on channel management or support than legacy distributors, and their dual roles serving both end-customers and channel partners creates the risk of conflict.

Change, choices and challenges

Vendors do not have an infinite amount of money to spend on developing relationships with all these partners and partner types equally, and many will be stronger in some regions and countries than others. As internal budgets come under greater pressure in a deteriorating economy, demands to improve channel ROI, or cut channel spending, are likely to increase. Who does one invest in?

In the end, perhaps there is only so much change vendors can absorb before coming to the same conclusions: Understand your end customers’ needs; ensure you are providing enough choice and flexibility in your channel strategy to support customers however and wherever they want to buy; and make sure you are delivering the right partner support to maximize your value in the partner ecosystem. In a US$4.3 trillion IT market, there is still enough opportunity for everyone.

Canalys provides ongoing research to vendor clients around their channels strategy, focus on MSPs and the evolution in the channels ecosystem. Do contact the Channels team to arrange a call.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band