HONOR climbs to third place in China’s smartphone market in Q3 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 29 October 2021

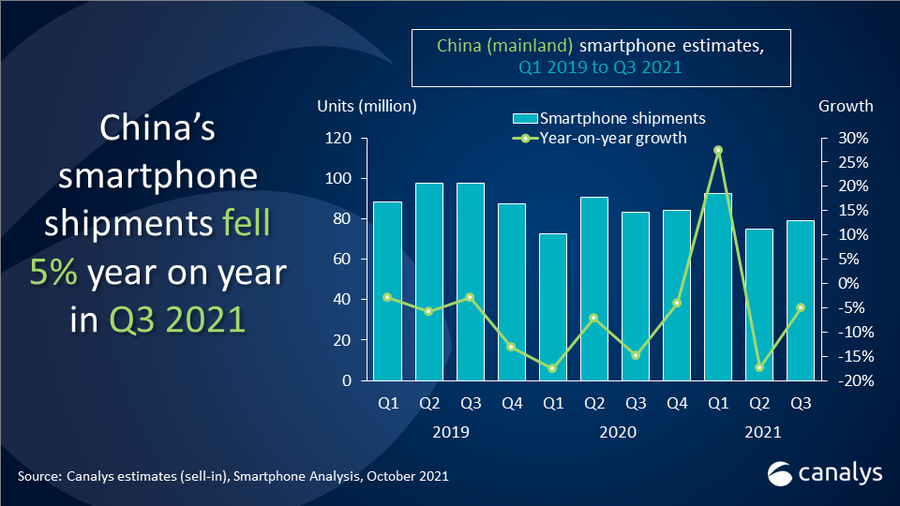

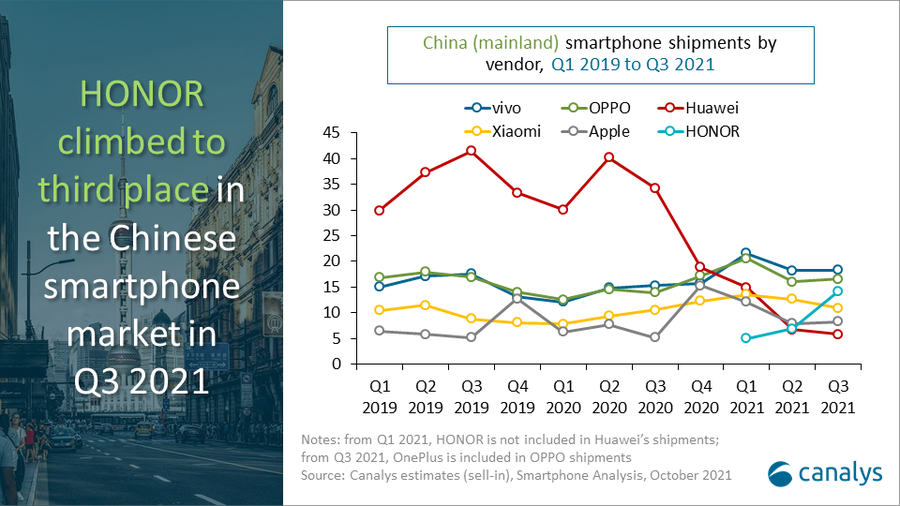

Smartphone shipments fell 5% year on year in Mainland China in Q3 2021, reaching 78.8 million units. Market leader vivo solidified its position, shipping 18.3 million units for a 23% share. OPPO, which has now merged with OnePlus, stayed in second place with 16.5 million shipments. HONOR entered the top three for the first time, with its market share soaring from 9% in Q2 to 18% in Q3. Xiaomi ranked fourth with 10.9 million units shipped amid supply constraints, while Apple completed the top five, shipping 8.3 million units.

“After a soft Q2, Chinese smartphone sales were stimulated by new launches in Q3,” said Canalys Analyst Toby Zhu. “HONOR and Apple led the way here. HONOR was the stand-out vendor of the quarter, achieving 105% sequential growth driven by its Play 20, X20 and flagship 50 series. It is successfully upgrading Huawei users, supported by its breadth of channel partnerships. HONOR is now sending clear signals that the brand has returned after its split from Huawei, and these signals will go beyond China to reverberate around the world. Apple launched the iPhone 13 as expected, but more aggressive pricing has helped drive demand for its new smartphones. As the second generation of iPhone with 5G, the iPhone 13 series is appealing strongly to the large 4G iPhone installed base in China. As a result, pre-orders and early orders were high, with many customers opting to wait several weeks for delivery.”

“The strategic value of smartphones is no longer limited to unit share and revenue,” said Canalys Research Analyst Amber Liu. “Vendors now count the entire smartphone ecosystem, including software and services, as important metrics to benchmark success. Hardware margin is under pressure, but maintaining and growing market share is still vital for vendors. One novel way to do this is via demographic-based product segmentation. As a result, niche segment products, such as Xiaomi’s Civi, OPPO’s K9s, HONOR’s 50 series, vivo’s IQOO8 series and realme’s GT Neo, are becoming popular among female users, gamers, vloggers, online shoppers and generation z. The marketing messages behind these products are clear, and explicitly target their demographic audiences. This product strategy has won consumer attention and prompted upgrades.”

“For 2021, the Chinese smartphone market is expected to achieve a very low growth rate as it suffers due to global chipset shortages,” added Liu. “Smartphone vendors are already well into their product roadmap planning for 2022, assessing new form factors, such as foldable and rollable smartphones, to carve out additional volume and revenue from an already saturated market.”

For more information, please contact:

Nicole Peng (China): nicole_peng@canalys.com +86 150 2186 8330

Amber Liu (China): amber_liu@canalys.com +86 136 2177 7745

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

HONOR climbs to third place in China’s smartphone market in Q3 2021

HONOR climbs to third place in China’s smartphone market in Q3 2021