Analysis of carmakers’ strategies in making smartphones

NIO officially unveiled its first NIO Phone at the 2023 NIO Innovation and Technology Day, joining other carmakers in exploring smartphone integration in the automotive ecosystem. Here we discuss the reasons behind carmakers entering the smartphone market, differences in strategies, and how to evaluate the success of automotive smartphone products in creating a seamless user experience.

On 21 September, NIO officially unveiled its first NIO Phone at the 2023 NIO Innovation and Technology Day, with three different models priced between CNY 6,499 and CNY 7,499 (US$900 and US$1000). It joins a growing number of carmakers such as Xpeng and Li Auto (in cooperation with OPPO) the have leveraged smartphones to explore ways to enrich the automotive ecosystem.

Here we look at why carmakers are foraying into the smartphone market, the strategy differences between carmakers, and how to evaluate whether carmaker’s smartphone products are successful.

Establishing an intelligent ecosystem for EVs with smartphones

Carmakers want to shape their ecosystems by offering smartphones to ensure the interaction between phone and digital cockpit systems is seamlessly integrated to create a differentiated user experience. Through a well-integrated digital ecosystem, automobile manufacturers can learn more about user preferences to meet the hidden, yet crucial, needs of their vehicles' target users.

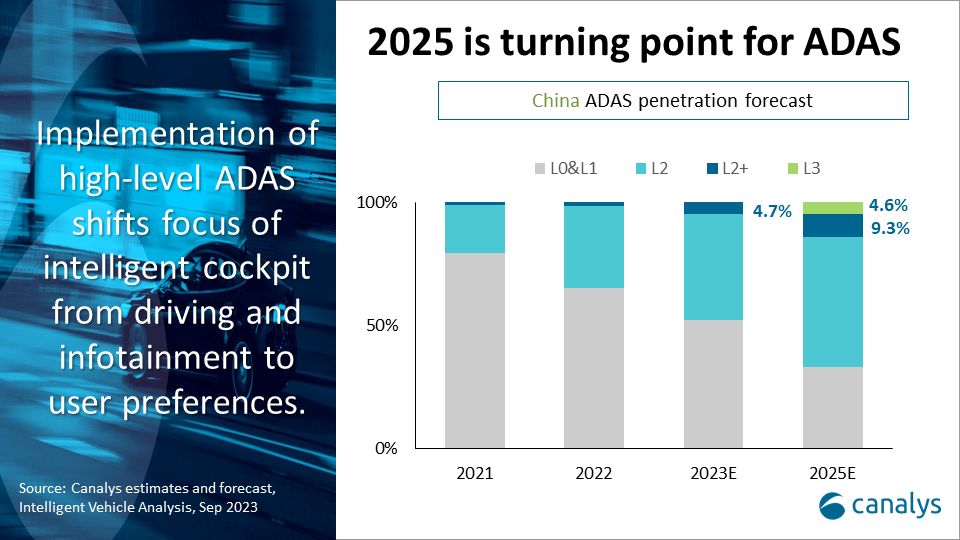

By 2023, Canalys expects the penetration rate of L2+ advanced driver assistance systems (ADAS) in China to reach 4.7%. With the gradual clarification of regulations for L3 and above high-level ADAS functions in China, 2025 is expected to be a turning point as L3 penetration is expected to reach 4.6%. As vehicles shift to higher levels of driver assistance, the digital cockpit user experience must evolve to match the shifting user scenarios where drivers are driving less and may engage with other activities or devices. The introduction of a smartphone, a high-frequency touch-point device, into the EV ecosystem can help carmakers understand the intricate needs of drivers as driving behavior changes with increasing autonomy levels. When smartphone apps and services are tightly integrated with cockpits, users can unlock digital lifestyle features in key areas such as productivity and entertainment that may be limited by the digital cockpits of today.

Compared to the high cost and R&D time for introducing new features built into vehicles, carmakers can incorporate smartphone features and achieve similar levels of user experience through cockpit connectivity integration, smartphone app, and mobile services, which will effectively reduce the R&D cost, time, and trial-and-error cost.

NIO emphasizes interoperability of the NIO Phone with its digital cockpits

NIO claims over 50% of its customers are Apple iPhone users. However, Apple's next-generation CarPlay hasn't gotten any significant traction so far. NIO has chosen to rely on in-house technologies to showcase some of NIO’s new intelligent and connected features.

NIO emphasizes the interoperability between its NIO Phone with its automotive products, offering a range of features such as digital car keys, which enable remote control of vehicles without connectivity, and 30 other features. NIO also introduced the “Vehicle Control Hub” for select ES8 models. Once the smartphone is placed on the control hub, this cockpit feature engages the control interface integrating the vehicle display and controlling key in-cabin features. NIO sees this "Vehicle Control Hub" in future car models, highlighting the importance of smartphones in NIO’s digital cockpit strategy.

Polestar has a differentiated mobile strategy

Polestar is a contender with a more aggressive smartphone strategy regarding technical investment, as it aims to offer other consumer IoT products such as smartwatches. This move is expected to enhance the trendy tech brand appeal that Polestar may be interested in pursuing. Furthermore, all its future vehicles and smart devices in China will feature Polestar OS, which is based on "Flyme Auto Core", leveraging the acquisition of Meizu by Geely not too long ago. However, vehicles sold in other overseas markets will likely adopt Google's solution. This reflects Polestar's "China-first" strategy, prioritizing building a strong tech brand image here.

Determining the success of automotive OEMs smartphone strategies

The core objective of automotive manufacturers in producing smartphones is to enhance the competitiveness of their vehicles while also increasing the automotive brand exposure. Car owner's frequency of use of the devices will become a benchmark to determine whether carmakers succeeded in their smartphone strategies.

Carmakers’ smartphone’s basic functions and performance must match with vehicle owners’ commonly used smartphones. Additionally, design aesthetics and UI need to be consistent with the automotive OEM’s brand identity.

To increase the frequency of use during the driving process carmakers need to:

- Identify key use-cases and services that are common on smartphones which can be extended to the digital cockpit, such as communication (voice or video calling), location services, (route planning, parking) social media, media sharing, content streaming, etc.

- Break down barriers between systems to enable seamless handoffs of features between devices.

- Enable ease of access and improve user experience with sensors and equipment found in the digital cockpit.

- Provide intuitive controls depending on whether the driver is alone or with passengers, the driving scenario and conditions.

Carmakers must explore tactics to encourage users to try the new quality-of-life smartphone-cockpit integration features as they can only be appreciated by having users experience them directly. If the features can successfully delight users, it not only increases the overall user experience of the cockpit but also increases the chance of word of mouth where discussions of both the smartphone and the cars can increase carmakers’ brand exposure rapidly.

A challenging task for carmakers to produce smartphones

Getting into the smartphone business means carmakers have to compete with major smartphone players such as Apple, Huawei and other market incumbents. The global smartphone industry is highly competitive and carmakers urgently need clear advantages to stand a chance at competing or even just winning over the carmakers’ target audiences. Initially, the sales volume of smartphones and vehicles is a different order of magnitude, so reasonable cost control will be challenging. However, as consumers’ mobile lifestyles increasingly include traveling in highly connected vehicles, integration between the smartphone and vehicles will further emphasize ecosystem-driven features inside and outside of digital cockpits. Carmakers producing smartphones will become a trend in China, and if successful, this will be replicated in global markets.

Note: Passenger vehicles include sedan, SUV / Crossover, MPV, Mini-Van; New emerging brands are cross-border car brands

Share this article

CATEGORY

- All

- Canalys Forums

- Canalys Forums,Channels

- Canalys Forums,Channels,Partner Program

- Canalys Forums,Channels,Sustainability

- Canalys Forums,Sustainability

- Enterprise

- Market

- Market,Canalys Forums,Channels

- Market,Canalys Forums,Channels,Cloud

- Market,Canalys Forums,Channels,Sustainability

- Market,Channels,PC

- Market,PC

- Market,Smartphone

- Market,Technology,AR/XR/VR

- Market,Technology,Automotive

- Market,Technology,Canalys Forums,Channels

- Market,Technology,Canalys Forums,Channels,Cloud

- Market,Technology,Channels

- Market,Technology,Channels,Cloud,Partner Program

- Market,Technology,Smart Personal Audio

- Market,Technology,Smart Speaker

- Market,Technology,Smartphone

- Smart Personal Audio

- Smartphone

- Technology

- Technology,Canalys Forums,Channels,Security

- Technology,Channels

- Technology,Channels,Cloud,Partner Program

- Technology,Channels,Partner Program

- Technology,Unified Communications

- Technology,Wearable Band