Hyperscaler cloud marketplaces force greater disruption in SaaS channels

The emergence of hyperscaler cloud marketplaces has disrupted global technology channels, offering a rapidly growing route to market for SaaS, software and cybersecurity. As enterprise customers look to scale back on cloud adoption and cut costs, accessing these marketplaces becomes vital for meeting cloud commitments and finding alternative funding. Channel partners and distributors face both competitive threats and opportunities as they navigate the marketplace momentum, with the involvement of trusted partners being vital for the success of cloud marketplace strategies.

Hyperscaler cloud marketplaces have emerged as one of the most disruptive forces in global technology channels, and the fastest-growing route to market for SaaS, software and cybersecurity. Canalys predicts that global sales of third-party vendor software and services through cloud marketplaces will hit US$45 billion by 2025, up 84% CAGR over five years, led by AWS Marketplace, Microsoft Azure Marketplace and Google Cloud Marketplace. While these are big numbers, that’s less than 5% of the total global software and cybersecurity market.

That momentum has been fuelled by co-sell incentives from the hyperscalers, lower marketplace fees and investments in marketing and demand generation as they seek to recruit more ISVs and attract customers. But the biggest driver by far has been the ability of enterprise customers to “burn down” their upfront committed cloud spend with the hyperscalers using marketplace purchases. All three hyperscalers allow these committed dollars to be spent on third-party products via their marketplaces, either partially or in full. Despite economic turbulence weighing down on public cloud growth, marketplace momentum is likely to gather pace in 2023, thanks to this trend. With many enterprises now scaling back cloud adoption to cut costs, shifting more of their software and cybersecurity purchases to the hyperscalers’ marketplaces is an attractive way to hit their cloud commitments. At the same time, the availability of cloud credits with AWS, Microsoft Azure and GCP offers an attractive source of funding for IT buyers when core budgets are being cut. With the top three hyperscalers sitting on tens of billions of dollars of unspent cloud “backlog”, IT vendors and ISVs are rushing to capture that potential spend, both through developing go-to-market strategies around the hyperscalers’ marketplaces, but often by more tactically pushing customers to take advantage of cloud commitments to finance deals.

For channel partners, the implications of this shift are intensifying.

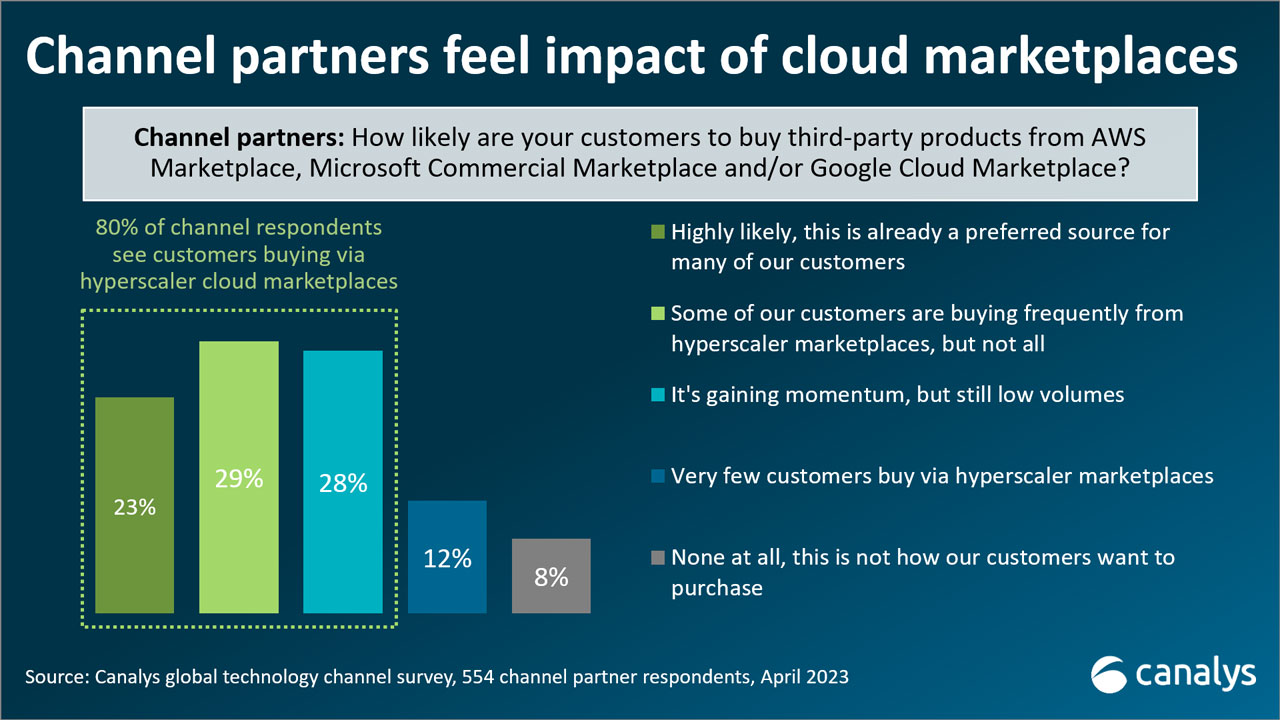

- 52% of partners surveyed worldwide by Canalys recognize that their customers are now either highly likely (23%) or somewhat likely (29%) to buy through one of the top three hyperscaler marketplaces.

- A further 28% see this gaining momentum, though from small volumes.

So what does this all mean for channel partners, distributors, vendors and the hyperscalers themselves? How can they adapt for the biggest benefit? How do they manage potential risk? And will this momentum continue in the long term, as customers seek to scale back their financial commitments with the hyperscalers? These will be major topics at the 2023 Canalys Channels Forums in APAC, EMEA and North America, where partners and vendors can join the Expert Hub debates to explore how to adapt, manage risk and explore the long-term viability of this marketplace model.

Trusted partners are vital to marketplace success

Hyper-growth in marketplaces brings clear risks for the channel. Customers can buy directly, and vendors can bypass partners, attracted by a more automated, efficient sales channel. For distributors, the threat is even more acute, as channel partners start sourcing from hyperscaler marketplaces, such as AWS Marketplace, on behalf of customers.

In reality, however, marketplace momentum will increasingly depend on partners. Cloud marketplaces are far from the automated, self-service platforms that they were initially expected to be. Most enterprise deals involve complex sales processes and negotiations, often with multiple partners. And as more complex technologies become available on marketplaces, customers are seeking expert partners to help them discover, procure, deploy and manage these technologies. The professional services skills of partners remain critical, as does their ability to support customers throughout technology lifecycles. All three hyperscalers are actively investing in channel strategies and processes, and enabling vendors on their marketplaces to sell through and with channel partners. AWS has led with models such as Channel Partner Private Offers (CPPO), which allows vendors selling on the marketplace to extend channel discounts to their partners, and there are now over 1,600 CPPO-enabled partners. Both Google Cloud and Microsoft are following with similar approaches. Last year, Google Cloud enabled all its authorized partners to act as resellers of ISV offers on Google Cloud Marketplace. And this week at its Inspire global partner event, Microsoft launched Multiparty Private Offers (initially in the US), which support “margin-sharing” for resellers and even distributors for ISVs to sell via Microsoft’s Commercial Marketplace.

For vendors with established partner channels, managing conflict with existing partners is the biggest challenge. The most successful will incorporate partners into their hyperscaler marketplace strategies, not be in competition with them. Newer, cloud-native vendors using hyperscaler marketplaces for the first time are discovering the difficulty of creating traction alongside thousands of other ISVs without the help of partners. Most of these processes remain relatively immature and work is needed by hyperscalers and vendors. But, increasingly, end customers will choose their preferred marketplaces based on the support of indirect partners. Canalys forecasts that by 2025, close to a third of total marketplace transactions will involve channel partners.

Long-term viability of marketplaces depends on partners

Ultimately, the hyperscalers must find ways to wean customers off the drug of committed cloud spend if marketplaces are to remain a sustainable route to market for the long term. The current spending boom is driven primarily by the fact that customers over-committed and over-spent with the hyperscalers. Once current backlogs have cleared, many enterprise customers will be reluctant to tie themselves into the same level of upfront investment with the hyperscalers. Without this driver, what will motivate customers to procure through these marketplaces? Consolidated monthly billing, frictionless transactions and simplified governance and control are all benefits touted by the cloud providers. But one of the most important of these benefits will be the inclusion of indirect channel partners in the marketplace procurement process, particularly as more SMBs choose to buy this way.

This will require vendors and hyperscalers to develop strategies that ensure that marketplaces actively support partner models for the long term. With many partners developing their own cloud marketplaces, how can different platforms co-exist? Many channels still prefer to source through distribution rather than go direct to cloud marketplaces for credit, local in-country presence, training and often, most importantly, technical support and expertise. The distributors themselves are becoming marketplaces supporting complex ecosystems of partners. Integration of hyperscaler and channel marketplaces will be important to the viability of this model but remains challenging. Hyperscalers and vendors are exploring ways of involving distribution to a greater extent – with some distributors starting to offer bundled solutions on hyperscaler marketplaces – but these models need further development. Maintaining profitability is a key challenge, as margin is stretched across more channel tiers.

Meet face to face to tackle the questions

So how should partners adapt? Where should they prioritize their investments – with one marketplace, many or their own? What skills do they need to build internally? And how do they make sure they hold onto their customer relationships if those customers move to marketplace procurement? If you are a channel partner keen to understand more, join the discussions at the Canalys Forums 2023. These events will provide partners with the opportunity to learn, discuss, collaborate and win!

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5 – 7 December

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band