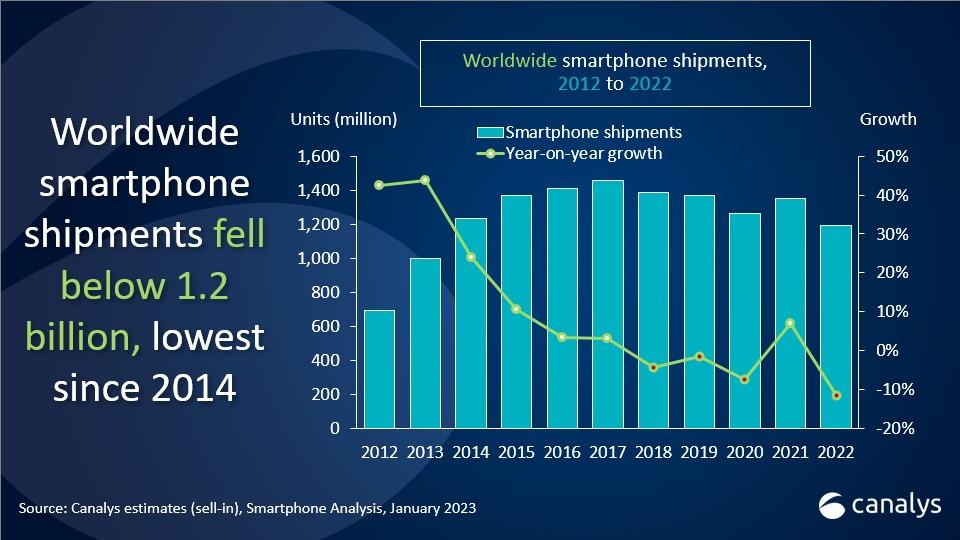

Worldwide smartphone shipments fall for fourth consecutive quarter, leaving market down 12% in 2022Â

Tuesday, 31 January 2023Â

Canalys’ latest research shows that global smartphone shipments fell 18% to 296.9 million units in Q4 2022. As demand dwindled, vendors shipped fewer than 1.2 billion units in full-year 2022, leading to a 12% drop in annual shipments. The top five vendors in 2022 remained the same as in 2021. Samsung defended its first-place position, claiming a 22% market share with 257.9 million shipments. Apple came second with shipments of 232.2 million and a 19% market share, despite ending 2022 with its first-ever double-digit decline in Q4, due to COVID-19 restrictions on Chinese manufacturing facilities and weaker demand. Xiaomi came third with 152.7 million shipments and a 13% market share. With 10% and 9% market shares, respectively, OPPO and vivo ranked fourth and fifth.

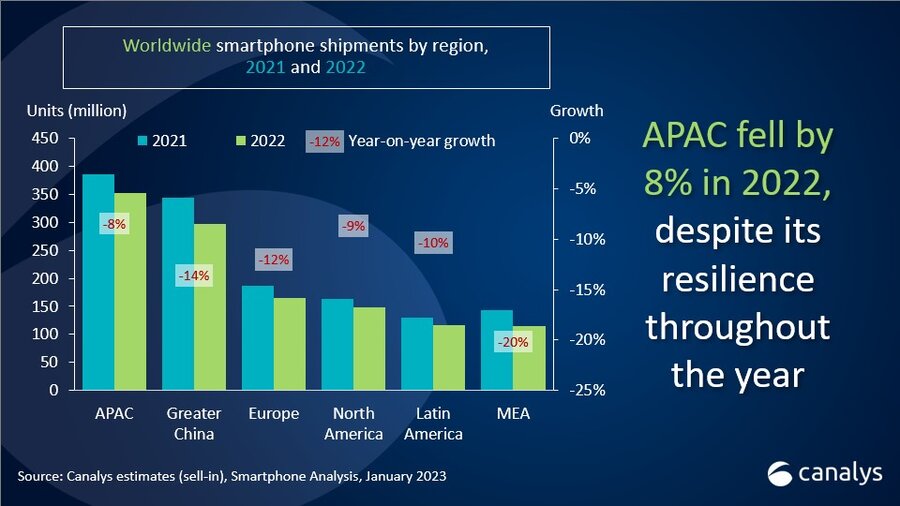

“Leading markets struggled with sharp shipment declines toward the end of 2022, hitting both Samsung and Apple hard,” said Sanyam Chaurasia, Analyst at Canalys. “Despite showing some stabilization in Q3, Asia Pacific and Europe suffered their worst Q4 performances in history in 2022. Stocks piled up in top markets, such as India and the People’s Republic of China (Mainland), leading to a disappointing final quarter. Meanwhile, economic distress dented consumer spending in North and Latin America. Vendors must carefully plan their new product launches as retailers and telcos are reluctant to increase inventory levels.”

“Moving into 2023, Apple and Samsung are better placed to navigate ongoing uncertainties thanks to their high-end dominance,” said Le Xuan Chiew, Research Analyst at Canalys. “The popularity of iPhone Pro models will help Apple extend its revenue share, despite overall demand being under pressure. Meanwhile, the unexpected supply challenges with the Pro models have led to the acceleration of Apple’s production diversification, which will help the company mitigate the supply risk and ongoing geopolitical tensions. Samsung is also maintaining its profitability focus by strengthening its high-end portfolio and creating a premium niche segment via its Fold series. On the other hand, Chinese vendors are still vulnerable to international market headwinds and a cut-throat home market. Beyond poor demand, channel inventory, margin pressure and operational efficiency also challenge their expansion strategies.”

“2023 will be a tough year. Recent macroeconomic trends indicate a growing risk of global recession,” said Amber Liu, Analyst at Canalys. “The road to recovery for the smartphone market is clouded with uncertainties. Vendors and channels will watch the market dynamic closely and take a cautious approach. Smaller vendors must focus on securing profitability by finding niche opportunities with streamlined portfolios and efficient channel management. On the other hand, the popular brands will investigate ways of driving demand through their established IoT ecosystems, differentiated high-end offerings and effective channel and promotional strategies.”

|

Worldwide smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

73.2 |

25% |

82.6 |

23% |

-11% |

|

Samsung |

58.3 |

20% |

70.5 |

19% |

-17% |

|

Xiaomi |

33.2 |

11% |

45.4 |

13% |

-27% |

|

OPPO |

28.5 |

10% |

33.8 |

9% |

-16% |

|

vivo |

23.9 |

8% |

28.5 |

8% |

-16% |

|

Others |

79.8 |

27% |

101.5 |

28% |

-21% |

|

Total |

296.9 |

100% |

362.3 |

100% |

-18% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

|

Worldwide smartphone shipments and annual growth |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Samsung |

257.9 |

22% |

274.5 |

20% |

-6% |

|

Apple |

232.2 |

19% |

230.1 |

17% |

1% |

|

Xiaomi |

152.7 |

13% |

191.2 |

14% |

-20% |

|

OPPO |

113.4 |

10% |

145.0 |

11% |

-22% |

|

vivo |

101.9 |

9% |

129.9 |

10% |

-22% |

|

Others |

335.2 |

28% |

380.7 |

28% |

-12% |

|

Total |

1193.3 |

100% |

1351.4 |

100% |

-12% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

Canalys analyzes Samsung’s IoT strategy and details the opportunities and challenges it faces in 2023 in our latest complimentary research.

For more information, please contact:

Sanyam Chaurasia: sanyam_chaurasia@canalys.com

Le Xuan Chiew: lexuan_chiew@canalys.com

Amber Liu: amber_liu@canalys.com

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com