Cybersecurity spend tops US$10 billion in Q4 2018 as new deployment models gain traction

Palo Alto, Shanghai, Singapore and Reading (UK) – Thursday, 28 March 2019

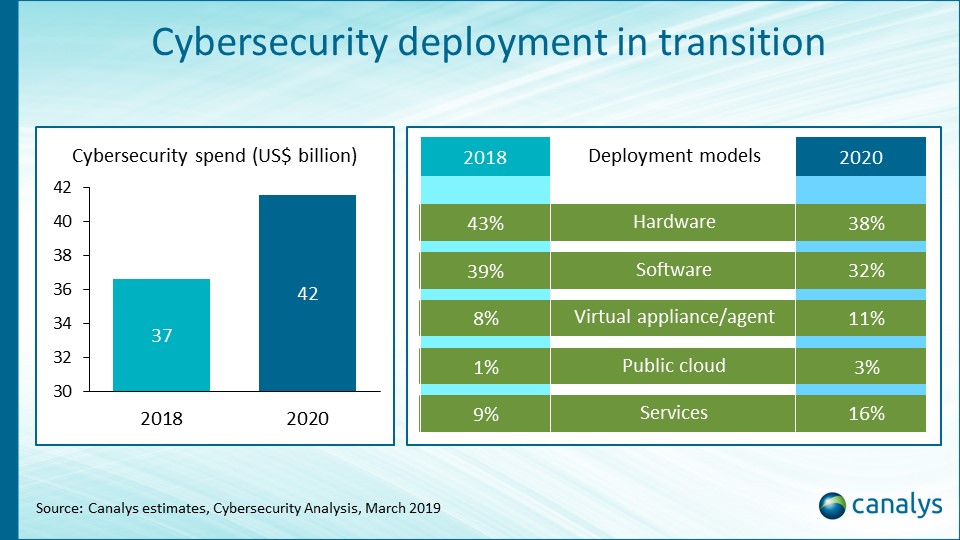

According to Canalys estimates, worldwide cybersecurity spending exceeded US$10 billion for the first time in Q4 2018. Organizations increased their level of protection against malicious threats, while adhering to strengthening data compliance regulations. Total cybersecurity investment in 2018 reached US$37 billion, up 9% from US$34 billion in 2017. Despite the high priority many organizations give to protecting their data assets, endpoints, networks, employees and customers, cybersecurity still only represented 2% of total IT expenditure last year. This will inevitably rise as new, more frequent and sophisticated threats emerge, which will give vendors further growth opportunities. By 2020, total cybersecurity spend is expected to surpass US$42 billion on an annual basis.

“Over the next two years, the transition in cybersecurity deployment models will accelerate. Customers are changing their IT buying behavior, with the adoption of public cloud, and flexible consumption and subscription services,” said Canalys Principal Analyst Matthew Ball. Canalys data shows that in 2018 traditional hardware and software deployment accounted for 82% of the cybersecurity market. The remaining 18% was deployment of virtual appliances and agents, procurement through public cloud marketplaces and subscriptions to cybersecurity as a service.

By 2020, the proportion from traditional deployment models will fall to 70% as newer ways of delivering cybersecurity solutions gain traction. “Vendors will have to establish a diverse range of business models to support this transition, as different products suit different types of deployments. The key challenge to date for many has been making the new models more channel-centric, and integrating them with existing partner programs, especially customer transactions via cloud marketplaces,” Ball added. “This has recently been addressed by some cloud marketplaces, allowing partners to offer customized deals and pricing direct to customers, while tracking deal registration and rebates.”

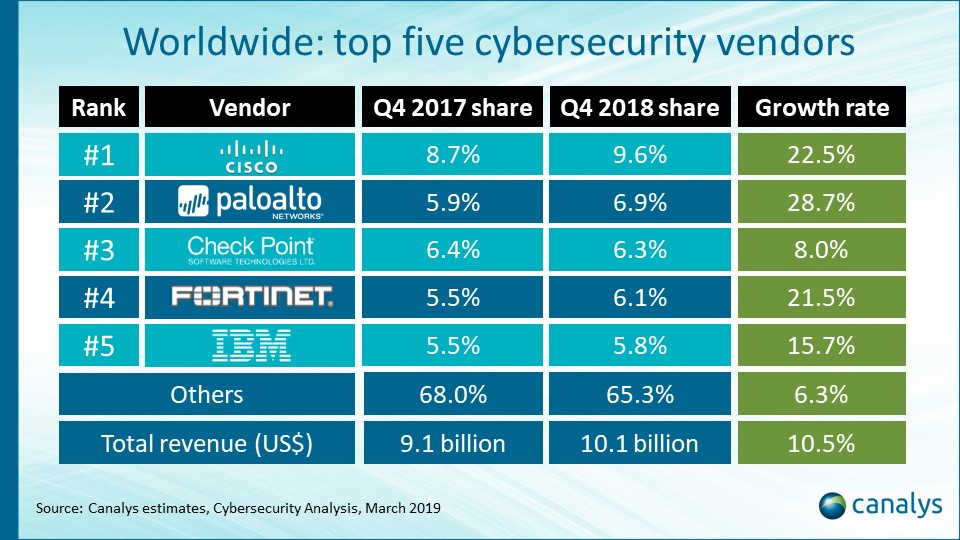

“The leading cybersecurity vendors have embraced new deployment models, with each in the process of transitioning their businesses to more subscription-based revenue and increasing transactions via cloud marketplaces,” said Canalys Research Analyst Ketaki Borade. In Q4 2018, Cisco remained the overall worldwide market leader, growing its share from the previous year to just under 10%. Palo Alto Networks grew faster but remained in second place with 7%. Check Point, Fortinet, IBM and Symantec each had 6% market share in Q4. Overall, the top 10 cybersecurity vendors collectively represented 53% of shipments during this period, with the next 20 accounting for 21%.

“Cisco, Palo Alto Networks, Barracuda and Check Point are also the top cybersecurity vendors on the leading public cloud marketplace, AWS Marketplace, selling their virtual offerings on a per hour and annual basis. This is still a small part of their overall business, but is the fastest growing area,” Borade added. “Barracuda Networks, Trend Micro and F5 Networks also have a strong presence on cloud marketplaces, highlighting their early move to adopt new deployment models.”

Cybersecurity quarterly estimate and forecast data is taken from Canalys’ Cybersecurity Analysis service. Estimates include network security, endpoint security, web and email security, data security and vulnerability and analytics security. The subscription service tracks the transition of deployment options from hardware and software to services, public cloud workloads and virtual appliances/agents by channel and end user size.

For more information, please contact:

Canalys EMEA: +44 118 984 0520

Matthew Ball: matthew_ball@canalys.com +447887950505

Claudio Stahnke: +447881934784

Canalys APAC (Shanghai): +86 21 2225 2888

Daniel Liu: daniel_liu@canalys.com +8615800756471

Canalys APAC (Singapore): +65 6671 9399

Sharon Hiu: sharon_hiu@canalys.com +6597779015

Canalys Americas: +1 650 681 4488

Alex Smith: alex_smith@canalys.com +16507994483

Ketaki Borade: ketaki_borade@canalys.com +16503875389

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us.

Alternatively, you can email press@canalys.com or call +1 650 681 4488 (Palo Alto, California, USA), +65 6671 9399 (Singapore), +86 21 2225 2888 (Shanghai, China) or +44 118 984 0520 (Reading, UK).

Please click here to unsubscribe

Copyright © Canalys 2019. All rights reserved.

Americas: Suite 317, 855 El Camino Real, Palo Alto, CA 94301, US | tel: +1 650 681 4488

APAC: Room 310, Block A, No 98 Yanping Road, Jingan District, Shanghai 200042, China | tel: +86 21 2225 2888

APAC: 133 Cecil Street, Keck Seng Tower, #13-02/02A, Singapore 069535 | tel: +65 6671 9399

EMEA: Diddenham Court, Lambwood Hill, Grazeley, Reading RG7 1JQ, UK | tel: +44 118 984 0520

email: inquiry@canalys.com | web: www.canalys.com

For more information:

e-mail press@canalys.com