Canalys: Global smartphone market shrinks 6% amid component shortages

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 15 October 2021

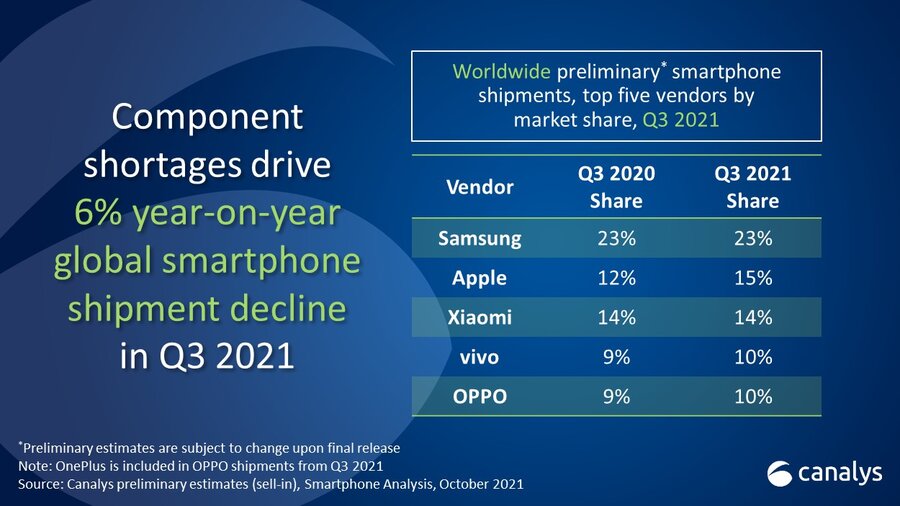

In Q3 2021, global smartphone shipments fell 6%, as vendors struggled to meet demand for devices amid component shortages. Samsung was the leading vendor with 23% share. Apple regained second place with 15% share, thanks to strong early demand for iPhone 13. Xiaomi took 14% share for third place, while vivo and OPPO completed the top five with 10% share each.

“The chipset famine has truly arrived,” said Canalys Principal Analyst, Ben Stanton. “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply. But despite this, shortages will not ease until well into 2022. As a result of this, as well as high costs of global freight, smartphone brands have reluctantly pushed up device retail pricing.”

“At the local level, smartphone vendors are also having to implement last-minute changes in device specification and order quantities. It is critical for them to do this and maximize volume capacity, but unfortunately it does lead to confusion and inefficiency when communicating with retail and distributor channels,” continued Stanton. “Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west. Channel inventories of smartphones are already running low, and as more customers start to anticipate these sales cycles, the impending wave of demand will be impossible to fulfill. Customers should expect smartphone discounting this year to be less aggressive. But to avoid customer disappointment, smartphone brands which are constrained on margin should look to bundle other devices, such as wearables and IoT, to create good incentives for customers.”

|

Worldwide smartphone shipments and growth Canalys Preliminary Smartphone Market Pulse: Q3 2021 |

||

|

Vendor |

Q3 2020 shipments (% share) |

Q3 2021 shipments (% share) |

|

Samsung |

23% |

23% |

|

Apple |

12% |

15% |

|

Xiaomi |

14% |

14% |

|

vivo |

9% |

10% |

|

OPPO |

9% |

10% |

|

Preliminary estimates are subject to change upon final release. Note: percentages may not add up to 100% due to rounding Note: OnePlus is included in OPPO shipments from Q3 2021 Source: Canalys estimates (sell-in shipments), Smartphone Analysis, October 2021 |

||

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Canalys: Global smartphone market shrinks 6% amid component shortages

Canalys: Global smartphone market shrinks 6% amid component shortages