US PC shipments fell 12% in Q3 2022 amid weak demand across all segments Â

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 1 December 2022

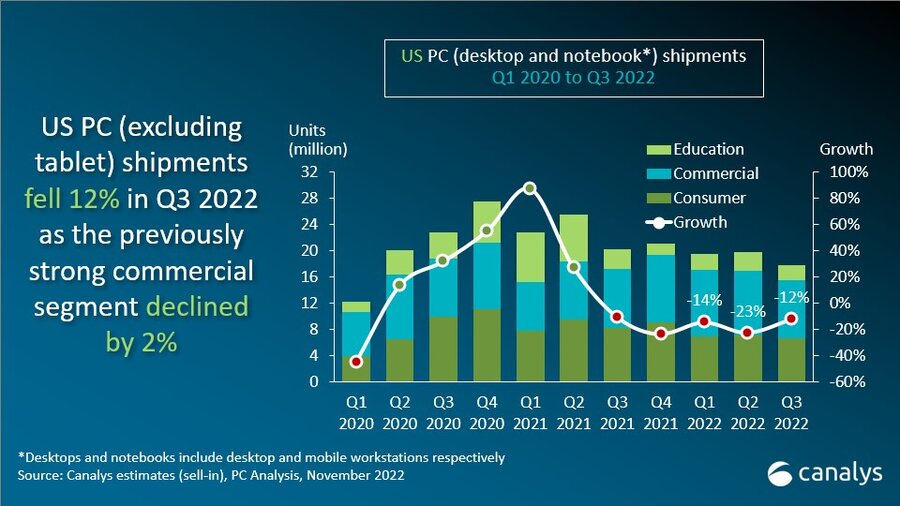

US shipments of desktops, notebooks and workstations fell by 12% year on year in Q3 2022 to 17.8 million units. Notebooks suffered a 14% decline, the largest of any category, as cautious business spending added to the consumer and education drop-off. Desktops grew a modest 1% in Q3 as the category recovers from pandemic-era declines. Tablets fell slightly by 1% as inflation diminished demand despite heightened promotional activity. Commercial demand, which has been strong in recent quarters, slowed as the segment dipped by 2% in Q3.

“The US PC market was already in an extended period of contraction as both consumer and education demand struggled with inflation and saturation,” said Brian Lynch, Canalys Research Analyst. “Now, the previously resilient commercial segment has started to wane, posting its first year-on-year decline in 2022. The ISM Services and Manufacturing Purchasing Managers Indexes have both steadily declined since late 2021 and are now at their lowest levels since the onset of the pandemic. Inflationary pressure, interest rate hikes and cost-cutting measures are beginning to squeeze spending by IT managers. While overall employment remains strong, the onset of layoffs in the tech and finance industries is an early sign that business spending on PCs may become even more cautious in the first half of 2023. Nevertheless, the fundamental importance of PCs in supporting trends such as hybrid work and digital transformation means the long-term outlook remains positive. Device lifespans will be extended in the short term as firms navigate the current economic uncertainty.”

“Looking ahead, the US PC market will face further headwinds,” added Lynch. “Despite the Q4 holiday season, the market will suffer a continued downturn. Cash-strapped consumers will cut spending on expensive technology products. Retailers have ramped up promotions in recent months to make room for new device launches as the holiday season approaches. But overall retail inventories are still growing faster than sales. The education segment will begin a slow recovery in 2023, but the bulk of device refreshes are now likely to occur in 2024. Education funding remains healthy, but schools are expected to want better-specified devices, which come with higher price tags. Given the confluence of these factors, we expect US PC shipments to undergo further declines in the first half of 2023.”

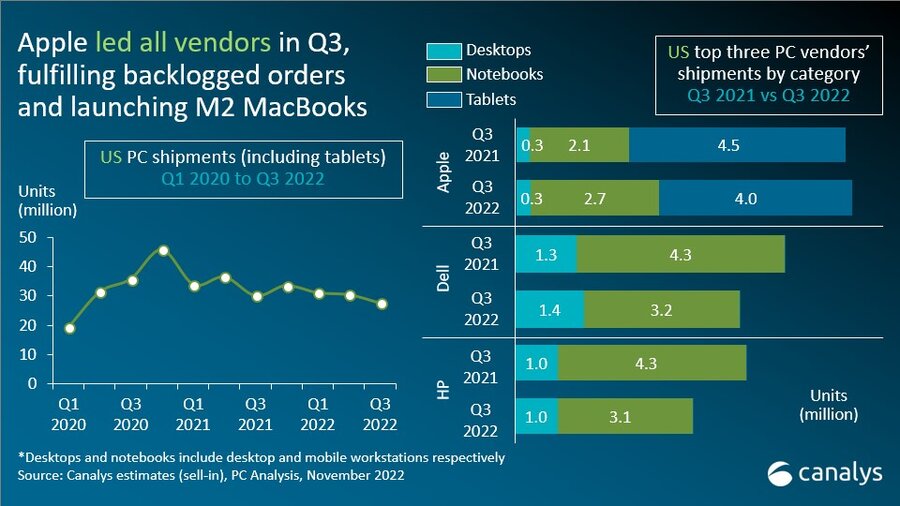

Dell held onto first place in the US desktop and notebook market in Q3 with a 26% market share, but its shipments were down 17% year on year. HP shipped 4.1 million units to secure second place but suffered the largest fall of the top five vendors, with shipments down 23%. Apple performed well in Q3 with 26% growth as it benefited from fulfilling backlogged orders from a supply-crunched Q2 and launched new M2 devices. Lenovo fell to fourth place as it struggled in the commercial segment. Acer came fifth with strong growth of 14%.

|

US desktop, notebook and workstation shipments (market share and annual growth) Q3 2022 |

|||||

|

Vendor (company) |

Q3 2022 |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Dell |

4.7 |

26.1% |

5.6 |

27.6% |

-16.9% |

|

HP |

4.1 |

22.7% |

5.3 |

26.0% |

-23.2% |

|

Apple |

3.0 |

16.7% |

2.3 |

11.6% |

26.5% |

|

Lenovo |

2.7 |

15.4% |

3.5 |

17.4% |

-22.2% |

|

Acer |

1.0 |

5.7% |

0.9 |

4.4% |

14.0% |

|

Others |

2.4 |

13.4% |

2.6 |

13.0% |

-9.1% |

|

Total |

17.8 |

100.0% |

20.3 |

100.0% |

-12.1% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

||||

Apple maintained its long-held leadership position in the US tablet market with a 41% market share. Premium tablets have struggled with price-sensitive consumers in recent quarters, while affordable tablets have performed well. Second-placed Amazon secured a market share of 27% and grew shipments by 20% on the back of a successful Prime Day in July. Samsung came third with 1.6 million shipments, an annual decline of 13%. TCL continued its strong surge with 133% growth as it increased marketing and branding efforts in the region, while Microsoft rounded out the top five with a 12% decline.

|

US tablet shipments (market share and annual growth) Q3 2022 |

|||||

|

Vendor (company) |

Q3 2022 |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Apple |

4.0 |

40.6% |

4.5 |

44.9% |

-10.4% |

|

Amazon |

2.7 |

26.7% |

2.2 |

22.1% |

19.5% |

|

Samsung |

1.6 |

16.3% |

1.9 |

18.6% |

-13.0% |

|

TCL |

0.6 |

5.7% |

0.2 |

2.4% |

133.2% |

|

Microsoft |

0.3 |

3.0% |

0.3 |

3.4% |

-12.0% |

|

Others |

0.8 |

7.7% |

0.9 |

8.6% |

-11.0% |

|

Total |

9.9 |

100.0% |

10.0 |

100.0% |

-0.9% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2022 |

|

||||

For more information, please contact:

Brian Lynch: brian_lynch@canalys.com +1 503 927 5489

About PC Analysis

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

US PC shipments fell 12% in Q3 2022 amid weak demand across all segments Â

US PC shipments fell 12% in Q3 2022 amid weak demand across all segments Â