Tablet shipments grew in Q4 2022 despite economic challengesÂ

Monday, 6 February 2023Â

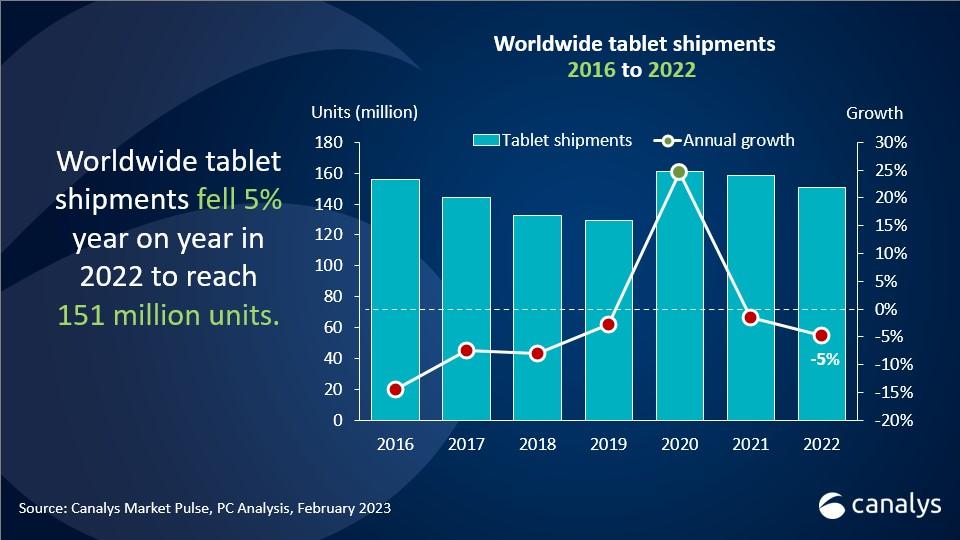

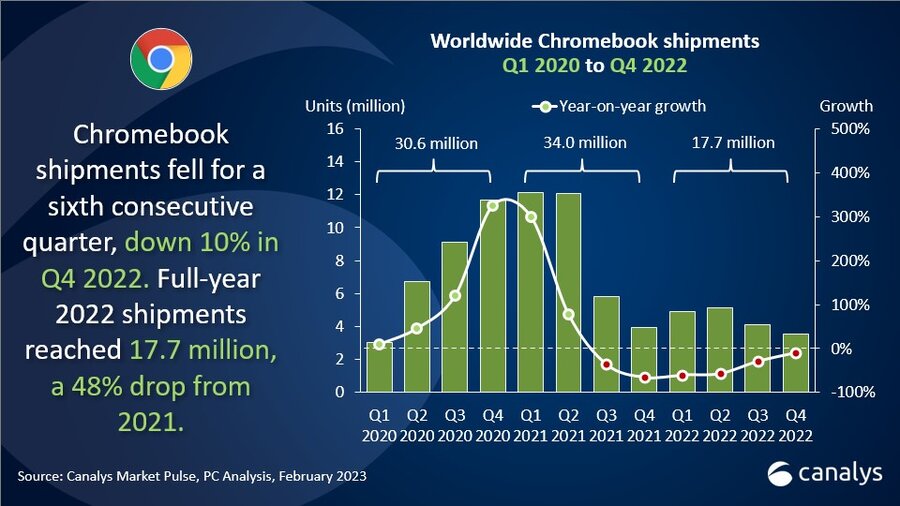

The latest Canalys data shows that worldwide PC (including tablet) shipments fell 21% year on year in Q4 2022, to 105.6 million units. This brought full-year 2022 PC and tablet shipments to 434.5 million units, a decline of 13% from 2021 when nearly half a billion devices were shipped. The tablet market proved to be resilient in Q4, posting shipment growth of 1% to land at 42.3 million units. 2022 ended with a total of 150.8 million tablets shipped, down 5% from 2021. Chromebook shipments hit 3.6 million units in Q4 2022, down 10% annually. This put full-year 2022 shipments at 17.7 million units, a hefty 48% decline from the highs of 2021.

Worldwide tablet shipments grew following three consecutive quarters of decline, up a modest 1% year on year in Q4 2022. Apple held onto first place in the rankings, shipping 19 million units and commanding a whopping 46% market share worldwide as rollover demand and the launch of new M2 iPads drove success. Samsung came second with 7.6 million units, with shipments growing 10%, driving it to 18% market share. Third-placed Amazon shipped 3.5 million units after a 10% year-on-year drop, staving off a larger decline with steep discounting on its Fire tablets around Black Friday. Lenovo and Huawei finished fourth and fifth, with large declines of 51% and 36% respectively. Total shipments by other vendors grew 4%, highlighting the entrance of new vendors into the tablet market.

“Demand for tablets remained healthy in spite of worsening economic conditions,” said Himani Mukka, Analyst at Canalys. “Market leader Apple helped drive the overall growth with new premium product launches, showing that customers will respond positively to compelling innovation in the space. Significant discounting and promotions driven by vendors and retailers during the holiday season also helped spur demand as consumers looked to stretch their budgets. However, on the commercial front, both businesses and governments have adopted a more cautious approach to IT spending, putting some digital transformation plans that would include tablet procurement on hold.”

“Despite the decline from 2021, tablet shipment volumes in 2022 were well above pre-pandemic levels and opportunities for future growth remain intact,” added Mukka. “The need for educational digitalization remains high in developing markets, which often favor tablets over notebooks due to price and connectivity advantages. Vendors are making efforts to enter this segment and gain a first-mover advantage. Tablets also saw some renewed interest and innovation at CES 2023, with a focus on improvements to productivity and premium user experiences. On-the-go workers, prosumers, customer touchpoints and office conferencing hubs all represent commercial frontiers where tablets are likely to see traction.”

While Chromebooks suffered a sixth consecutive quarter of decline, the drop in Q4 2022 was softer than in the previous five quarters, with shipments down just 10% year on year. “Heavy retail discounting and a boost to school purchasing brought some reprieve to the Chromebook market,” said Ishan Dutt, Senior Analyst at Canalys. “But total shipments in 2022 were down nearly 50% against 2021, emphasizing the extent to which a ‘return to normal’ has affected the segment’s fortunes. With expansion into commercial settings remaining a challenge and consumer spending set to be constrained, Chromebook vendors are awaiting the education refresh cycle in key markets, such as in the US, Japan and Europe, to help drive significant volumes again. With the current pressure on public sector budgets, Canalys expects this year to bring only pockets of opportunity, as short-term inventory clearance remains a focus for vendors and the channel ahead of the back-to-school season. Significant growth is only likely to arise in 2024 as devices bought during the pandemic peak reach the end of their lifespans. There will also be an opportunity to deliver higher-value products as students and teachers have developed stronger expectations for devices that are being used on such a frequent basis. With digital curriculums firmly embedded in education systems, long-term demand for Chromebooks is set to be consistent and cyclical.”

HP regained the top spot in the Chromebook rankings and was the only vendor to grow in Q4 2022, with shipments up 117% year on year to just over a million units. Acer fell back to second place, posting 710,000 shipments in the quarter after a decline of 22%. The rest of the top five remained unchanged from Q3 2022, with Lenovo in third place with 550,000 units shipped, down 27%. Dell and Asus were placed fourth and fifth, posting declines of 25% and 37%, respectively.

In the total PC market (desktops, notebooks and tablets) in Q4 2022, Apple took first place with 25.5 million units shipped, growing 5% year-on-year and expanding its market share to 24%. Lenovo finished second, ceding first place to Apple from the same period last year, with 17.9 million devices shipped and a 32% annual decline. HP and Dell remained in third and fourth place, with 13.2 million and 10.9 million units shipped respectively. Samsung, backed by tablet growth, rounded out the top five with 6% year-on-year growth and 8.3 million devices shipped.

Appendix: Shipment (sell-in) estimates for worldwide PC (including tablet) market, tablet market and Chromebook market, Q4 2022 and full-year 2022

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

19,480 |

46.0% |

16,443 |

39.2% |

18.5% |

|

Samsung |

7,612 |

18.0% |

6,899 |

16.5% |

10.3% |

|

Amazon |

3,566 |

8.4% |

3,948 |

9.4% |

-9.7% |

|

Lenovo |

2,334 |

5.5% |

4,742 |

11.3% |

-50.8% |

|

Huawei |

1,441 |

3.4% |

2,239 |

5.3% |

-35.6% |

|

Others |

7,916 |

18.7% |

7,633 |

18.2% |

3.7% |

|

Total |

42,349 |

100% |

41,904 |

100% |

1.1% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

60,844 |

40.3% |

61,046 |

38.6% |

-0.3% |

|

Samsung |

29,024 |

19.2% |

30,099 |

19.0% |

-3.6% |

|

Amazon |

13,646 |

9.0% |

13,235 |

8.4% |

3.1% |

|

Lenovo |

11,558 |

7.7% |

17,467 |

11.0% |

-33.8% |

|

Huawei |

6,287 |

4.2% |

9,189 |

5.8% |

-31.6% |

|

Others |

29,454 |

19.5% |

27,253 |

17.2% |

8.1% |

|

Total |

150,813 |

100% |

158,289 |

100% |

-4.7% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

HP |

1,021 |

28.6% |

471 |

11.9% |

116.8% |

|

Acer |

710 |

19.9% |

910 |

23.0% |

-22.0% |

|

Lenovo |

550 |

15.4% |

749 |

19.0% |

-26.6% |

|

Dell |

479 |

13.4% |

641 |

16.2% |

-25.3% |

|

Asus |

456 |

12.8% |

722 |

18.3% |

-36.8% |

|

Others |

357 |

10.0% |

457 |

11.6% |

-21.9% |

|

Total |

3,573 |

100% |

3,950 |

100% |

-9.5% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Acer |

4,251 |

24.0% |

5,159 |

15.2% |

-17.6% |

|

Lenovo |

3,711 |

20.9% |

8,136 |

23.9% |

-54.4% |

|

HP |

3,524 |

19.9% |

10,250 |

30.2% |

-65.6% |

|

Dell |

2,965 |

16.7% |

3,603 |

10.6% |

-17.7% |

|

Asus |

1,728 |

9.7% |

3,314 |

9.8% |

-47.9% |

|

Others |

1,553 |

8.8% |

3,519 |

10.4% |

-55.9% |

|

Total |

17,732 |

100% |

33,981 |

100% |

-47.8% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

25,499 |

24.1% |

24,256 |

18.2% |

5.1% |

|

Lenovo |

17,942 |

17.0% |

26,500 |

19.8% |

-32.3% |

|

HP |

13,220 |

12.5% |

18,646 |

14.0% |

-29.1% |

|

Dell |

10,883 |

10.3% |

17,279 |

12.9% |

-37.0% |

|

Samsung |

8,308 |

7.9% |

7,862 |

5.9% |

5.7% |

|

Others |

29,793 |

28.2% |

39,079 |

29.2% |

-23.8% |

|

Total |

105,645 |

100% |

133,622 |

100% |

-20.9% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

87,864 |

20.2% |

90,007 |

18.0% |

-2.4% |

|

Lenovo |

79,290 |

18.2% |

99,667 |

20.0% |

-20.4% |

|

HP |

55,314 |

12.7% |

74,140 |

14.9% |

-25.4% |

|

Dell |

50,011 |

11.5% |

59,560 |

11.9% |

-16.0% |

|

Samsung |

32,156 |

7.4% |

35,637 |

7.1% |

-9.8% |

|

Others |

129,882 |

29.9% |

140,215 |

28.1% |

-7.4% |

|

Total |

434,517 |

100% |

499,226 |

100% |

-13.0% |

|

|

|

|

|

||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2023 |

|

||||

For more information, please contact:

Himani Mukka: himani_mukka@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

About PC Analysis

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology, and is broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

About Canalys

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

Receiving updates

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.

For more information:

e-mail press@canalys.com

PDF download

Tablet shipments grew in Q4 2022 despite economic challengesÂ

Tablet shipments grew in Q4 2022 despite economic challengesÂ