Smartwatch a rising star in a falling Mainland China wearable market in Q3 2022Â

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 15 December 2022

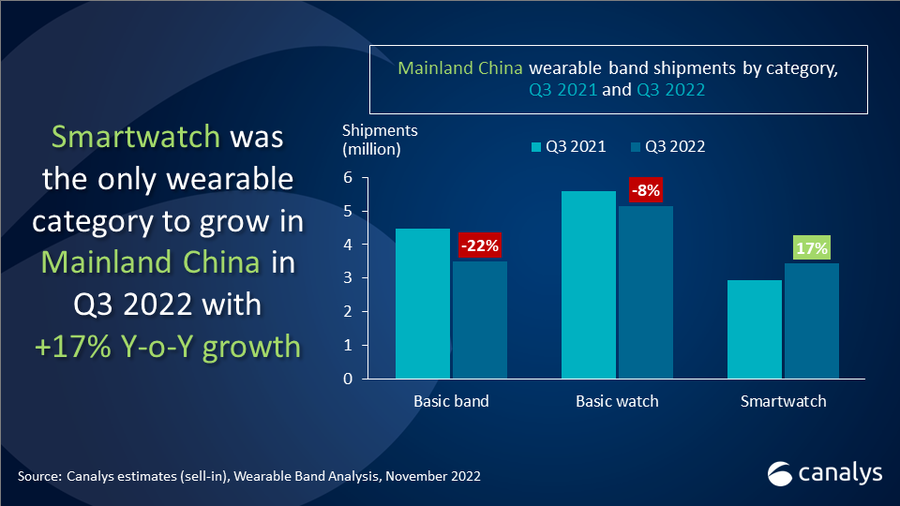

According to the latest Canalys estimates, China's wearable band market continued its weak performance in Q3 2022, with overall shipments down 7.1% to 12 million units. However, the smartwatch segment bucked the trend and maintained growth in the third quarter, up 16.8% to 3.4 million units. Cities across China experienced intermittent lockdowns in the first half of the year, consumer confidence has declined, and consumers are more conscious of spending on non-essential goods such as wearable bands. That showed in the basic band market, which declined sequentially for the eighth quarter, with shipments falling to 3.5 million units. Basic watches also suffered a 7.7% decline in the quarter, to reach 5.1 million units shipped. Basic watches still held the largest market share, accounting for over 40% of the overall market in China, while basic bands and smartwatches were almost evenly split at 29% and 28%, respectively. These sub-categories saw an alternating shift in shipment share.

Huawei gradually lost its home field advantage in Q3 in Mainland China. “Competitors are catching up and Xiaomi, OPPO and vivo are aggressively expanding their watch portfolios to cover a wider range of price segments while accelerating the deployment of IoT ecosystem strategies,” commented Canalys Analyst Cynthia Chen.

Apple’s new Watch Ultra has been a hit with local consumers with its recognizable design, driving growth in the US$700+ (approximately CNY 6299) segment. “Novel forms of kid’s smartwatches, such as the flip design with dual cameras from Okii (XTC), also contributed to smartwatch growth. Due to the limited play value, basic bands and basic watches cannot fully meet local consumers’ growing demands. However, smartwatches attract consumers’ interest with a wider range of user scenarios and more innovative experiences,” added Chen.

In addition to seeking strategic cooperation with local professional sports or medical institutions, Chinese vendors are actively exploring various application scenarios, leveraging the home-field advantage to enhance the product value of basic watches to achieve innovation breakthroughs. For example, to deepen the interaction between products and consumers’ daily life, Xiaomi and vivo are exploring RTOS with third-party applications for in-depth development in niche functional areas. Compared to smartwatches, the low cost and short-cycle of developing applets for basic watches has attracted more vendors to invest in this area. However, such investment in breakthrough innovation has yet to translate into commercial returns.

“The market landscape for mainstream vendors will remain stable,” commented Canalys principal analyst Jason Low. “New use-case development takes time to accumulate, and vendors need to build a high-end brand image.”

Meanwhile, new market entrants are trying to develop differentiations by obtaining professional medical device certification. “Vendors need breakthroughs in health and fitness tracking and digital health to disrupt the market,” said Low.

On top of that, the recent announcement of an eSIM promotion by China’s Ministry of Industry and Information Technology may be good news for the struggling wearable band market in China. “eSIM and cellular networks offer natural advantages to wearables and will bring more development possibilities if partnerships can be established with operators. Strong channel potential can create more diverse wearable applications incorporating eSIM and cellular networks, which will energize the wearable market in mainland China,” added Low.

|

Mainland China wearable bands shipments and annual growth |

|||||

|

Vendor |

Q3 2022 shipments (million) |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Huawei |

2.9 |

24.0% |

4.0 |

30.6% |

-27.1% |

|

Xiaomi |

2.6 |

21.9% |

2.5 |

19.1% |

6.5% |

|

XTC |

1.2 |

9.8% |

1.3 |

9.9% |

-7.5% |

|

Apple |

1.0 |

8.6% |

0.7 |

5.3% |

52.9% |

|

OPPO |

0.5 |

4.3% |

0.4 |

3.3% |

22.2% |

|

Others |

3.8 |

31.4% |

4.2 |

32.0% |

-8.7% |

|

Total |

12.1 |

100.0% |

13.0 |

100.0% |

-7.0% |

|

|

|

|

|||

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments; percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com +86 158 2151 8439

Jason Low: jason_low@canalys.com +86 159 2128 2971

About Wearable Band Analysis

Canalys’ Wearable Band Analysis service provides qualitative and quantitative insights into the wearable band market and addresses the areas where vendors can improve. Our best-in-class service guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and enhance go-to-market strategies to engage in different markets worldwide. The data has detailed splits, tracking a list of 50+ features around connectivity, components, sensors, chipsets and many other different categories. Model-level information is available for 30+ key markets.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com