Western Europe’s PC market grows 3% in Q2 2021, despite phenomenal Q2 2020

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 24 August 2021

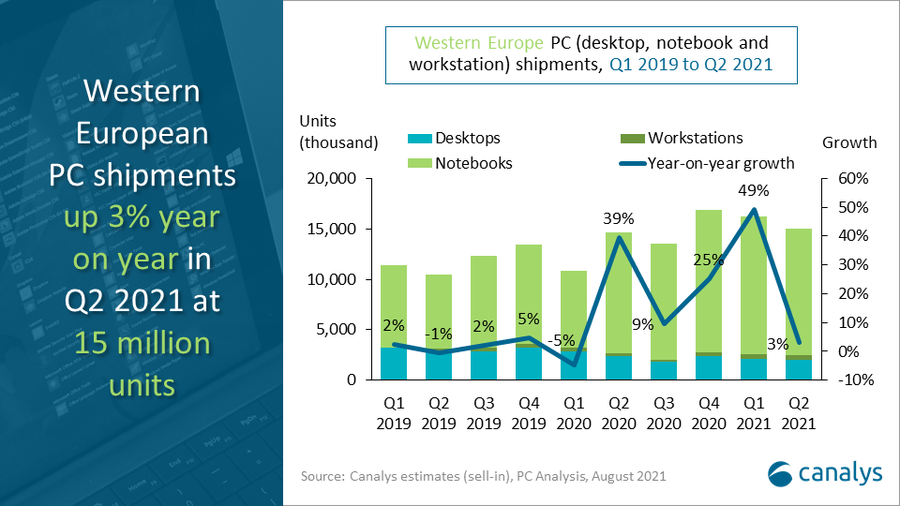

In Q2 2021, Western European PC shipments (desktops, notebooks and workstations) reached 15.0 million units, up 3% year on year. Post-COVID demand in 2021 has been stable thanks to lockdown-enforced lifestyle changes becoming permanent. Shortages of key components remain a problem, limiting vendors’ orders and growth. Lenovo led the market, shipping 4.1 million units and taking a 27% share. HP came second, shipping 3.7 million units to take a 24% share. Dell, Acer and Apple completed the top five, with 14%, 10% and 9% shares respectively.

After four consecutive quarters of stellar growth, Western Europe recorded more modest annual growth of 3% in Q2 2021. At the same time, Q2 2020 was a phenomenal quarter, the first to show the COVID-accelerated spike in demand, so 3% growth now is still very impressive. Trang Pham, Research Analyst at Canalys, said, “Demand is still strong. Western Europe has emerged into a post-COVID ‘new normal’, a rapidly digitalizing world, as shown by the robust shipment numbers. Had supply issues been resolved, we could have seen even higher growth in the PC market.”

Worldwide market leader Lenovo has now sealed its leadership in Western Europe by staying on top for three consecutive quarters. “In a time of high demand and short supply, vendors can secure market share by fulfilling order more quickly. Lenovo’s global leading market position gave it greater bargaining power with suppliers, allowing it to fulfill orders faster than its competitors, especially in Western Europe. Previous leader HP, in comparison, was unable to maintain the required balance between the US and Europe, which resulted in the vendor losing its top spot in Western Europe.”

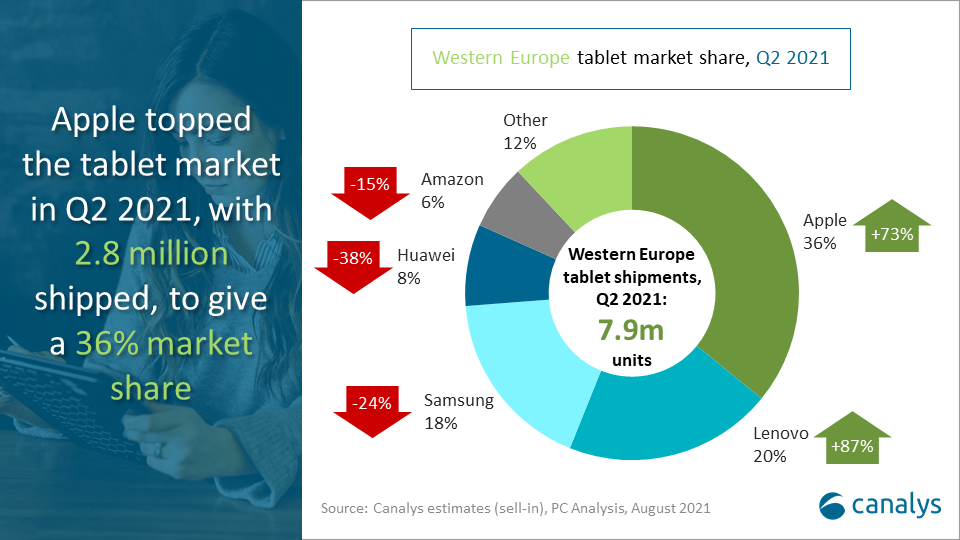

Tablet shipments in Western Europe grew by 18%, with 7.9 million units shipped. “Tablets are no longer just devices for entertainment but have emerged as cheaper alternatives to PCs for remote working and learning, and are especially popular among students with basic needs,” said Pham. The tablet space in Western Europe has long been dominated by Apple, which grew shipments 73% in Q2 2021. Apple’s latest release of the M1-powered iPad Pro was warmly received in Western Europe. Lenovo came second, with a stellar 87% annual jump in shipments. Lenovo was quick to capitalize on the demand for tablets and delivered a wide range, including cheaper models, filling the gap that Apple leaves with its more costly iPads. The other vendors in the top five – Samsung, Huawei and Amazon – however, all suffered declining shipments.

After extensive vaccine rollouts, Western European nations have mostly lifted COVID restrictions, paving the way for business, education and social activities to resume. Canalys has previously observed that the second quarter in Western Europe’s PC market is usually weaker, and Q2 2021 was no exception. “Many workers have now been asked to return to the office, students have been attending classes since early March and social gatherings are once again popular. Overall, the economic recovery looks promising in Western Europe. Demand for PC products is still growing, but unlikely to skyrocket again without another catalyst as strong as the 2020 pandemic’s digital acceleration,” said Canalys Research Manager Ben Stanton.

|

Western Europe PC (workstation, desktop, notebook) shipments and growth |

|||||

|

Vendor |

Q2 2021 shipments (thousand) |

Q2 2021 Market share |

Q2 2020 shipments (thousand) |

Q2 2020 Market share |

Annual |

|

Lenovo |

4,124 |

27% |

3,891 |

27% |

+6% |

|

HP |

3,655 |

24% |

4,438 |

30% |

-18% |

|

Dell |

2,070 |

14% |

1,865 |

13% |

+11% |

|

Acer |

1,440 |

10% |

1,328 |

9% |

+8% |

|

Apple |

1,358 |

9% |

1,223 |

8% |

+11% |

|

Others |

2,394 |

16% |

1,867 |

13% |

+28% |

|

Total |

15,043 |

100.0% |

14,615 |

100.0% |

+3% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys estimates (sell-in shipments), PC Analysis, August 2021 |

|||||

For more information, please contact:

Ben Stanton (UK): ben_stanton@canalys.com +44 7824 114 350

Trang Pham (UK): trang_pham@canalys.com +44 7881 934 784

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Western Europe’s PC market grows 3% in Q2 2021, despite phenomenal Q2 2020

Western Europe’s PC market grows 3% in Q2 2021, despite phenomenal Q2 2020