Global smartphone shipments fall 9% in Q2 2022 as economic headwinds blowÂ

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 18 July 2022

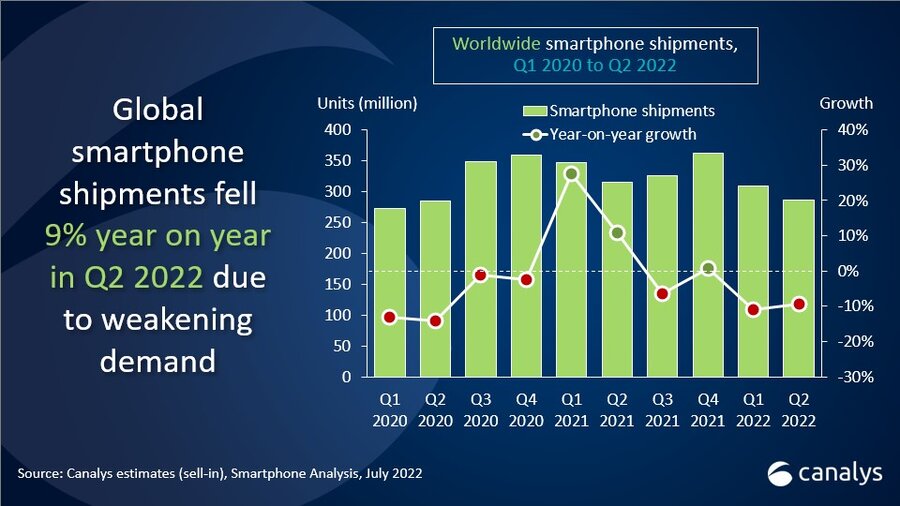

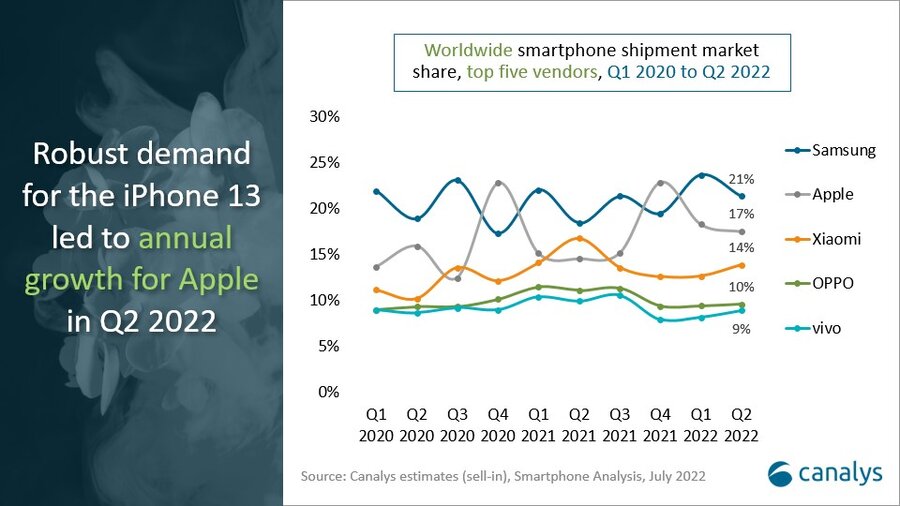

Worldwide smartphone shipments fell 9% year on year in Q2 2022. Demand has started to wane following economic headwinds and regional uncertainty. Samsung took first place with a 21% market share as it strengthened its low-end A series supply. Apple came second with a 17% share as the iPhone 13 remained in high demand. Xiaomi, OPPO and vivo continued to struggle in China, suffering double-digit declines to take 14%, 10% and 9% market shares respectively.

“Vendors were forced to review their tactics in Q2 as the outlook for the smartphone market became more cautious,” said Canalys Research Analyst Runar Bjørhovde. “Economic headwinds, sluggish demand and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end.”

“Falling demand is causing great concern for the entire smartphone supply chain,” said Canalys Analyst Toby Zhu. “While component supplies and cost pressures are easing, a few concerns remain within logistics and production, such as some emerging markets’ tightening import laws and customs procedures delaying shipments. In the near term, vendors will look to accelerate sell-through using promotions and offers ahead of new launches during the holiday season to alleviate the channel’s liquidity pressure. But in contrast to last year’s pent-up demand, consumers’ disposable income has been affected by soaring inflation this year. Deep collaboration with channels to monitor the state of inventory and supply will be vital for vendors to identify short-term opportunities while maintaining healthy channel partnerships in the long run.”

|

Worldwide smartphone shipments and growth |

||||

|

Vendor |

Q2 2021 market share |

Q2 2022 market share |

||

|

Samsung |

18% |

21% |

||

|

Apple |

14% |

17% |

||

|

Xiaomi |

17% |

14% |

||

|

OPPO |

11% |

10% |

||

|

vivo |

10% |

9% |

||

|

Preliminary estimates are subject to change on the final release |

|

|||

For more information, please contact:

Runar Bjørhovde (UK): runar_bjorhovde@canalys.com +44 7787 290115

Toby Zhu (China): toby_zhu@canalys.com +86 150 2674 3017

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Global smartphone shipments fall 9% in Q2 2022 as economic headwinds blowÂ

Global smartphone shipments fall 9% in Q2 2022 as economic headwinds blowÂ