Generative AI will be a US$158.6 billion opportunity for the channel ecosystem by 2028

Generative AI presents a significant opportunity for channel partners to unlock new revenue streams and drive operational efficiencies. With an expected growth of US$158.6 billion by 2028, channel partners can capitalize on this opportunity by offering AI services, developing AI software, offering advanced data services, and reselling, co-selling and upselling AI products with services around them. While these services may generate billions for the industry, GSIs and ISVs are best positioned today to tap into this revenue opportunity, while all channel partners can improve productivity and offerings by adopting Gen AI internally. To succeed in this rapidly evolving market, channel partners should determine their AI strategy and invest in strategic AI partnerships.

Gen AI is a multi-billion-dollar opportunity for the channel ecosystem that is still early in its lifecycle. Gen AI will amount to a US$15.4 billion opportunity for the channel ecosystem this year alone and is expected to grow to US$158.6 billion by 2028. This report underscores the enormous opportunity for the channel ecosystem where the partners have to leverage Gen AI to unlock revenue for new services and enhance internal productivity.

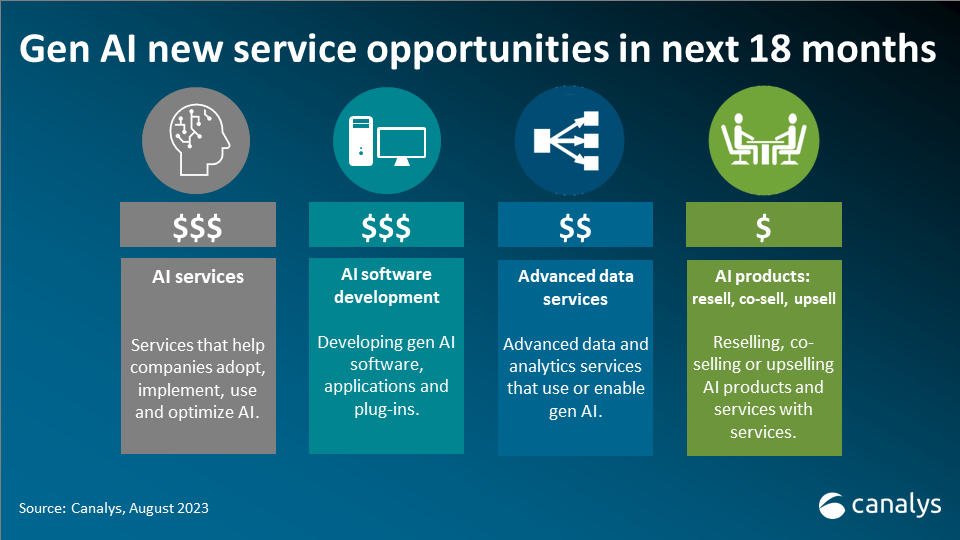

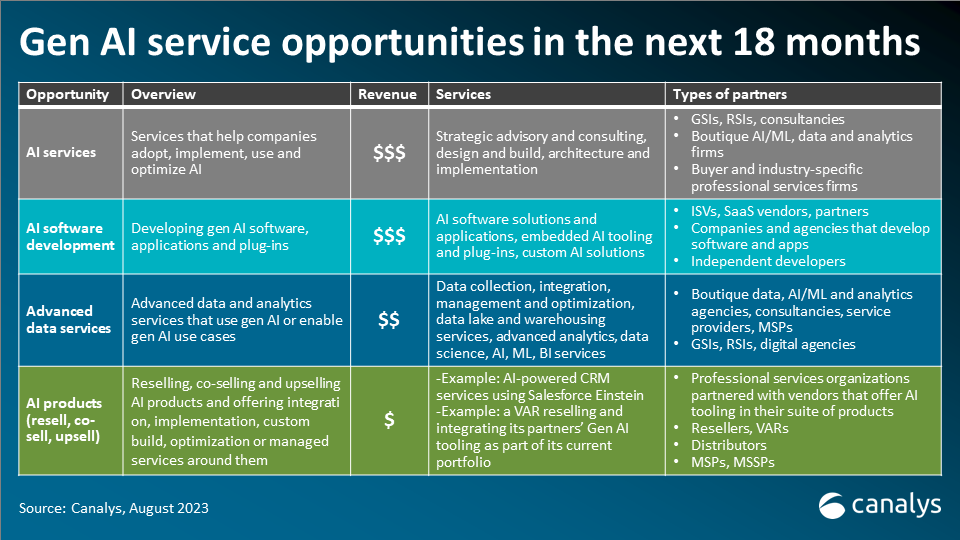

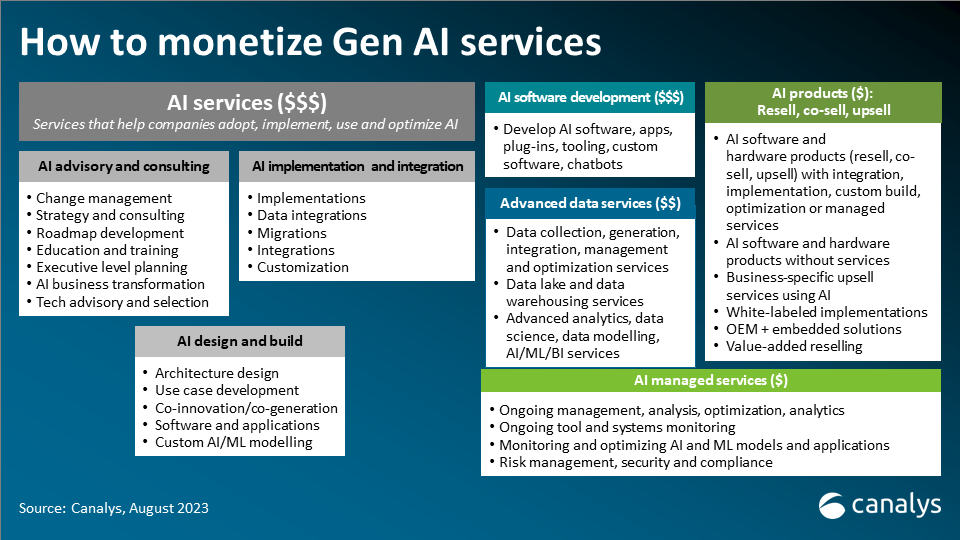

The two largest new revenue opportunities for the channel ecosystem are in offering AI services and AI software development. Other new revenue opportunities include advanced data services that use or enable AI, and the reselling, co-selling and upselling of AI products with services around those products.

GSIs, RSIs, niche consulting firms, professional services firms, ISVs and companies that develop software and applications are best positioned to capitalize on Gen AI services over the next 18 months. Additionally, every type of channel partner can improve productivity by integrating Gen AI into their internal operations. This move can automate business functions, enhance client services and create competitive advantages.

Channel partners should prepare today to capitalize on these opportunities while safeguarding against over-investment, depending on their business model. To do this, partners should determine their AI strategy and offerings, while also building expertise and strategic AI partnerships and continue to invest in ongoing development.

Unlocking new services revenue in Gen AI

The four categories of new services in Gen AI are AI services, AI software, advanced data services, and selling (i.e., reselling, co-selling or upselling) Gen AI products and offering services around them.

While these services may bring in billions for the industry, not all channel partners will benefit evenly. Opportunities for partners will differ by the type of AI offering, channel partner’s business model and strategic alignment between complementary service offerings, skill proficiencies, and target markets.

AI services

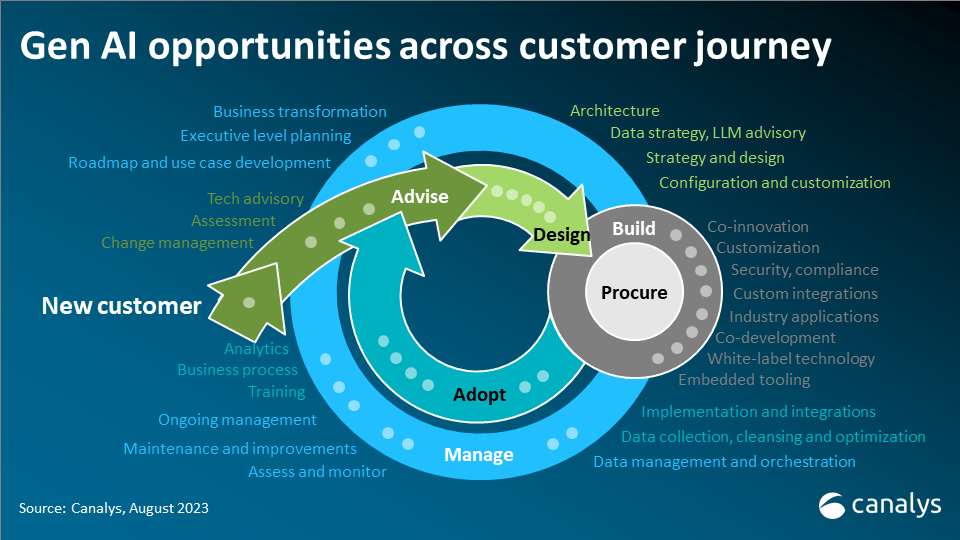

A significant new revenue opportunity for channel partners is around AI services, or more specifically, services that help companies adopt Gen AI successfully. This includes AI advisory and change management services, consulting, design and build, architecture design, implementation, and integration. These are typically highly customized large-scale engagements that bring in substantial revenue amounts, often exceeding millions of US dollars.

First-movers in the AI services space will have a distinct advantage. With Gen AI innovation and adoption happening at unparalleled speeds, AI services across the customer journey will continue to grow rapidly.

Channel partners best positioned to launch and deliver AI services today are GSIs, RSIs, buyer-and industry-specific professional services firms, as well as niche AI consulting firms. GSIs and large consulting organizations are increasingly announcing new practices, centers of excellence and services centered around Gen AI, and are partnering with leading AI tech vendors to grow their presence in the space. Some examples include:

- Capgemini and Google announced a strategic partnership for Capgemini to use Google Cloud’s Gen AI to develop 500+ industry use cases, accelerate clients’ business transformation, and deliver bespoke AI strategies and enterprise implementations.

- PWC announced a US$1 billion investment to expand and scale its AI practice, focusing on its relationship with Microsoft’s AI offerings.

- Deloitte launched a Generative AI practice and is leveraging services like Amazon Bedrock to enhance their offerings.

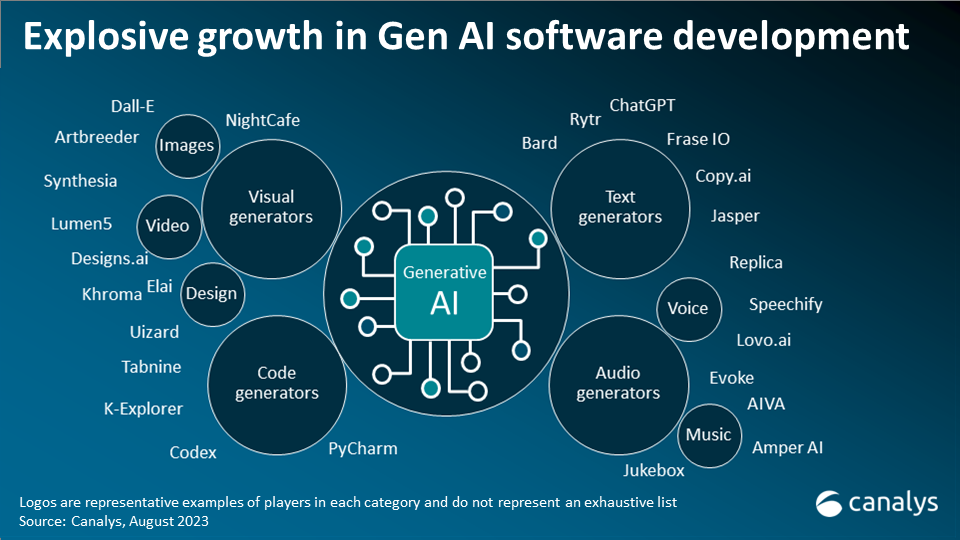

AI software development

Another substantial opportunity for the channel is the development of Gen AI software and applications for specific use cases, industries, verticals, markets or businesses. Gen AI software solutions are growing exponentially, with both startups and established players contributing to the rapid expansion and diversification of innovative products. These solutions range from enterprise-grade AI software to AI-enhanced software, to vertical-specific AI tools, applications, plug-ins, chatbots and custom solutions.

A sampling of the vast opportunities the channel ecosystem has to develop and customize Gen AI solutions include:

- EY Tax is leveraging Microsoft Azure OpenAI Service to build its own EY Intelligent Payroll Chatbot product that is available to clients and amplifies their tax and payroll intelligence practices.

- Other Gen AI applications are productized through cloud marketplaces, such as Forethought.ai, a Gen AI customer support application that is integrated with enterprise platforms like Salesforce and Zendesk.

- Streebo, a custom chatbot developer, leverages IBM Watson to deliver specialized chatbot solutions for mutual customers.

Partners best positioned to capitalize on this opportunity include Independent Software Vendors (ISVs), SaaS vendors, and development companies, agencies and independent developers engaged in software and application development.

Advanced data services

Advanced data and analytics services that utilize or enable Gen AI will also grow. Such data services include data collection, integration, management and optimization, data lake and data warehousing services, custom modeling, and advanced data science, AI, ML and BI services.

Channel partners most primed for this opportunity span boutique data and analytics firms, AI/ML and analytics agencies, consultancies, service providers, MSPs, GSIs, and RSIs. Some examples include:

- Deloitte is offering data modernization and advanced analytics services using the Databricks lake house.

- Specialized data and analytics firms like AB Data Consulting (an Alteryx Analytic Consultant) help clients maximize the power of their data and enable Gen AI use cases.

- Other niche data consultancies such as Pandata, have strategic partnerships with data platforms like Snowflake, to provide data transformation services.

AI products: resell, co-sell and upsell

Reselling, co-selling and upselling AI products and offering integration, implementation, custom build, optimization or managed services around them are other opportunities for channel partners. While this opportunity is growing and important for some channel partners, it is not yet a hugely profitable new revenue stream in the short term.

Examples include:

- Global reseller and systems integrator Insight has announced large-scale strategic partnerships with Microsoft, NVIDIA, NetApp and more to offer Gen AI solutions to customers.

- Slalom has announced new services to help customers prepare for and roll out Microsoft Copilot, all in advance of Co-Pilot being available.

- Accenture, one of Salesforce’s largest partners, announced a deep collaboration with Salesforce and Einstein GPT to roll out AI-and-data-powered CRM services to mutual customers that enhance their current CRM offerings.

- Cybersecurity platforms, like CrowdStrike, are offering new Gen AI functionality that enable MSPs, MSSPs, SIs and other service providers to sell AI-enhanced, custom security solutions.

The partners most prepared to capitalize on this opportunity today are the VARs, resellers, distributors, boutique service providers, MSPs, MSSPs, SIs and any professional service firm that is partnered with vendors offering Gen AI hardware and software. These partners should continue to build the right skills in Gen AI and take an opportunistic approach by offering their current vendors’ AI solutions with services as they become available.

Channel partners should think critically about their core business model and Gen AI strategy before launching new services. In the long term, partners should monitor the market as it evolves and be ready to capitalize on new AI product opportunities as they grow.

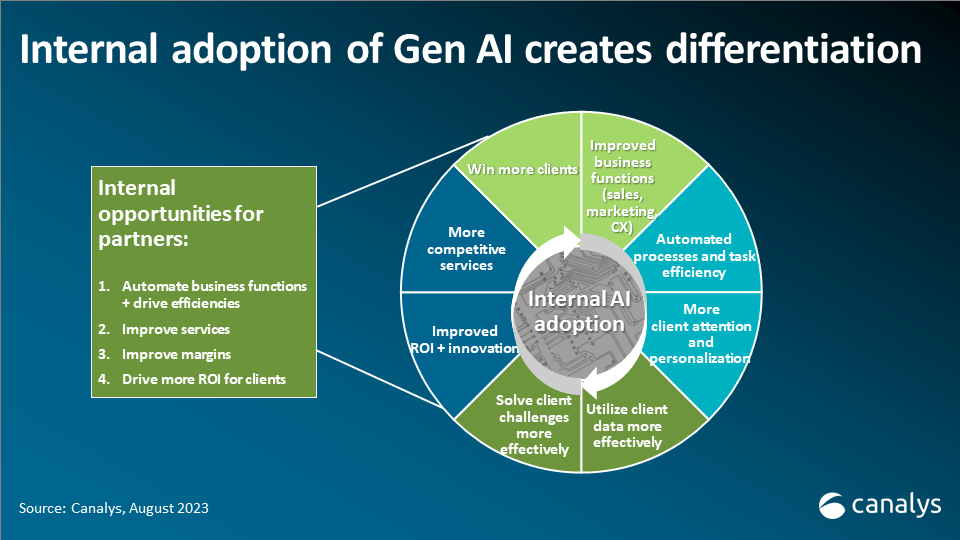

Enhancing operational efficiency and client services with Gen AI

While the above areas highlight the specific revenue-generating opportunities associated with Gen AI, all channel partners have the opportunity to integrate Gen AI into their day-to-day work tools, processes, and business functions like sales, marketing and customer success to drive efficiencies and offer more competitive services. When AI is implemented well it can lower costs, automate workflows and enable partners to focus on innovation.

Examples highlighting the importance of adopting internal Gen AI to stand out in a competitive space include:

- Microsoft and KPMG announced a strategic alliance to utilize Microsoft’s Gen AI tools across KPMG’s professional services, tapping into what they are estimating is a US$12 billion growth opportunity for KPMG. The partnership will empower KPMG’s 265,000 employees with Microsoft’s AI products, enabling teams to provide more effective and strategic client services.

- WPP, the largest global advertising agency, and NVIDIA, have partnered to develop a content engine that utilizes Gen AI to enable WPP’s creative teams to produce digital content faster and more efficiently. Mark Read, CEO of WPP, states: “Our partnership with NVIDIA gives WPP a unique competitive advantage through an AI solution.”

- Wipro and Google Cloud announced an expanded partnership to help integrate generative AI across all of Wipro’s services and capabilities.

Ultimately, AI tools and AI-driven insights can help clients solve challenges better and faster, maximizing ROI. Channel partners that successfully integrate AI into their business will gain a competitive edge in a hyper-competitive industry.

Recommendations

Channel partners should prepare now to capitalize on Gen AI opportunities while ensuring they do not over-invest in their specific business use cases or target markets. To position themselves for success, organizations should consider the following steps:

1. Determine AI strategy

Channel partners should begin by defining a clear AI strategy that aligns with the organization’s goals, strengths and target markets. Partners should conduct a thorough analysis of the AI opportunity and perform a total addressable market (TAM), serviceable addressable market (SAM) and serviceable obtainable market (SOM) analysis to identify the scope of their opportunity.

Partners should then focus on identifying their value proposition and competitive differentiation, carefully identifying their strengths, weaknesses, opportunities and threats, as well as opportunity costs given limited resources and capital.

After completing the necessary analysis, partners should finalize their strategy for integrating Gen AI internally and monetizing, packaging, and delivering Gen AI services to clients.

By developing a well-defined Gen AI strategy, channel partners lay the groundwork to execute focused, competitive and profitable services.

2. Build expertise and partnerships

After developing an AI strategy, channel partners should focus on building a skilled team and hiring or developing data scientists, machine learning engineers, developers and AI specialists to drive their initiatives forward.

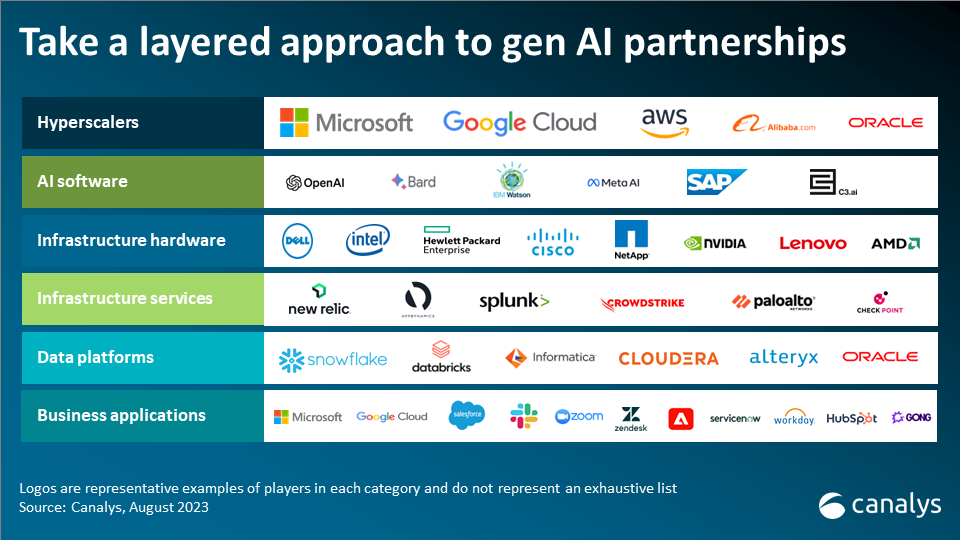

Channel partners should also focus on forging strategic partnerships with the right Gen AI technology vendors. The channel ecosystem should take a layered approach to selecting the vendors and partnering with them that best align with their AI strategy and target market’s technology stack.

Partners should determine the best go-to-market partnerships for their business and services across the hyperscalers, AI software, infrastructure hardware, infrastructure software, data platforms and various business applications, depending on their industry and niche.

Being a first mover in a vendor’s AI partner program is an enormous opportunity to grow and innovate with the biggest and best AI technology players in the world. First movers also reap the benefits of exclusive resources and support, and the ability to position themselves as thought leaders for years to come.

3. Invest and develop

Once channel partners have solidified their Gen AI strategy, assembled their teams and created strategic, long-term partnerships, they should focus on continuing to refine and enhance their offerings. Channel partners should commit to acquiring ongoing certifications, deep AI competencies and working closely with their partners to bring innovative and tailored solutions to market.

Long term, the channel ecosystem should continue to monitor the market, adapt its strategies and capitalize on emerging opportunities. Gen AI is rapidly advancing and the partners who are able to adapt, innovate and evolve with the industry will win.

Meet face-to-face to unlock new opportunities

Find out new strategies, revenue streams and new AI service offerings in the industry, and drive operational efficiency. Join the discussions at the Canalys Forums 2023 and understand a plethora of Generative AI opportunities. These events will provide partners with the opportunity to learn, discuss, collaborate and win strategic partnerships!

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5 – 7 December

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band