China cloud service spending to grow by 12% in 2023

Monday, 20 March 2023

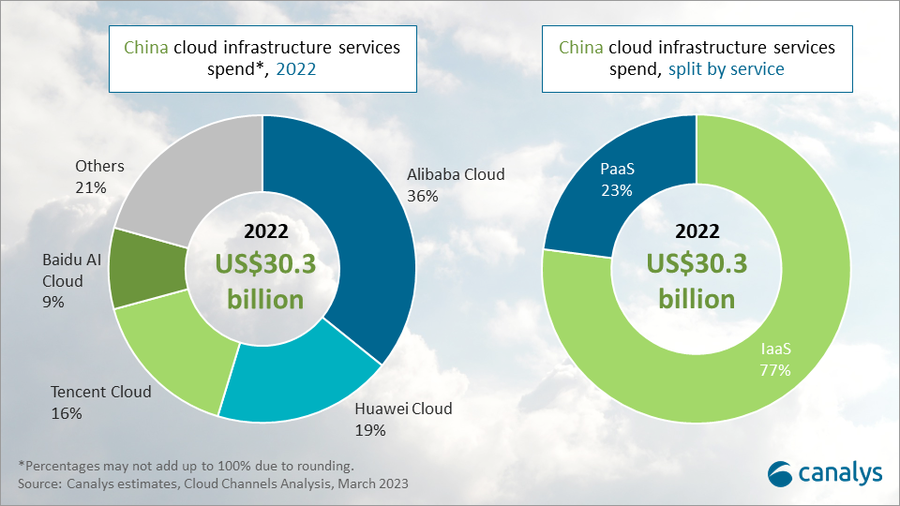

2022 was a conservative year overall for the cloud market in Mainland China, with the market growing 10% to a total of US$30.3 billion. The year closed out with 4% year-on-year growth in Q4, totaling US$7.9 billion in cloud spend. Growth rates showed a significant drop in 2022 compared to the strong performance of the past few years (over 30% annual growth in the previous three years). The impact of the pandemic and its restrictions cannot be ignored – enterprises are showing less enthusiasm for cloud adoption and are more concerned about the operational cost benefits from cloud. Customers who have already migrated to the cloud are starting to look at platform and software services. With restrictions being lifted, the negative impact on enterprises is gradually being eliminated and cloud demand is poised to return. But a degree of caution surrounding IT budgets will make it difficult to return to peak cloud growth. In 2023, Canalys expects Chinese cloud infrastructure services spending to grow 12% for the full year.

Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud, the top four cloud vendors in Mainland China in 2022, collectively grew 9% to account for a combined 79% share of customer spending. Telcos are seeking to capture cloud market share by introducing their own cloud services, resulting in a very slight decline in market share for the top four cloud vendors. The competitive pressure on the top four vendors will increase further, especially in the government and public sectors, as this is where telcos have a competitive edge. Despite the telcos' initial strong momentum, a gap still exists in platform and software capability offerings that needs to be closed before they become strong players in cloud infrastructure services.

"23% of the overall China cloud services market is expected to be represented by platform-as-a-service in 2022,” said Canalys Research Analyst Yi Zhang. “Cloud services requirements from enterprise customers have become more complex, with many demanding customizations, and the focus has shifted from simply providing cloud infrastructure to providing comprehensive cloud platform and software capabilities. The share of PaaS is expected to increase in 2023 as China's top cloud vendors announce investments in recruiting vertical-focused partners to provide PaaS solutions to customers."

Alibaba Cloud remained in first place in 2022, with 36% of total customer spending in cloud infrastructure services after growing 7% year-on-year. Alibaba Cloud experienced a tough year, with growth rates slowing quarter-on-quarter, after a strong 2021. However, the contraction in revenue from internet-based customers, which was Alibaba’s strongest business segment, is expected to diminish in 2023. Cloud demand from internet-based customers will rebound as the economy restabilizes after pandemic restrictions are lifted. Having survived a data security attack, Alibaba Cloud is actively seeking opportunities for customer expansion in government and public sector. Alibaba Cloud is making steady progress in its overseas expansion, announcing the opening of its third data center in Japan this quarter. It launched six new data centers, spanning three continents, in Asia Pacific, the Middle East and Europe in 2022.

Huawei Cloud ranked second with 19% market share in 2022, growing 13% annually (ahead of the overall market growth rate). In 2022, Huawei Cloud reaped considerable rewards from its investment in its channel ecosystem, with revenue growing by 55% through its partners. It announced plans to upgrade its partner program to provide partners with more attractive benefits, although details have yet to be revealed. In addition, Huawei Cloud has seen impressive revenue growth in overseas regions in 2022, benefiting from its strategy of helping Chinese enterprises expand overseas. It is scheduled to open new data centers in Turkey, Saudi Arabia, the Philippines, Egypt and other regions in 2023.

Tencent Cloud came third with a 16% market share. Tencent Cloud continued to be impacted by internal business restructuring during the year, leading to slowing revenue growth. However, following its strategy to focus on profitability, it has turned its attention to developing platform and software service capabilities, coming in second behind Alibaba Cloud in the PaaS market in 2022. In addition, it launched ‘Media Services’ a one-stop media offering covering 400 media-related services. Tencent Cloud is determined to build on its experience in media services, to improve competitiveness and differentiation. Tencent Cloud recently expanded its portfolio to include the launch of 'Metaverse-in-a-Box' to accelerate enterprises’ journey into Metaverse.

Baidu AI Cloud captured 9% of the Chinese cloud market in 2022 and grew 11% year-on-year. Baidu AI Cloud restructured its cloud business in Q4 by proactively cutting low-value customer projects, which impacted its growth rate in the short-term. Baidu has been following a strategy of combining AI and cloud services. With the launch of ChatGPT making waves, Baidu launched a local version of the ChatGPT model called ‘ERNIE Bot’ in March 2023. Baidu AI Cloud will likely seek to use this as a way to attract enterprises to its cloud, similar to Microsoft's integration of OpenAI.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed, to host and operate them.

For more information, please contact:

Yi Zhang: yi_zhang@canalys.com

Alex Smith: alex_smith@canalys.com

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

China cloud service spending to grow by 12% in 2023

China cloud service spending to grow by 12% in 2023