Smart Personal Audio segment declines 26% in Q4 2022, with a tough 2023 ahead

Tuesday, 7 March 2023

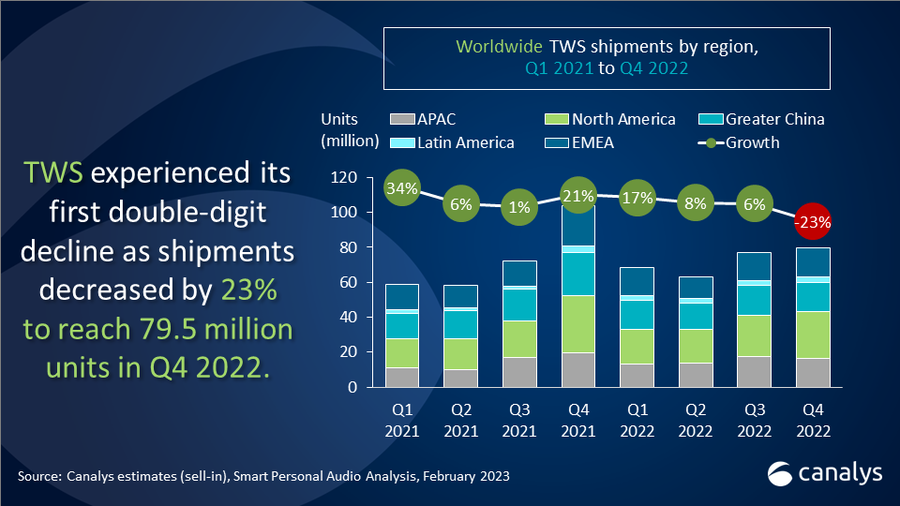

The global smart personal audio market saw a significant decline of 26% to 112.1 million units in Q4 2022 according to estimates released by Canalys, the leading industry analyst company. The decline was attributed to challenging macroeconomic conditions, with TWS unit shipments falling 23%, wireless earphones shipments dropping 36% and wireless headphones declining 25%.

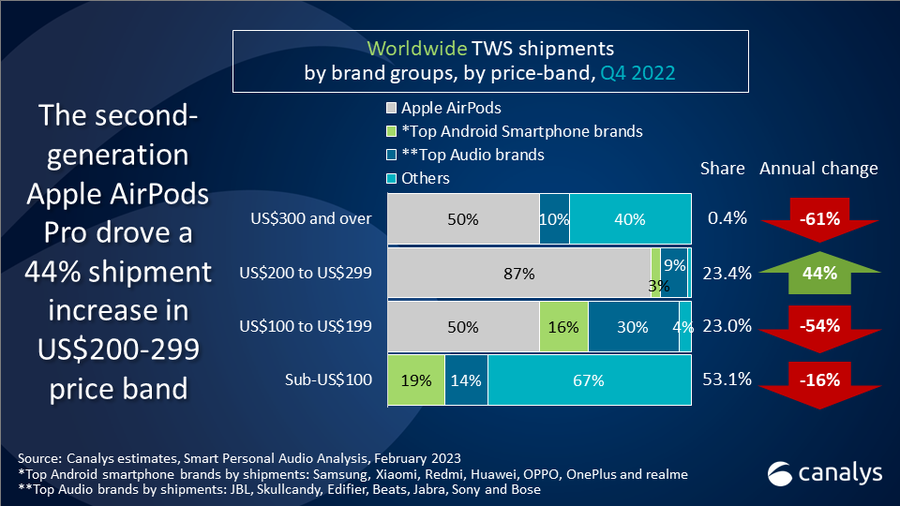

TWS, the category that had previously supported the smart personal audio market’s growth, saw shipments drop to 79.5 million in Q4 2022. Apple (including Beats) decreased by 30% year-on-year because shipments were strong in Q4 2021 after the third-generation AirPods had a delayed release. The second-generation AirPods Pro helped Apple retain its lead, contributing to 63% of all AirPods’ TWS shipments. Samsung (including JBL and other Harman subsidiaries) and Xiaomi experienced double-digit decreases despite their subsidiary brands adopting a different market strategy. Samsung and Xiaomi leveraged their respective sub-brands, JBL and Redmi, to expand their addressable markets and improve accessibility at lower prices. Samsung and Xiaomi were then able to focus on core users within their smartphone ecosystems without impacting brand image. India’s boAt slipped to fourth, while OPPO (including OnePlus), the only top five vendor to grow (11%), rose to fifth place, backed by its robust performance in China and strong OnePlus sub-brand in India.

Since early 2022 vendors had expected a grim market due to macroeconomic conditions and cautiously controlled inventory levels throughout the year. This worsened the overall TWS market performance in Q4 2022 as shipments were kept to a minimum. Asia Pacific’s (excluding Greater China) shipment dropped by 17%. India, the largest TWS market in APAC, maintained growth but at a flattened rate of 5%, signaling the market is reaching its peak. Western Europe and North America’s decline rate was modest, and market share remained stable, as consumer electronic consumption was relatively strong. Emerging markets in Latin America and Southeast Asia, which were once seen as potential growth areas, didn’t live up to expectations due to the impact of the weakened market environment.

According to Canalys Analyst Cynthia Chen, price band shifting trends were evident in Q4, with the sub-US$100 band taking up 55% market share, compared to 48% a year ago. “The US$200-299 price band saw an increase of shipments driven by Apple’s second-generation AirPods Pro. Apart from the weaker market performance of the third-gen AirPods, the downgrading of consumption happening on a global level contributed to the shrinking of the US$100-199 price band. Smartphone vendors, whose scales are often larger, felt the most significant impact as they saw their market shares shrink.”

|

Worldwide TWS shipments and growth Q4 2022 |

|||||

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple* |

28.4 |

35.8% |

40.4 |

38.9% |

-30% |

|

Samsung* |

6.0 |

7.5% |

7.8 |

7.5% |

-24% |

|

Xiaomi |

3.5 |

4.4% |

6.9 |

6.7% |

-49% |

|

boAt |

3.2 |

4.0% |

3.7 |

3.6% |

-15% |

|

OPPO |

2.4 |

3.0% |

2.1 |

2.1% |

+11% |

|

Others |

36.0 |

45.3% |

42.7 |

41.2% |

-16% |

|

Total  |

79.5 |

100.0% |

103.8 |

100.0% |

-23% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries |

|

||||

|

Worldwide TWS shipments and growth 2022 |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple* |

91.4 |

31.8% |

92.7 |

31.7% |

-1% |

|

Samsung* |

25.6 |

8.9% |

28.4 |

9.7% |

-10% |

|

Xiaomi |

15.2 |

5.3% |

23.1 |

7.9% |

-34% |

|

boAt |

12.8 |

4.4% |

8.4 |

2.9% |

+52% |

|

Skullcandy |

9.9 |

3.5% |

11.7 |

4.0% |

-15% |

|

Others |

132.7 |

46.1% |

128.6 |

43.9% |

+3% |

|

Total  |

287.7 |

100.0% |

292.8 |

100.0% |

-2% |

|

|

|

|

|||

|

*Apple includes Beats; Samsung includes Harman subsidiaries |

|

||||

For the full-year 2022, the share of TWS increased to 68% compared with 63% in 2021, but 2022 shipments dropped by 2% to reach 287.7 million units. The TWS share increase is directly influenced by India market local vendors’ fast development and push of market education to accelerate consumers’ adoption of devices. Canalys predicts that in 2023 the smart personal audio market will drop by 5%, while TWS will decline by 2% to reach 281 million units.

“2023 will not be an easy year for vendors to recover,” said Canalys Research Analyst Sherry Jin. “Faced with a constrained market, competition intensifies. Mainstream vendors are forced to fight for market share and strengthen differentiations to stand out, as consumers tighten their belts on spending.”

The recent FDA ruling announcement of over-the-counter (OTC) hearing aids is expected to offer pockets of growth for TWS in 2023. Several audio vendors and brands, such as Jabra, Sennheiser, Sony, Bose and others have launched OTC hearing aids in the form of TWS, compatible with smartphones for calling and streaming features. “TWS with hearing aids can address the hearing loss group’s repulsion of hearing aids. Such devices have the potential to hit one million this year as they are poised to satisfy specific consumer groups’ needs for hearing supplements while improving digital lifestyles. Vendors looking to capitalize on this rising trend must invest in building algorithms and the supply chain to support developing this new generation of TWS devices,” added Jin.

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com +86 158 2151 8439

Sherry Jin: sherry_jin@canalys.com +86 158 0076 4291

About Smart Personal Audio Analysis

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Smart Personal Audio segment declines 26% in Q4 2022, with a tough 2023 ahead

Smart Personal Audio segment declines 26% in Q4 2022, with a tough 2023 ahead