Partners are more bullish on managed services in 2023

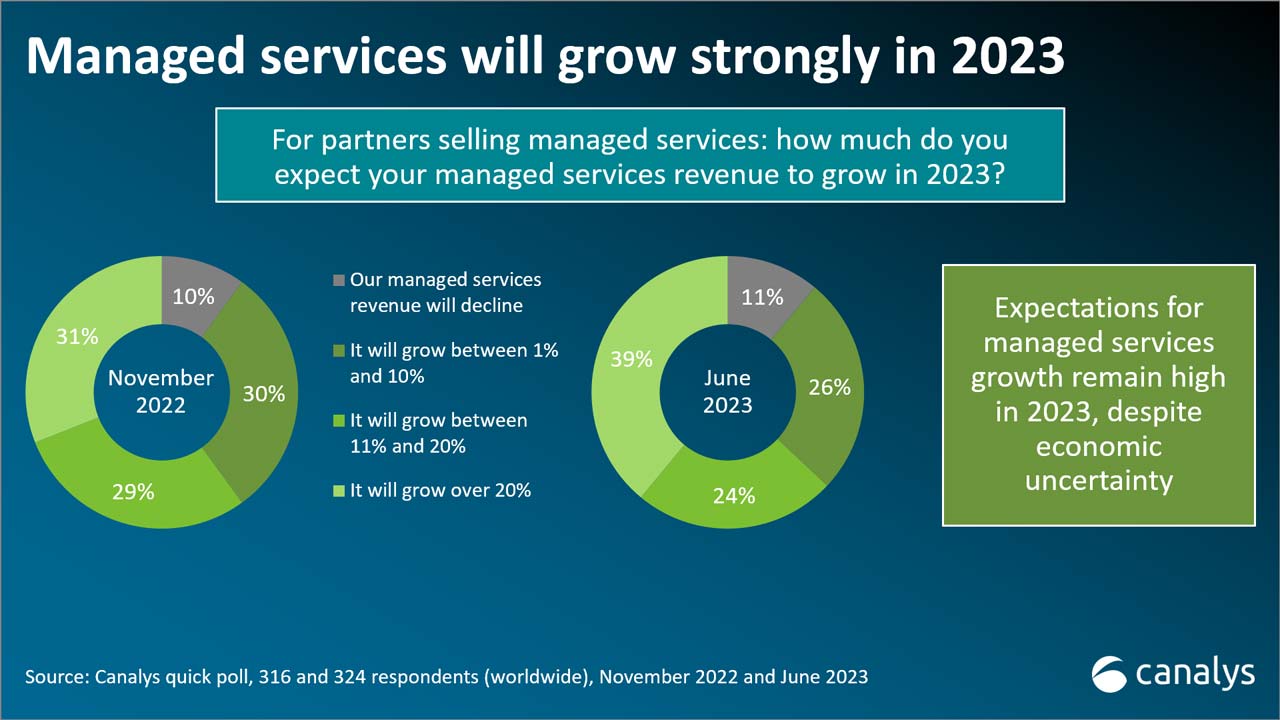

The latest channel poll shows the highest levels of growth are expected in managed services in 2023.

According to the latest Canalys data, the percentage of partners expecting the highest levels of growth has gone up in 2023, as managed services continue to dominate headlines around opportunities for the channel, alongside cybersecurity, AI-based automation and sustainability. Canalys looks at what the numbers mean, and what partners are facing in the future.

Breaking down the numbers: more partners will see higher growth, but more will see declines

Looking at the numbers from Canalys’ most recent poll of Candefero members, two things jump out. The number of partners that are expecting over 20% growth has risen sharply, while the number that will see a decline has also gone up, though by only 1% overall. What does all this mean?

At the end of 2022, Canalys asked partners what their expectations were for growth in managed services in the following year. Of those selling managed services, 90% expected growth. This was far higher than was expected by those partners operating in the broader channel landscape, as hardware revenue growth has obviously declined strongly from its pandemic-related highs.

We decided to ask the question again in the middle of 2023, to see if the numbers held up after six months of a difficult year. The results are pretty strong, but how you see them depends on your perspective. The overall percentage swing is 9%, which means that of those that previously thought they would see between 1% and 20% growth, 1% believe it will now decline, while the remaining 8% have shifted to the over 20% growth category.

The consensus among partners so far this year is that the wider economic issues have not had as big an impact on demand for managed services as was initially feared. Why?

The growth is indicative of larger patterns underlying the channel

The picture has changed in an interesting way, because at the end of 2022 partners were perhaps being a little cautious in their predictions for 2023, based on the economic narrative that was being told. At that time, many assumed fears over broader macroeconomic issues would, or could, affect all areas of the IT channel. Six months into the year, the picture is a little clearer.

One thing is certain, customers are tightening investments: budgets are harder to access, sales cycles have lengthened and larger projects are less easy to sign off. This affects the hardware-driven managed services contracts that some partners have been building, based on their legacy business models. But for big resellers and systems integrators, the growth of flexible payment terms for hardware-as-a-service, as well as other managed services, is helping partners to unlock customer budgets in a difficult market.

Even though interest rates have risen in many places and the cost of money is higher than it has been for many years, the same issues are not being seen across all regions. In India, for example, the rate of inflation is not as high, making conditions for channel partners very different.

In EMEA, one prediction Canalys made in 2022 is coming true. We predicted 20% of pure MSPs would disappear between 2023 and 2025. Primarily, this would be driven by M&A activity as prices for MSPs dipped and the need to grow skills and new customer bases would drive resellers and systems integrators to buy managed services specialists. At the same time, many MSPs have found it harder to keep up with the competition, to gain new skilled staff and to find that next level of growth. This has also contributed to the increase in the supply of MSPs on the market.

All of these things have so far come true, and the rate of acquisition may be even higher than we first thought. There is another, simpler reason for the growth in managed services revenue expectations. Demand from customers has continued to grow, particularly in co-managed IT models where customers and partners work together to manage the customer’s IT estate.

Canalys will return to these figures at the end of the year to assess if this growth has been fully realized, but it seems for now that partners are still seeing growth in many areas of their businesses. While overall growth expectations in the channel for the first half of the year have remained in the high single digits, it is in software, professional and managed services where partners are unlocking customer budgets and seeing the most success.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band