Software defined vehicles: The future of the automotive industry

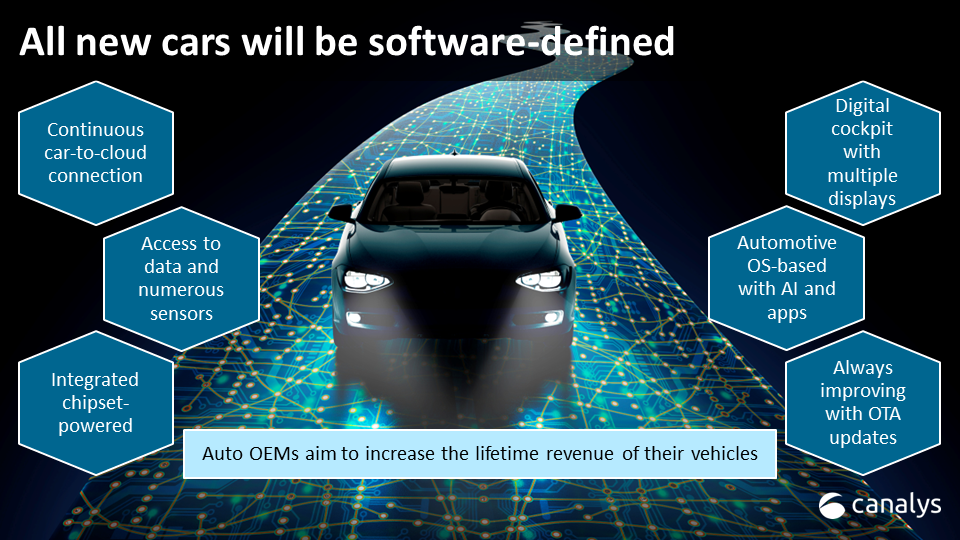

Automakers are developing software defined vehicle platforms for smarter, more connected cars, as the industry undergoes a digital transformation.

The automotive industry is undergoing a massive digital transformation, and the future is more technology driven. Automakers are in a race to become technology companies, and 2025 will be the inflection point for software-defined vehicle (SDV) penetration globally. Automakers are developing their own OS or very closely collaborating on OS developments to reduce hardware/software complexity, enable vertical integration, and open new revenue streams. Tesla has always used its own OS and its cars have been software-defined from day one.

This shift means software will become tightly coupled with hardware, and a vehicle's services domains, such as ADAS, navigation, connectivity, HMI, or electrification, will run through a central computer. The vehicles will be smarter, powered by an automotive OS and AI services enabled through the digital cockpit. Technology such as ADAS and navigation systems will complement each other, with services in conjunction with cloud computing and over-the-air updating technology enabled through connectivity.

More automakers are building electric vehicles from the bottom up, embracing dedicated platforms. Most of these vehicles will focus on an enhanced user experience and are more likely to adopt a central computer responsible for handling multiple vehicle services run on an exclusive OS. Many OEMs have announced their strategic road maps.

GM will transition to its Ultifi platform in 2023

Ulitifi is the end-to-end software platform that sits above GM’s Vehicle Intelligence Platform (VIP) and will allow software-defined features in next-generation vehicles. It will appear in 29 global GM models by 2023. GM projects annual software and services revenue from US$20 billion to US$25 billion from a projected 30 million vehicles by 2030.

GM is developing the Ultifi platform with 100 software specialists and will hire an additional 300 to 400 to support other areas that are building what sits on top of the platform. GM partnered with Red Hat in May 2022 to power the phased roll-out of the Ultifi platform in 2023. GM will partner with Google to run the infotainment system in its new vehicles running Google services, ditching Apple CarPlay and Android Auto.

Mercedes-Benz will replace MBUX with MB.OS

Mercedes-Benz Operating System (MB.OS) is a major overhaul of its MBUX UI, which includes the pillar-to-pillar Hyperscreen. It will be data-driven and flexibly updateable. Mercedes announced it in 2020 and stated MB.OS would debut in the next generation fleet from 2024, starting with models on the new compact car MMA platform. Its new software-defined architecture for automated driving will be built on the Nvidia Drive platform. In February 2023, Mercedes and Google announced a strategic partnership to embed Google services/technologies (Maps, YouTube, and Cloud) in the MB.OS - replacing other apps, including Here maps and navigation.

Mercedes invested €200 million in the Electric Software Hub at the Mercedes Technology Centre (MTC) in Germany. 1,000 MB.OS software developers are being recruited in what will become the central hub for software R&D and training. 2,000 jobs are being created in tech hubs in the global R&D network.

XPeng started life with a software strategy

Xmart OS creates an ecosystem based on smart hardware and software systems with a variety of intelligent connected vehicle functions and entertainment solutions, such as voice assistance and intelligent cockpit. XPeng has released 30 major OTA updates to date.

XPeng digital cockpits are powered by Qualcomm Snapdragon, with the strategic partnership extended in late 2021. Personalized navigation and Navigation Guided Pilot (NGP) are powered by AutoNavi’s high-precision map and data.

XPeng has developed a full-stack autonomous driving solution powered by Nvidia technology, vehicle OS and core vehicle systems, including powertrain and electronic architecture. Xmart OS supports continuous dialogue and completes hands-free control with the Xiao P voice assistant, providing an intelligent cockpit that adapts to the user.

The Xmart OS 3.1 upgrade increased the Valet Parking Assist range from 1km to 2km and added multi-floor support. Hill-assisted driving capability and ADAS features were also added but only supported in LIDAR and XPilot 3.5 trims.

Implications for Suppliers, OEMs, and Smartphone Integration

This transition leads to an increase in royalty opportunities for technology suppliers such as Qualcomm, Nvidia, and BlackBerry QNX. The role of traditional tier-one suppliers such as Bosch and Continental will evolve as the number of individual automotive components decreases, the reliance on software, the cloud, and OTA updates increases, OEMs set new strategies, and new technology company competitors emerge. As a result, the tier ones have, or will have, tens of thousands of software engineers. The evolution is also a huge challenge for OEMs, as they aim to utilize the ever-increasing number of displays in the vehicle, with everything synchronizing, updating, and integrated, while getting their vehicles to market on time and transforming, not compromising the user experience.

Shifting from Android Auto and Apple CarPlay, commonly used to mirror navigation and entertainment apps into the vehicle, will create conflicts. GM recently announced it would renounce Android Auto and CarPlay from its future EVs, choosing Google's Android-based platform instead, which is a setback for Apple in competition with Google. Apple announced its next-generation CarPlay at WWDC 2022 in June, which will have deep integration with a car's hardware and will power the entire instrument cluster. Canalys estimates that over 70 million cars in the US had smartphone mirroring capability at the end of 2022. In a recent Canalys survey, 90% of US drivers with smartphone mirroring in their car said having the same solution in their next car was important. As automakers continue to develop software-defined vehicles, they must not underestimate the level of usage and satisfaction for smartphone mirroring solutions, the obsession with the smartphone, and the reach of their app ecosystems.

The future of the automotive industry is rapidly changing. Digital cockpits and SDV are the future. Automakers are investing in technology platforms to keep up with macro trends such as connected, autonomous, electric, and shared mobility. They are transforming the customer experience to keep them in healthy competition. However, they must carefully balance the shift to next-generation operating systems and subscription or one-time payment for services from what drivers are used to today.

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band