Huawei’s IoT Ambition

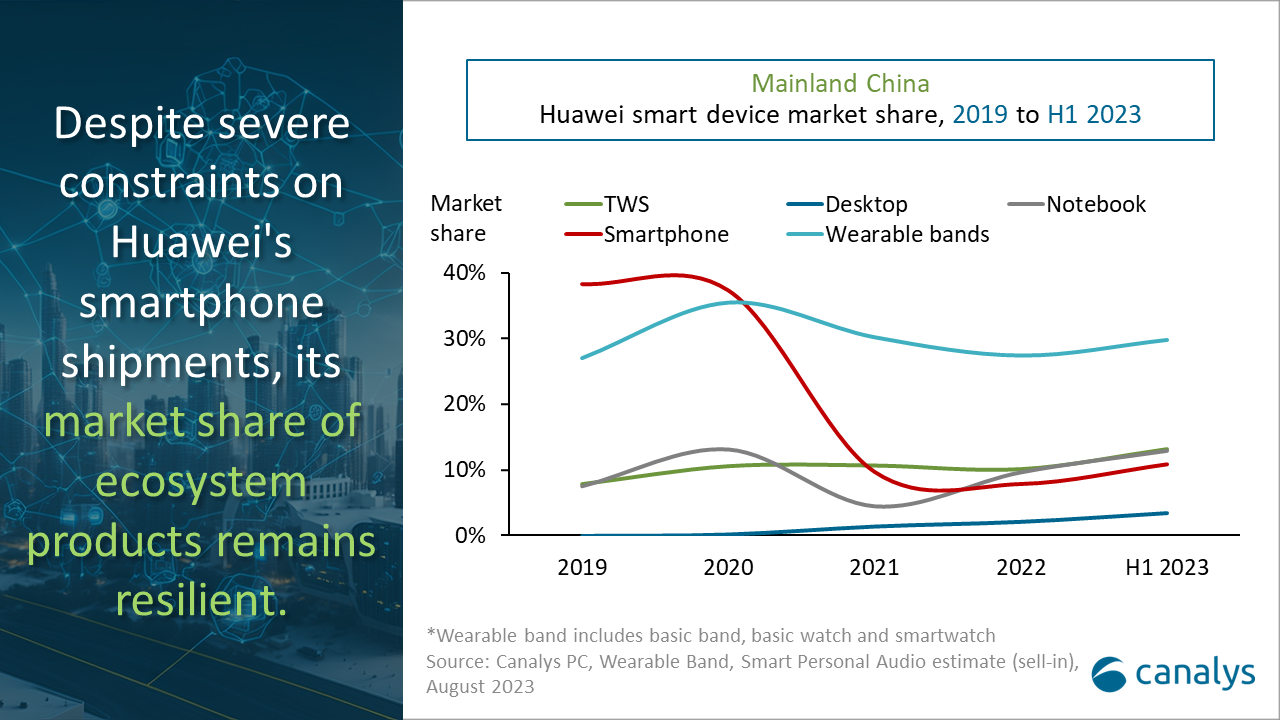

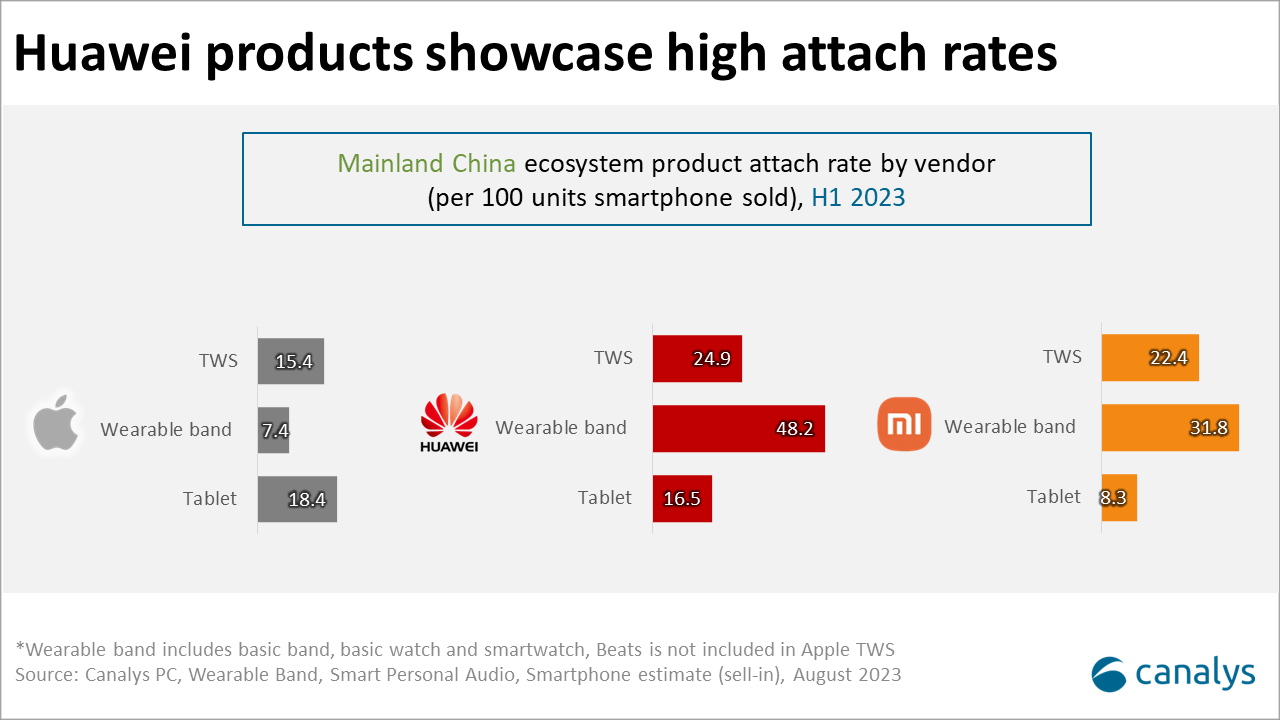

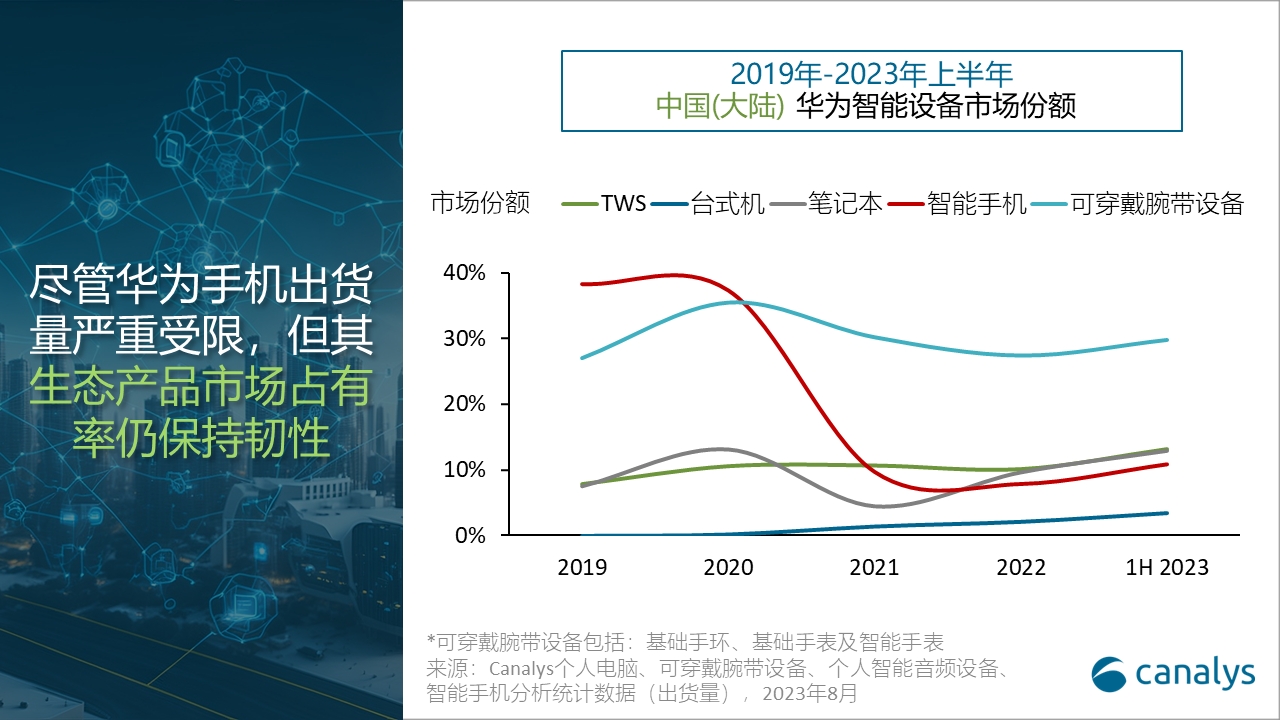

Huawei’s smartphone shipment has been severely restrained in the past three years. However, its market share of ecosystem devices achieved growth against an ebbing tide in mainland China. How can Huawei build competitive barriers for its ecosystem to hamper other players? And what insights can Huawei's story offer for building a comprehensive ecosystem?

On 25 September, Huawei held an autumn launch event. Putting its high-profile smartphone products to one side for the moment, Huawei also showcased its vision and ambitions for a full-scene smart life centered around HarmonyOS. In the past three years, Huawei has invested in, and upgraded HarmonyOS, and other consumer products, which has meant in mainland China, Huawei’s wearable, desktop, TWS and notebook market share achieved resilient growth from H1 2019 to H1 2023.

To realize its strategic vision of "Building a fully connected, intelligent world," Huawei has established differentiation barriers within its ecosystem, laying a solid foundation for the sustainable development of its products.

Seamless ecosystem experience based on technological capabilities:

Huawei's robust in-house, full-stack R&D capabilities for operating systems and communication technologies can add value to scenarios using a complete set of Huawei mobile devices, establishing formidable barriers to compete with. Huawei's in-house operating system, HarmonyOS, features distributed algorithms that enable users to seamlessly switch tasks between smartphones, tablets and notebooks; Huawei's wireless connection technology, NearLink, offers a low-power, low-latency, high-speed and seamless experience for devices that support this technology.

Comprehensive ecosystem scenarios based on various hardware:

Huawei boasts a broad range of personal and business hardware products, offering users seeking a complete ecosystem experience a wide selection. In the consumer product category, Huawei competes with products in various segments, including notebooks, desktops, wearable and hearable devices, smart speakers, smart TVs, and smart home solutions. In the business product category, Huawei also offers a comprehensive portfolio, such as the Huawei “Qingyun” series, which covers commercial smart screens, tablets, desktops, printers and more. Users can easily enter Huawei's ecosystem through a single product or scenario.

The differentiating strengths result in high user retention and conversion rates once users enter the Huawei ecosystem. However, Huawei’s ecosystem faces challenges. The closed nature of HarmonyOS requires continuous resource investment to ensure extensive software adaptation and developer involvement. This is essential for Huawei to compete effectively with the Apple and Android ecosystems and gain the trust and trial of more users.

- The smartphone business, as the core of ecosystem access, is waiting for a substantial recovery in terms of R&D and shipment performance.

Huawei's exploration of "connecting everything" offers valuable insights for building a comprehensive ecosystem and establishing ecosystem competitiveness.

- Ecosystem competitiveness necessitates the establishment of technological barriers. It represents firm, long-term, and substantial investments. The strategic determination of vendors is one of the crucial foundations.

- Smartphones, as the core business of vendors, serve not only as a source of revenue but also as an entry point into the ecosystem and a gateway to channel clients. While vendors traverse exploratory businesses, they must ensure the market share and profitability of the smartphone business is robust.

- Collaboration with industry partners, beyond functional compatibility and software integration, should aim for deep integration and empowerment. For example, Huawei can provide digital cockpits and smart, self-driving support to automotive partners. Deep cooperation maximizes value and product competitiveness for both parties and users.

Huawei's "Internet of Everything" empire is smoothly entering a high-growth phase despite facing challenges related to operating system expansion and smartphone business. It is destined to set a new benchmark and bring fresh examples and competitiveness to the industry of building an ecosystem and leading to a breakthrough.

华为“万物互联”的野心

过去三年间华为手机出货严重受限,而生态产品在中国大陆市场的占有率实现逆境增长。华为为何能够建立起万物互联的生态壁垒?华为的故事能够给打造全场景生态带来哪些启示?

华为于9月25日举行名为华为秋季全场景的新品发布会。虽未详细提及备受瞩目的手机产品,华为展示了以鸿蒙OS为核心的全场景智慧生活的前景及野心。

在过去的三年,尽管手机出货受到了严重的限制,华为持续投入鸿蒙OS及其他消费者业务产品的升级。在中国大陆市场,华为可穿戴腕带设备、台式电脑、真无线耳机(TWS)、笔记本电脑的市场占有率保持韧性,2023年上半年与2019年相比实现逆境增长。

为实现”构建万物互联的智能世界“的战略愿景,华为建立了其生态系统的差异化竞争壁垒,为其生态产品的可持续发展打下夯实基础。

基于技术能力的无缝生态体验:

华为具有强势的操作系统、通信技术全栈自研开发能力, 能够为使用其全套移动智能设备的场景带来附加价值,为生态系统建立难以逾越的壁垒。华为自研操作系统鸿蒙OS的分布式算法可以实现跨端硬件调用,用户可以无缝在手机、平板、电脑之间切换任务设备;华为近距离无线连接技术星闪,能够为支持该技术的设备提供低功耗、低延迟、高效率的无缝体验。

基于广泛硬件的全面生态场景:

华为拥有全面的个人及商用硬件产品覆盖,为追求完整生态体验的用户提供丰富选择。在个人消费品类方面,华为可以在个人电脑、可穿戴腕带设备、耳机音箱、智慧屏、全屋智能等品类提供有竞争力的自有产品;在商业品类方面,华为亦拥有全面的产品,例如华为擎云系列覆盖商用智慧屏、平板、台式机、打印机等,用户很容易透过一个产品或场景进入华为的生态圈。

上述差异化竞争力使得用户一旦进入华为生态将会有高留存率以及高转换率。与此同时,华为及其建立起的生态王国在未来仍面临亟待解决的挑战。

- 封闭的鸿蒙OS适配需要持续投入资源,确保广泛的软件适配及开发者投入,才能与苹果和安卓生态形成有力竞争,并赢得更多用户的信任与尝试。

- 手机业务作为生态接入的核心枢纽,其仍待研发及出货的进一步实质性恢复。

华为建立“万物互联”的探索为如何打造全场景生态、建立生态竞争力提供了思考和启示。

- 生态竞争力需要技术壁垒的建立,其代表着坚决、长期、高昂的开发投入,厂商的战略坚定性是重要的根基之一。

- 手机作为厂商基础业务,不仅是利润来源,更是生态入口和渠道敲门砖,厂商在投入探索性业务的同时,需要确保手机业务的市场占有率及盈利性。

- 与行业伙伴的合作,除了功能适配、软件接入外,应追求深度融合与赋能,例如华为能够为智选车伙伴提供智能座舱、智能驾驶支持。深度合作将为双方及用户最大限度的提供增值及产品竞争力。

总体而言,华为的“万物互联”帝国即使面临系统扩张及手机业务的挑战,仍顺利进入高速发展期,注定为行业的融合创新、生态壁垒的打造带来的全新范例及竞争活力。

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band