US PC shipments fell 23% in Q4 2022 and declines will continue in 2023

Monday, 27 March 2023

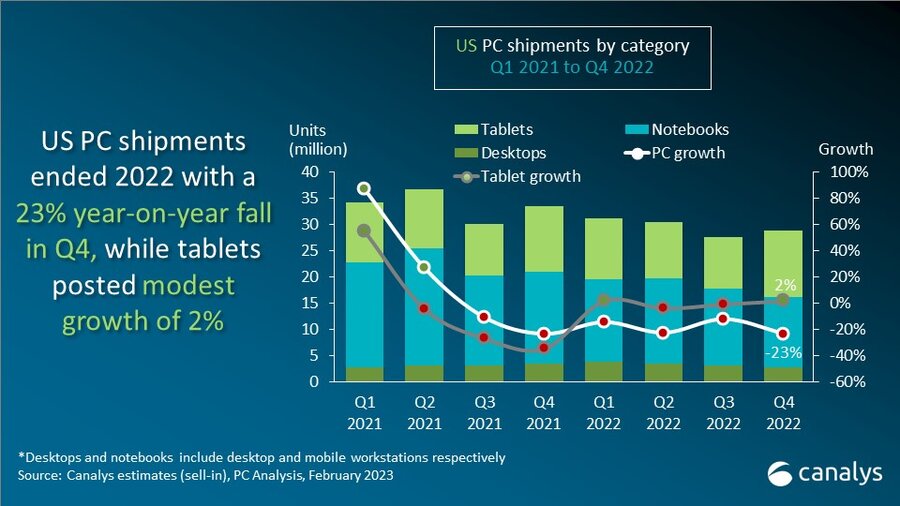

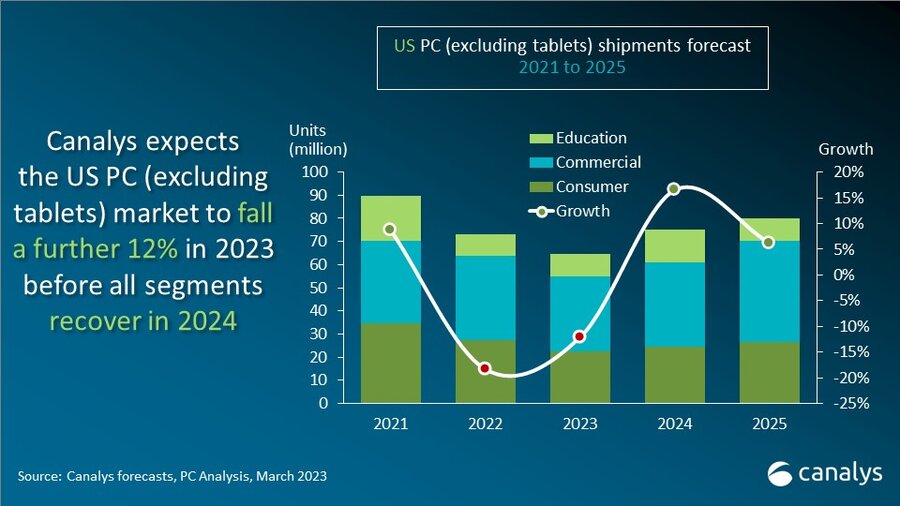

US shipments of PCs (desktops, notebooks and workstations) fell 23% year on year in Q4 2022 to 16.1 million units as demand remained muted by high inflation and economic uncertainty. Shipments of notebooks (including mobile workstations) fell by 24%, while desktops (including desktop workstations) declined by 22%. Tablets grew by a modest 2% to 12.6 million units, as heavy discounting and promotions during the holiday season helped clear retail inventories. For full-year 2022, US PC shipments fell by 18% while tablet shipments remained flat compared with 2021. With the market set to be constrained by subdued demand and ongoing inventory correction in 2023, Canalys expects PC shipments to fall by a further 12% and tablet shipments by 15% this year.

“The US PC market is in a period of prolonged declines as it grapples with inflation and demand stabilizes after the record highs of the pandemic,” said Canalys Research Analyst Brian Lynch. “While consumer spending on PCs has been weak for several quarters, commercial shipments faced an even greater decline in Q4 as businesses struggled with higher interest rates and budget cuts. After rapid growth in hybrid working powered PC demand in 2021 and early 2022, commercial procurement of new devices has been largely slowed or delayed.”

Canalys forecasts continued PC shipment declines until Q4 2023 and an overall decline of 12% in 2023. “The possibility of further interest rate hikes and some instability in the financial sector point to more uncertainty for commercial demand recovery,” said Lynch. “But improving signs around business sentiment, such as the uptick in Purchasing Managers’ Indices (PMIs) in January and February provide some optimism for recovery later in the year, especially once channel inventory levels have normalized. Looking ahead, PC market recovery will accelerate in 2024 as consumer spending returns, businesses make Windows 11 upgrades and education demand drives a wave of large-scale device refreshes.”

HP took first place in the American desktop and notebook market in Q4 with 4.6 million shipments but came second overall in 2022 after struggling with weak education performance early in the year. Dell, the second-placed vendor in Q4, shipped more units than any other in 2022, as it performed well in the commercial market in the first half of the year as hybrid working and reopening offices drove demand. Lenovo shipped 2.4 million units in Q4 to take third place for the quarter and full year as its shipments fell 23%. Apple saw the smallest decline of the top vendors in 2022 as its new M series devices drove refreshes and attracted new users throughout the year. Asus rounded out the top five in Q4, but Acer secured the final spot for overall shipments in 2022.

Apple cemented its dominance of the US tablet market in 2022, shipping 5.8 million iPads in Q4 and securing an overall market share of 42% in 2022. Amazon experienced a slight decline in shipments in Q4 but grew 6% overall in 2022. Samsung held onto third place, growing 15% in Q4 with a strong holiday season performance. TCL saw impressive growth of 79% in 2022 as it renewed its focus on tablets with several new devices. Microsoft’s tablet shipments plummeted by 42% in Q4 but it maintained its position among the top five vendors in 2022.

|

US desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022

|

|||||

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

HP |

4.6 |

28.4% |

5.4 |

25.5% |

-14.5% |

|

Dell |

4.0 |

24.6% |

5.9 |

28.0% |

-32.6% |

|

Lenovo |

2.4 |

14.6% |

3.1 |

14.6% |

-23.4% |

|

Apple |

2.0 |

12.6% |

2.8 |

13.4% |

-27.8% |

|

Asus |

1.0 |

5.9% |

0.9 |

4.3% |

6.1% |

|

Others |

2.3 |

14.0% |

3.0 |

14.3% |

-24.9% |

|

Total |

16.1 |

100.0% |

21.0 |

100.0% |

-23.3% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

US desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: 2022

|

|||||

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Dell |

19.3 |

26.3% |

22.0 |

24.5% |

-12.3% |

|

HP |

17.5 |

23.9% |

25.9 |

28.9% |

-32.5% |

|

Lenovo |

11.7 |

15.9% |

15.1 |

16.8% |

-22.7% |

|

Apple |

9.9 |

13.5% |

10.0 |

11.1% |

-1.1% |

|

Acer |

4.2 |

5.7% |

4.5 |

5.0% |

-6.4% |

|

Others |

10.8 |

14.7% |

12.3 |

13.7% |

-12.2% |

|

Total |

73.3 |

100.0% |

89.7 |

100.0% |

-18.3% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

US tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q4 2022

|

|||||

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

5.8 |

46.0% |

5.1 |

41.2% |

13.8% |

|

Amazon |

3.0 |

23.6% |

3.0 |

24.5% |

-2.0% |

|

Samsung |

2.1 |

16.3% |

1.8 |

14.4% |

15.4% |

|

TCL |

0.5 |

4.3% |

0.6 |

4.5% |

-1.0% |

|

Microsoft |

0.4 |

2.9% |

0.6 |

5.1% |

-42.0% |

|

Others |

0.9 |

6.8% |

1.3 |

10.2% |

-32.0% |

|

Total |

12.6 |

100.0% |

12.4 |

100.0% |

2.0% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

US tablet shipments (market share and annual growth) Canalys PC Market Pulse: 2022

|

|||||

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

18.8 |

41.8% |

19.1 |

42.5% |

-1.6% |

|

Amazon |

11.0 |

24.4% |

10.4 |

23.2% |

5.5% |

|

Samsung |

7.7 |

17.2% |

7.9 |

17.5% |

-2.0% |

|

TCL |

2.3 |

5.2% |

1.3 |

2.9% |

78.8% |

|

Microsoft |

1.6 |

3.5% |

1.8 |

3.9% |

-10.9% |

|

Others |

3.5 |

7.8% |

4.4 |

9.9% |

-20.8% |

|

Total |

44.9 |

100.0% |

44.9 |

100.0% |

0.1% |

|

|

|

|

|

||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

For more information, please contact:

Ishan Dutt: ishan_dutt@canalys.com

Brian Lynch: brian_lynch@canalys.com

About PC Analysis

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2023. All rights reserved.

For more information:

e-mail press@canalys.com