China’s smartphone market full-year shipment hits a 10-year lowÂ

Sunday, 29 January 2023

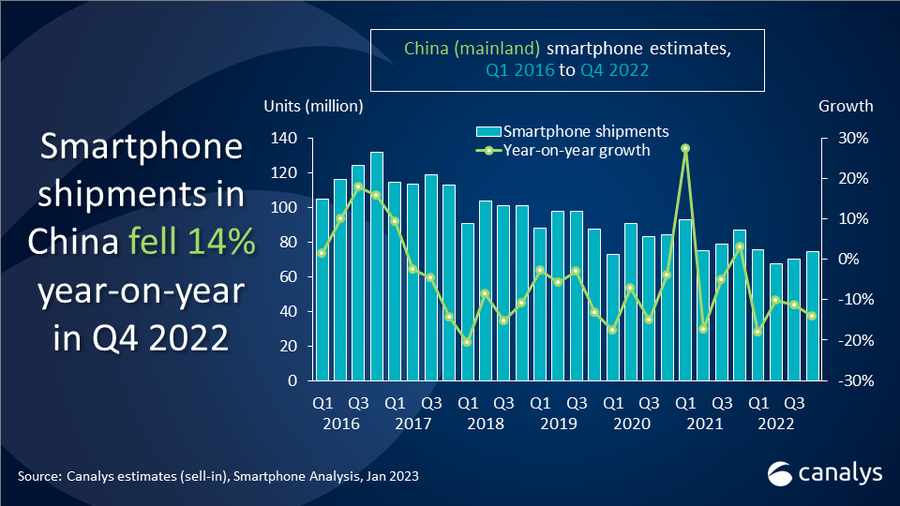

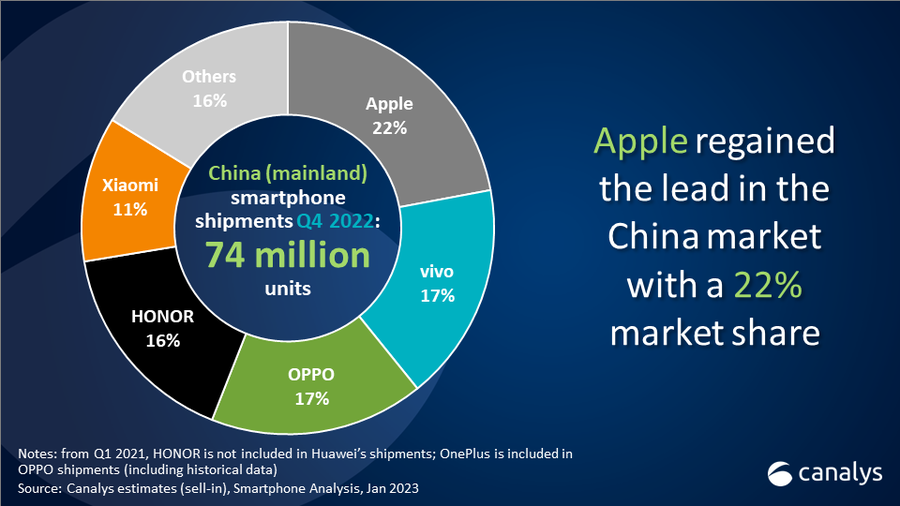

Mainland China’s smartphone market finished 2022 with an annual shipment of 287 million units, a year-on-year decrease of 14%. This is the first time since 2013 that China’s market shipment has fallen below 300 million units. The 2022 crown was taken by vivo, while HONOR and Apple ranked second and third respectively. Apple reached an all-time-high market share of 18% in China thanks to its aggressive promotions and demand in the high-end segment remained resilient. In Q4 2022, despite the sales season, the Chinese market only managed to ship 74.4 million units, recording a 14% year-on-year decline. Q4’s market leader Apple dropped by 24% due to the earlier release of the iPhone 14 series, of which supply was also affected by the lockdown of Foxconn’s plant in Zhengzhou. vivo ranked second with 12.7 million units while OPPO (including OnePlus) maintained third place with 12.5 million units. HONOR slipped to fourth while Xiaomi completed the league table in fifth place.

“The strict pandemic control policy has resulted in historically high household savings as consumer spending became conservative,” said Canalys Research Analyst Lucas Zhong. “The Consumer Confidence Index in October and November was at its lowest level since April. During the traditional double 11 shopping festival, there were also no apparent signs of demand uplifts. Despite that, in December, the government relaxed its ‘zero-COVID-19’ policy dramatically, but business activities were still impacted by surging cases.”

“Vendors have been dealing with inventory issues throughout 2022. Fortunately, most vendors started to normalize inventory levels during promotions in Q4. Vendors are also attempting to slow the expansion of offline channels to achieve a balanced online-offline channel split,” added Zhong. “Meanwhile, Chinese vendors still pursue premiumization product strategies with improved ecosystem experiences. Xiaomi collaborated with Leica to introduce its Xiaomi 13 Pro series equipped with a flagship IMX989 sensor. OPPO upgraded the Find N foldable lineup with the release of its first clamshell foldable product. And HONOR launched MagicOS 7.0 and MagicRing, which allowed a more seamless multi-device experience.”

“Vendors are still very cautious about the market in 2023,” said Canalys Analyst Amber Liu. “For example, HONOR which enjoyed rapid growth last year, will eye IoT products instead of growing shipments or offline channels. OPPO, on the other hand, will focus on deepening investments into its in-house R&D while trying to maintain its market share with a prudent strategy. The recovery of the consumer market is taking time as the effect of stimulus on the economy and demand may take six to 12 months to show. We expect the supply chain to finally stabilize in 2023 as the pandemic control policy is no longer in operation, and the overall smartphone market will likely grow slightly year-on-year as business activities and confidence return.”

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q4 2022 |

|||||

|

Vendor |

Q4 2022 shipments (million) |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

16.4 |

22% |

21.5 |

25% |

-24% |

|

vivo |

12.7 |

17% |

13.4 |

15% |

-5% |

|

OPPO |

12.5 |

17% |

14.3 |

17% |

-13% |

|

HONOR |

12.2 |

16% |

14.2 |

16% |

-14% |

|

Xiaomi |

8.5 |

11% |

13.5 |

16% |

-37% |

|

Others  |

12.1 |

16% |

9.7 |

11% |

24% |

|

Total  |

74.4 |

100% |

86.6 |

100% |

-14% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|

||||

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

vivo |

52.2 |

18% |

71.5 |

21% |

-27% |

|

HONOR |

52.2 |

18% |

40.2 |

12% |

30% |

|

Apple |

51.3 |

18% |

49.4 |

15% |

4% |

|

OPPO |

50.4 |

18% |

68.7 |

21% |

-27% |

|

Xiaomi |

38.6 |

13% |

50.5 |

15% |

-24% |

|

Others  |

42.6 |

15% |

52.5 |

16% |

-19% |

|

Total  |

287.3 |

100% |

332.9 |

100% |

-14% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact:

Lucas Zhong: lucas_zhong@canalys.com +86 182 1703 4400

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

China’s smartphone market full-year shipment hits a 10-year lowÂ

China’s smartphone market full-year shipment hits a 10-year lowÂ