Poor demand caused a 9% decline in the global smartphone market

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 27 October 2022

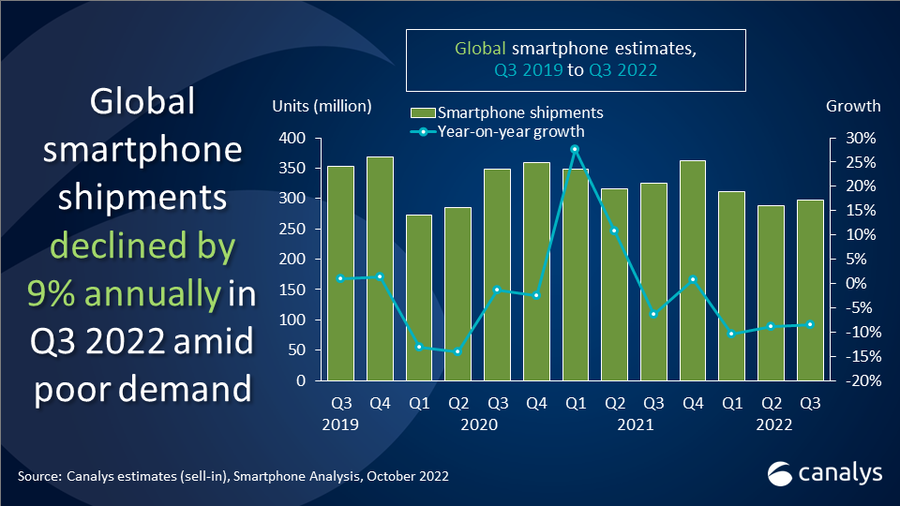

The latest Canalys smartphone analysis indicates weak demand in Q3 2022 caused worldwide smartphone shipments to decline by 9% year-on-year to 297.8 million units. Samsung defended its first place in the market despite an 8% decline, shipping 64.1 million units. Apple, the only leading vendor to increase year-on-year driven by robust demand, grew 8% and shipped 53.0 million units. Following two quarters of double-digit declines, Xiaomi leveraged its global scale to find opportunities helping it strengthen its position to only decline 8%, shipping 40.5 million units. OPPO and vivo took fourth and fifth place despite having over 20% declines, shipping 28.5 million and 27.4 million units respectively in Q3 2022.

“Performance of the high-end segment was the only highlight this quarter,” said Canalys Research Analyst Runar Bjørhovde. “Apple reached its highest Q3 market share yet, driven by both the iPhone 13 and newly launched iPhone 14 series. The popularity of the iPhone 14 Pro and Pro Max, in particular, will contribute to a higher ASP and stable revenue for Apple. On the Android side, Samsung refreshed its foldable portfolio and increased its marketing initiatives significantly to generate interest and demand for its new flagships. Mid-to-low-end demand has been hit making it challenging for vendors to navigate in a competitive segment. Xiaomi managed to leverage its global scale with a refreshed product line to offset declines in its home market. OPPO and vivo are still significantly impacted by the drop in the China market but have both shown small signs of recovery.”

“Europe and Asia Pacific outperformed the rest of the world in Q3,” said Canalys Analyst Sanyam Chaurasia. “Europe avoided a significant drop helped by a spike in shipments to Russia. Here, Chinese vendors leveraged short-term opportunities to stock up the channel in a market that has been undersupplied during previous quarters. APAC had a huge variation between different markets, but sequentially improving demand in India, Indonesia and the Philippines helped the region stabilize its performance. Carrier dominated markets such as North America and Latin America presented increasingly cautious sentiments on managing inventory before heading into big holiday seasons, contrasting a much more optimistic view in Q3 last year.”

“Moving into Q4, ongoing global disruptions are hampering the performance of entire ecosystem portfolios for vendors,” said Canalys Analyst Toby Zhu. “The upstream supply chain is entering a long winter sooner than expected where OEMs’ order targets are slashed heavily. Also, slow inventory turnover and poor economic figures have affected the channel's confidence, falling back to major brands with iconic devices to generate traffic for the most important revenue quarter. Vendors are entering Q4 with cautious strategies to handle the persisting difficulties. Managing the gloomiest Q4 outlook in over a decade will show which vendors are well-positioned for the long-term.”

|

Worldwide smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q3 2022 |

|||||||

|

Vendor |

Q3 2022 shipments (million) |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

||

|

Samsung |

64.1 |

22% |

69.4 |

22% |

-8% |

||

|

Apple |

53.0 |

18% |

49.2 |

16% |

8% |

||

|

Xiaomi |

40.5 |

14% |

44.0 |

14% |

-8% |

||

|

OPPO |

28.5 |

10% |

36.7 |

12% |

-22% |

||

|

Vivo |

27.4 |

9% |

34.2 |

11% |

-20% |

||

|

Others |

84.3 |

27% |

92.1 |

25% |

-6% |

||

|

Total |

297.8 |

100% |

325.6 |

100% |

-9% |

||

|

Note: percentages may not add up to 100% due to rounding |

|

||||||

For more information, please contact:

Runar Bjørhovde: runar_bjorhovde@canalys.com +44 7787 290115

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Toby Zhu: toby_zhu@canalys.com +86 150 2674 3017

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Poor demand caused a 9% decline in the global smartphone market

Poor demand caused a 9% decline in the global smartphone market