Western Europe’s PC market braces for a cold winter as shipments fall by 22% in Q3 2022Â

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Monday, 19 December 2022

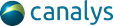

The latest Canalys estimates show Western Europe shipments of notebooks, desktops and workstations fell by 22% year-on-year to 12.8 million units in Q3 2022. Notebooks performed worst with 10.4 million units shipped down 25% year-on-year as previously stable commercial demand cooled amid deteriorating business confidence, adding to the consumer and education drop-offs. Desktops fell only 6% as large organizations continued to make purchases. Tablet shipments reached 6.0 million units, down 13% year-on-year and sequentially flat as the back-to-school season produced disappointing education refresh volumes.

“The decline in demand for PCs in Western Europe accelerated in Q3 2023,” said Canalys Research Analyst Kieren Jessop. “Previously robust commercial spending on PCs is now falling at the same rate as the consumer segment. Small-to-medium sized businesses cut PC purchases significantly, more than larger organizations, as economic headwinds shrank cashflows and increased interest rates made financing options costlier.

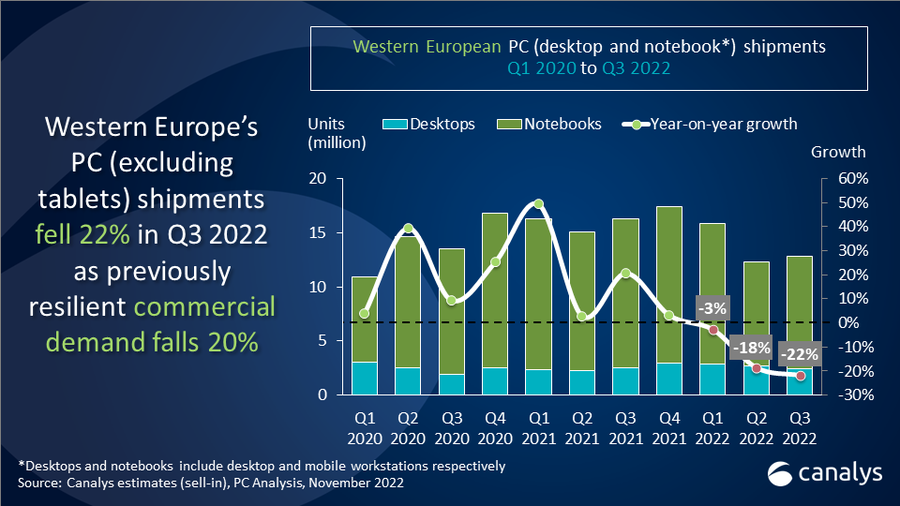

“Consumer PC demand remains suppressed due to rising prices, particularly for energy. And as real incomes shrink there is a shift in demand across price levels. Shipments for PCs in the low-end have declined substantially more than the mid-range or high-end segments. This reflects the divergent impact inflation has across income levels. And with disposable incomes expected to contract further, demand will transfer from the high-end to more affordable options. Vendors with portfolios encompassing broader price ranges will be best set to capitalize on this.”

“Lower demand has increased channel inventory levels,” added Jessop. A few days before the start of the third quarter a Canalys Candefero poll of channel partners highlighted 38% of EMEA-based respondents had over four weeks of PC inventory in stock; compared to just 25% a year ago. “Despite an increase in promotional activity throughout Q3, the channel remains filled.”

“Looking ahead, early signals for 2022’s fourth quarter performance aren’t promising either,” continued Jessop. “Spending during Black Friday week was higher than expected, especially for electronics, but planned spending for the upcoming festive season is forecast to be the strongest slump in over a decade. Vendors will need to continue offering promotions to stir demand and clear inventory in what is shaping up to be a cold winter for the market. However, after winter comes spring and Canalys’ latest forecast sees some growth returning in the second half of next year. Minimally at first with some refreshes of devices bought early into the pandemic, although the majority of these will now occur in 2024. From Q4 of next year until 2026 we anticipate a return to regular seasonal patterns and a new-normal demand level that averages around 25% above pre-pandemic volumes. Positive trends around consumer device usage and hybrid work mean there is still long-term optimism for PCs and tablets.”

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2022 |

|||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Lenovo |

3.1 |

24.1% |

4.1 |

24.9% |

-24.1% |

|

HP |

2.7 |

21.5% |

4.4 |

26.7% |

-36.9% |

|

Apple |

2.3 |

18.2% |

1.9 |

11.8% |

20.4% |

|

Dell |

1.9 |

14.6% |

2.3 |

14.1% |

-18.9% |

|

Asus |

0.9 |

7.2% |

1.2 |

7.4% |

-24.4% |

|

Others |

1.8 |

14.4% |

2.4 |

15.0% |

-24.7% |

|

Total |

12.8 |

100.0% |

16.3 |

100.0% |

-21.6% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2022 |

|||||

|

Vendor |

Q3 2022 shipments |

Q3 2022 |

Q3 2021 |

Q3 2021 |

Annual |

|

Apple |

2.8 |

47.0% |

3.1 |

45.4% |

-10.0% |

|

Samsung |

1.2 |

20.4% |

1.1 |

16.0% |

10.9% |

|

Lenovo |

0.7 |

11.9% |

0.9 |

13.2% |

-21.9% |

|

Amazon |

0.4 |

7.4% |

0.5 |

6.8% |

-4.5% |

|

Huawei |

0.2 |

2.7% |

0.5 |

7.9% |

-70.6% |

|

Others |

0.6 |

10.6% |

0.7 |

10.7% |

-14.0% |

|

Total |

6.0 |

100.0% |

6.9 |

100.0% |

-13.1% |

|

|

|

|

|||

|

Note: Unit shipments in millions. Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Kieren Jessop (UK) Kieren_jessop@canalys.com

About PC Analysis

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com