Cloud services spend in China hits US$7.3 billion in Q2 2022Â

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 8 September 2022

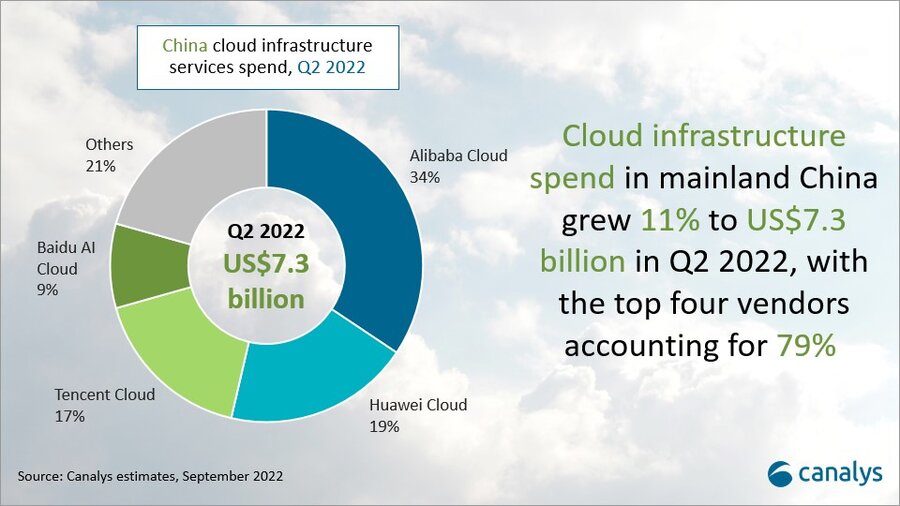

Cloud infrastructure services spend in mainland China grew 11% year on year in Q2 2022, reaching US$7.3 billion and accounting for 12% of overall global cloud spend. In contrast to the high growth momentum of 33% seen in the global cloud services market, China’s market growth slowed significantly, falling below 20% for the first time. The resurgence of COVID-19 in China was a major factor. Canalys forecasts that the Chinese cloud market will regain momentum in the second half of the year as business activities began to resume in first-tier cities in June. Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud maintained their positions as market leaders in the Chinese cloud market. The top four providers accounted for 79% of total expenditure in China, but all four saw a fall in their growth rates compared with past quarters.

The decline in growth rate was due to the resurgence of COVID-19 in China. But there is still strong potential for cloud adoption in the country as enterprise IT spend is far less there compared with countries with higher levels of cloud readiness. There remain many enterprise customers in traditional industries in China that are looking for ways to migrate to the cloud, especially SMBs.

“China’s cloud services have entered a new era where cloud vendors are no longer focused on just revenue scale and business growth, but more on high-margin, standardized products,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are trying to enrich their cloud capabilities by building their own channel ecosystems to bring together self-developed platform technologies and industry experience from partners. These market leaders have recently held, or will hold, channel ecosystem summits to recruit more channel partners.”

“Chinese cloud vendors typically emphasize having strong vertical focuses, creating products and solutions specific to certain industries, but that comes with high customization costs that can be challenging to navigate when economic pressures increase,” said Canalys VP Alex Smith. “Channel partners can help avoid this by taking over the services component, leaving the vendors to focus on broader platform development.”

- Alibaba Cloud remains the market leader in China’s cloud services market. It grew around 10% to account for 34% in Q2 2022. Its market share saw a significant decline of around 2% against the previous quarter as it faced challenges in customer acquisition in the government sector. But it hopes to gain momentum again as it launches a new partner program to expand its service ecosystem and shift toward a more partner-friendly model. Alibaba Cloud aims to proactively recommend ISVs in future project deliveries and has committed to investing CNY1 billion (US$150 million) in partnering with distributors to onboard more customers and close new deals in 300 cities across China. Alibaba Cloud continued to do well with its overseas expansion plans this quarter, launching four data centers in three countries, namely Germany, Thailand and Saudi Arabia. It also announced its cooperation with Thailand’s National Telecom and Saudi Telecom Company.

- Huawei Cloud accounted for 19% of the market after growing 11% annually and was the second-largest cloud service provider in Q2 2022. Huawei Cloud plans to focus on increasing cloud adoption across all upstream and downstream industries in China. Working with partners to develop a general package of solutions, it will begin making moves in a few select verticals – industrial, government, utilities, mining and education – which have historically been less digital but have a high propensity for cloud adoption. Huawei Cloud also announced that it will look into overseas businesses as a key driver for new business growth as it looks to provide cloud services to Chinese enterprises seeking overseas opportunities. Its expertise in localization, data center coverage and compliance in overseas projects will play an important role.

- Tencent Cloud accounted for 17% of the Chinese cloud market in Q2 2022. Tencent’s performance was in line with expectations as it placed less emphasis on market share growth and more on profitability. In June, Tencent Cloud announced that all its internal businesses, including QQ and Weixin, have been fully migrated to the cloud, lowering its internal IT costs.

- Baidu AI Cloud was fourth, taking 9% of the market and growing by 25% year on year. Baidu AI Cloud is yet to benefit from its industrial Internet platform Kaiwu, which has been recently updated to merge more than 200 solutions internally. Apart from the growth through industrial verticals, which has continued for several quarters, growth this quarter was strongly driven by vehicle manufacturing, medical and digital cities.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Yi Zhang (China): yi_zhang@canalys.com

Alex Smith (US): alex_smith@canalys.com

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Cloud services spend in China hits US$7.3 billion in Q2 2022Â

Cloud services spend in China hits US$7.3 billion in Q2 2022Â