Canalys Forums 2023: Channel partners are investing in staff to drive differentiation

Channel partners will benefit from focusing on sales and marketing efficiencies in 2023.

Partners are expecting revenue growth in 2023, despite the difficult times ahead. Headlines about headcount cuts are not always reflective of the wider channel landscape, where the majority are expecting to add staff this year. But whether partners are adding, freezing or reducing staff levels, everyone will benefit from focusing on their sales and marketing efficiencies. New customer acquisition is often a top-three area where companies struggle, so now is the time to reassess the process of lead-generation and make improvements wherever possible. In this blog, we’ll take a quick look at the latest trends, ahead of these important issues getting in-depth scrutiny at the APAC, EMEA and North American Canalys Forums 2023.

Growth is expected, despite budget concerns and macroeconomic indicators

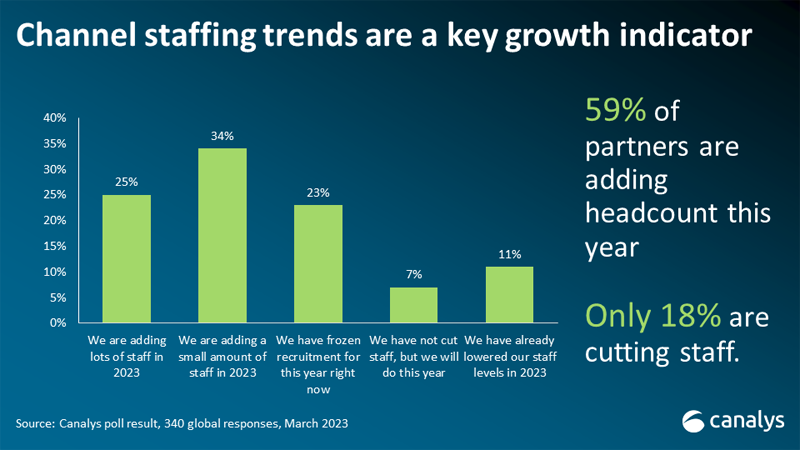

According to a recent Canalys quick poll, 59% of channel partners are adding headcount in 2023, while 36% of partners are expecting revenue growth of more than 10% this year. There is no doubt that business has become more expensive to conduct in the last year, with interest rates and other inflationary pressures driving both consumer and commercial costs. But the boost in the digitalization of the post-pandemic world requires management. Canalys data shows end customers understand the value of channel partners in helping them manage this digitalization. In times of difficulty, specialization is one of the most important factors for competitive differentiation. This is a primary driver for current staffing level increases.

Partners recognize the need to define their value propositions. Some of the greatest growth areas in channel hiring trends will be in consulting, sales, engineering and technical services roles. Skills and competition are often two of the biggest issues for partners. In many ways, this current economic crisis is no different to the ones we have faced in the past. There are specific causes, particular to our time and place, but the structural realities and the answers to the problems are the same as they ever were. Channel partners are investing in technological and vertical market specialization, helping customers to focus on either saving money or growing revenue through technology.

Differentiation and new customer acquisition in an economic downturn

Adding new skills, staff and strategies is important, but can be difficult to action in the immediate future. Channel partners are also changing the ways they do business and marketing to make the most of the resources they currently have. This means re-thinking marketing strategies, improving insights and efficiency in the sales funnel, and focusing on new growth drivers, particularly in areas such as cybersecurity, AI and automation, cloud, and data management.

Canalys research shows some of the top areas where partners are focusing on these initiatives:

- Defining the marketing reach: LinkedIn remains the most popular B2B online marketing channel for IT channel partners, with other routes, such as Facebook, also seeing growth in some regions. Events can be equally useful in generating leads, particularly where partners are hosting end customers either in-person or via webinars. These are increasingly crowded spaces. But partners that combine them with a clear value proposition, data analytics and clearer follow-up to join sales and marketing together are also seeing their lead-generation improve and become less costly.

- Website lead-generation: While many channel partners spend significant time on their websites to generate leads, many are not formatting their sites to encourage better conversion. Marketing agencies can be a useful resource, but partners can also improve this themselves with some simple tweaks. Adding customer success data, testimonials, differentiated, diverse imagery and a more compelling contact page can all have a significant impact on lead-generation.

- Improving the value proposition: partners that can show clear technological and vertical skills with use cases that define problem-solving abilities are seeing greater sales success. This also requires dedicated resources to market research that understands customer concerns. For example, partners in EMEA are struggling to show how they can improve their customers’ compliance requirements with cyber-insurers while also delivering risk management services.

While headcount and staffing increases are good news, partners must also use this time to ensure they are maximizing their current and future resources. By focusing on updating their marketing and sales practices, the cost-efficiencies of additional headcount can be improved, and those revenue and profit targets will be easier to achieve.

I’ll be discussing these issues alongside our global teams of channels analysts at the Canalys Channels Forums 2023. Channel partners will be able to hear from their peers as to what is working and what they are planning. To attend, register your interest: https://www.canalys.com/events

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5-7 December

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band