Southeast Asia's smartphone market dips 21% in Q1 2023 but a brighter future aheadÂ

Wednesday, 24 May 2023

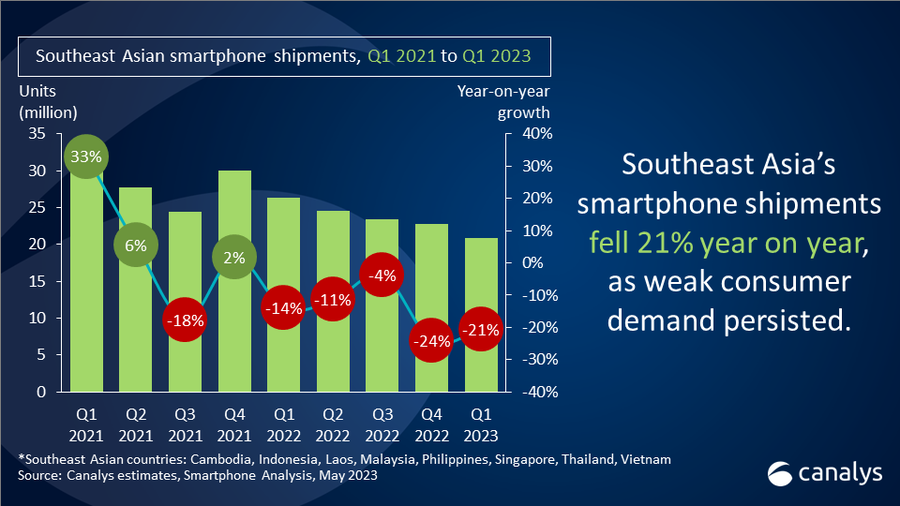

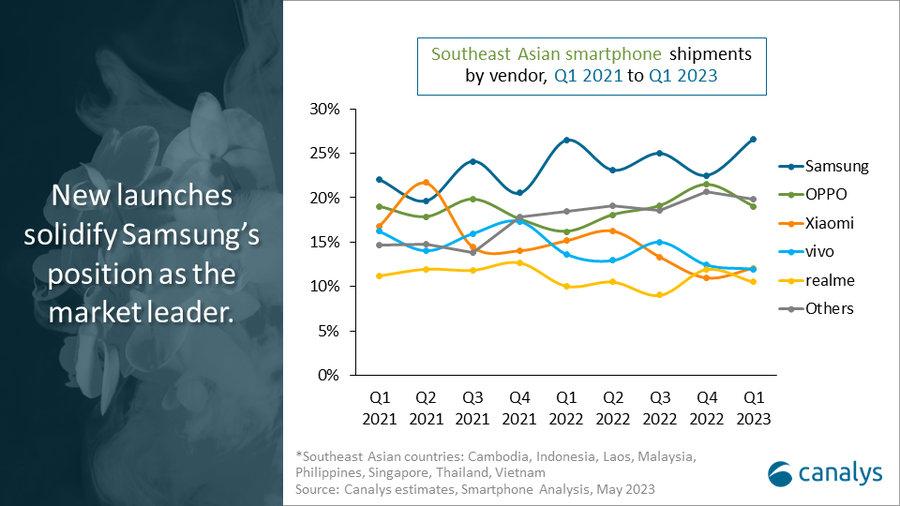

Canalys research reveals that the Southeast Asian smartphone market fell 21% year on year in Q1 2023 to 20.9 million units. Southeast Asia experienced its fifth consecutive quarter of decline as consumers remained financially prudent, cutting back their spending on consumer technology. Samsung widened its lead, shipping 5.6 million units with a market share of 27%, as new models in various price bands received a good response. OPPO secured the second position in the market by shipping 4.0 million units, representing a market share of 19%. The brand's primary emphasis was on the price range of US$150 to US$200, where it dominated the market with its A series. Xiaomi and vivo were in a close race, each recording 2.5 million shipments, with Xiaomi climbing to the fourth spot. realme finished in the top five with 2.2 million shipments and a market share of 11%.

“Brands eagerly waited for the March-April festivities coupled with new launches, but it failed to spark expected consumer demand,” said Chiew Le Xuan, Analyst at Canalys. “Smartphone vendors calibrated their inventory over the past few quarters, ready to capitalize on the Ramadan festivities in Indonesia and Malaysia, and election spending in Thailand. Even though the traction was lower compared to last year, Apple and Samsung increased channel activity to grow retail traffic and improve brand presence. Other Chinese vendors looked to emulate OPPO's successful strategy of gradually moving up the price band to enhance their brand image.”

“Smartphone penetration stumbled amid macroeconomic headwinds as cautious consumers from tier-2 cities in the region held back on high-value purchases,” added Chiew Le Xuan. “This was felt in large volume, price-sensitive developing countries like Indonesia and the Philippines, which saw their market size shrink by 21% and 17% year on year, respectively. Despite a 13% decline in Thailand shipments, the recent wave of M&A among operators empowered a ramp-up of promotions and 5G bundling, benefitting Apple and Samsung. Meanwhile, Vietnam's shipments plummeted by 40% year on year. There were significant reductions in inventories of older smartphone models amid a decline in consumer spending as local technology manufacturing slowed due to global economic conditions.”

“Canalys maintains a conservative outlook for Southeast Asia in 2023, with the region expected to face challenges in demand in the near term due to an unfavorable business environment,” said Sheng Win Chow, Analyst at Canalys. “Furthermore, lengthening replacement cycles coupled with a slow smartphone adoption rate will further result in ballooning channel inventory and financial challenges.”

“2024 is expected to spin a different story; Canalys forecasts a 7% increase in shipments as compared to 2023. Southeast Asia is in a favorable position to benefit from the global recovery,” added Sheng Win Chow. “The region has received investments that have prepared it for a demand rebound. Looking ahead, Southeast Asia continues to be a promising market for smartphone manufacturers, thanks to its expanding middle class and young population, which are key customer segments for smartphone vendors. Furthermore, the rise in digital payment and financing options makes high-end devices more affordable for the masses.”

|

Southeast Asian smartphone shipments and annual growth |

|||||

|

Vendor |

Q1 2023 |

Q1 2023 |

Q1 2022 |

Q1 2022 |

Annual |

|

Samsung |

5.6 |

27% |

7.0 |

26% |

-20% |

|

OPPO |

4.0 |

19% |

4.3 |

16% |

-7% |

|

Xiaomi |

2.5 |

12% |

4.0 |

15% |

-37% |

|

vivo |

2.5 |

12% |

3.6 |

14% |

-30% |

|

realme |

2.2 |

11% |

2.6 |

10% |

-17% |

|

Others |

4.1 |

20% |

4.9 |

18% |

-15% |

|

Total |

20.9 |

100% |

26.4 |

100% |

-21% |

|

|

|

|

|||

|

Note: Xiaomi estimates include sub-brand POCO, and OPPO includes OnePlus. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Chiew Le Xuan: lexuan_chiew@canalys.com

Sheng Win Chow: shengwin_chow@canalys.com

About Smartphone Analysis

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, detailed analysis of storage, processors, memory, cameras and many other specs. We combine detailed worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also provides a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Southeast Asia's smartphone market dips 21% in Q1 2023 but a brighter future aheadÂ

Southeast Asia's smartphone market dips 21% in Q1 2023 but a brighter future aheadÂ