Western Europe’s PC shipments fall 18% in Q2 2022 due to Chinese production crunch and inflationary pressureÂ

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 22 August 2022

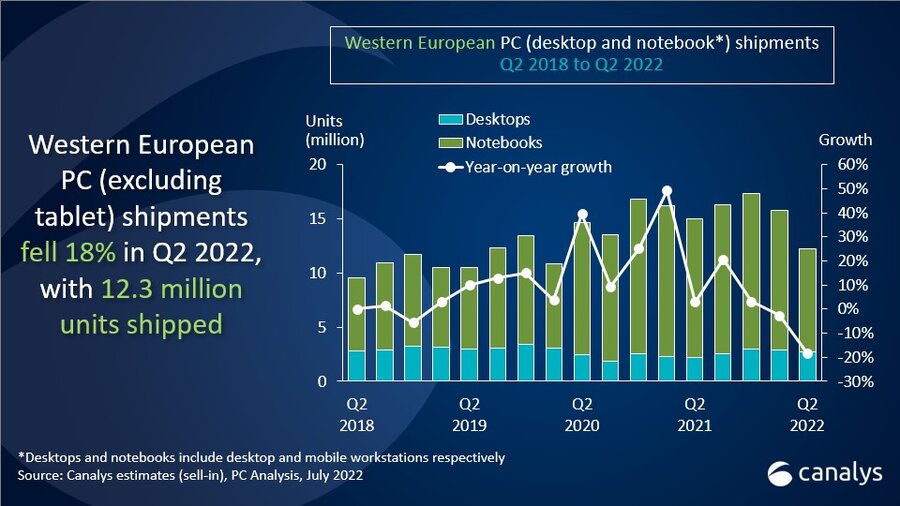

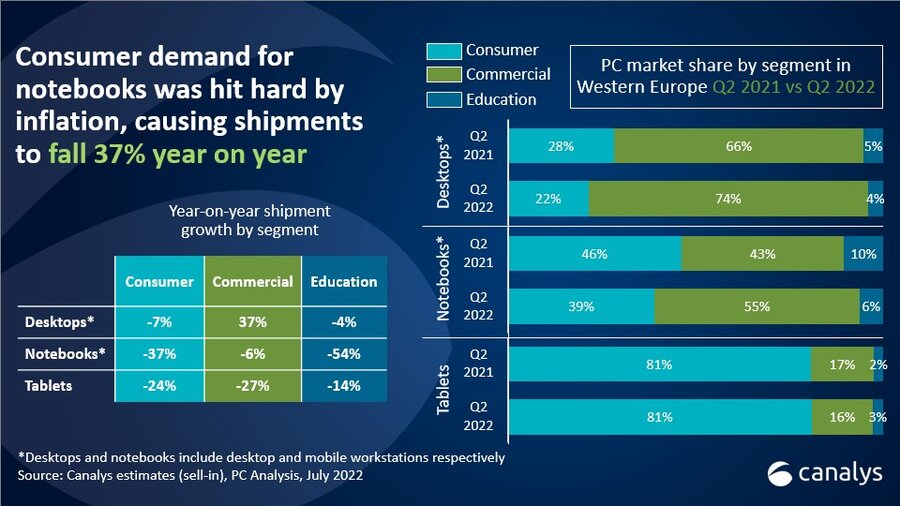

Strong headwinds in both supply and demand during Q2 caused Western Europe’s PC shipments to suffer a second consecutive quarter of decline. Total notebook and desktop shipments fell steeply to 12.3 million units, an 18% year-on-year drop. Notebooks were hit hardest, with shipments down 26% year on year to 9.5 million units. Conversely, desktops fared much better, growing 22% year on year to 2.7 million units in Q2 2022 as increased commercial demand kept the category afloat. The consumer-oriented tablet market was hit badly, shrinking 24% from last year to 5.9 million units.

Significant supply chain disruption was the main reason for Q2’s drastic decrease, as key regions and cities in China were in lockdown for much of the quarter. The lockdowns hampered factories and ports along the Beijing-Shanghai corridor. Though production began to ramp up again by the end of May, this bounce back wasn’t enough to compensate for the poor start to the quarter. After vendors waited out the delays in order lead times, they were then hit by increasing macroeconomic headwinds as consumers cut spending due to rising inflation.

“On top of unprecedented supply issues, the second quarter of 2022 highlighted the impact of rising inflation on consumer demand for PCs across Western Europe,” said Canalys Research Analyst Kieren Jessop. Eurostat, the statistical office of the European Union, reported that inflation rates in the euro area averaged around 8% during Q2. This was primarily driven by rising energy costs due to the war in Ukraine, which saw the euro area’s energy price inflation reach 42% year on year in June. “In this inflationary environment, the consumer/commercial mix is undergoing a significant shift. Consumer-bound shipments of desktops and notebooks fell by 34% in Q2 as many people were forced to delay buying new devices due to pressure on household budgets. Conversely, as countries in the region continued their post-COVID recoveries, business demand for high-quality devices to support returns to work and hybrid workstyles remained relatively robust, with non-education commercial PC shipments falling only 3%. Larger organizations that have the capital are still willing and able to refresh their employees’ devices and upgrade their office IT infrastructure. PC vendors with strong channel relationships and commercial-oriented offerings of products and associated services will see healthier overall performance in the region, even as economic conditions worsen.”

Lenovo remained Western Europe’s top choice for desktops and notebooks. Though its shipments fell 8% to 3.8 million units in Q2 2022, it was the best performing vendor in the top five and made a market share gain of more than three percentage points compared with a year ago. HP and Dell also suffered declines in Q2, falling 17% and 18% respectively. HP maintained a comfortable second place, shipping 3 million units against third-placed Dell’s 1.7 million. Apple endured the largest decline of the top five vendors, hurt by its premium price points and disruption to its Chinese manufacturing facilities. It shipped just under 800,000 units in Q2, a 42% drop from last year. Acer moved up to fourth place for the first time since Q2 2021, though it also suffered a significant decline of 30%, shipping just over a million units.

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2022 |

|||||

|

Vendor |

Q2 2022 shipments |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Lenovo |

3,785 |

30.9% |

4,124 |

27.4% |

-8.2% |

|

HP |

3,031 |

24.7% |

3,656 |

24.3% |

-17.1% |

|

Dell |

1,698 |

13.8% |

2,070 |

13.8% |

-18.0% |

|

Acer |

1,000 |

8.2% |

1,441 |

9.6% |

-30.6% |

|

Apple |

788 |

6.4% |

1,358 |

9.0% |

-42.0% |

|

Others |

1,958 |

16.0% |

2,393 |

15.9% |

-18.2% |

|

Total |

12,260 |

100% |

15,043 |

100% |

-18.5% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding |

|

||||

Apple maintained a comfortable lead as Western Europe’s top tablet provider for the eighth consecutive quarter, even though its year-on-year shipments fell 20% to 2.2 million in Q2. Samsung’s market share increased by an impressive four percentage points in Q2 as its total shipments hit 1.3 million units. Third-placed Lenovo and fifth-placed Huawei suffered the most in Q2 2022, down 38% and 56% respectively, while Amazon took fourth place with a relatively modest decline of 7%.

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2022 |

|||||

|

Vendor |

Q2 2022 shipments |

Q2 2022 |

Q2 2021 |

Q2 2021 |

Annual |

|

Apple |

2,243 |

37.7% |

2,825 |

35.9% |

-20.6% |

|

Samsung |

1,299 |

21.8% |

1,394 |

17.7% |

-6.8% |

|

Lenovo |

991 |

16.7% |

1,591 |

20.2% |

-37.7% |

|

Amazon |

465 |

7.8% |

499 |

6.3% |

-6.7% |

|

Huawei |

274 |

4.6% |

623 |

7.9% |

-56.0% |

|

Others |

675 |

11.3% |

930 |

11.8% |

-27.4% |

|

Total |

5,947 |

100% |

7,861 |

100% |

-24.3% |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Kieren Jessop (UK): kieren_jessop@canalys.com +44 7796 306 473

About PC Analysis

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Western Europe’s PC shipments fall 18% in Q2 2022 due to Chinese production crunch and inflationary pressureÂ

Western Europe’s PC shipments fall 18% in Q2 2022 due to Chinese production crunch and inflationary pressureÂ